This is a list of the official minimum wage rates of the 50 US states and the federal district of Washington, D.C. [1] [2] [3] [4] [5] [6] [7] [8] [9] For comparisons to other countries see: List of countries by minimum wage.

This is a list of the official minimum wage rates of the 50 US states and the federal district of Washington, D.C. [1] [2] [3] [4] [5] [6] [7] [8] [9] For comparisons to other countries see: List of countries by minimum wage.

See minimum wage in the United States for much more info, including detailed state-by-state and city-by-city breakdown of the facts and numbers, and more info on US territories. Some of the sources list many more exceptions to the main rate in each state (both lower or higher than the statewide rate). [5] The main source for the 2024 info is the U.S. Department of Labor. [1]

Notes:

| State | 2022 | 2023 | 2024 [1] [5] [12] |

|---|---|---|---|

| $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | |

| $10.34 | $10.85 | $11.73 | |

| $12.80 | $13.85 | $14.35 | |

| $11.00 | $11.00 | $11.00/7.25 [lower-alpha 1] [1] | |

| $15.00 | $15.50 | $16.00 | |

| $12.56 | $13.65 | $14.42 | |

| $14.00 | $15.00 [13] | $15.69 | |

| $10.50 | $11.75 | $13.25 | |

| $11.00 | $12.00 | $12.00. $13.00 on Sept 30, 2024 | |

| $5.15 (Employers subject to the Fair Labor Standards Act must pay the $7.25 federal minimum wage) | $5.15 (Employers subject to the Fair Labor Standards Act must pay the $7.25 federal minimum wage) | $5.15 (Employers subject to the Fair Labor Standards Act must pay the $7.25 federal minimum wage) | |

| $10.10 | $12.00 | $14.00 | |

| $7.25 | $7.25 | $7.25 | |

| $12.00 | $13.00 | $14.00 | |

| $7.25 | $7.25 | $7.25 | |

| $7.25 | $7.25 | $7.25 | |

| $7.25 | $7.25 | $7.25 | |

| $7.25 | $7.25 | $7.25 | |

| $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | |

| $12.75 | $13.80 | $14.15 | |

| $12.50 | $13.25 | $15.00 | |

| $14.25 | $15.00 | $15.00 | |

| $9.87 | $10.10 | $10.33 | |

| $10.33/8.42 [lower-alpha 2] | $10.59/8.63 [lower-alpha 2] [14] | $10.85/$8.85 [lower-alpha 2] [15] [1] | |

| $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | |

| $11.15 | $12.00 | $12.30/$7.25 [lower-alpha 3] [16] [1] | |

| $9.20 | $9.95 | $10.30 | |

| $9.00 | $10.50 | $12.00 | |

| $10.50/9.50 [lower-alpha 4] | $11.25/10.25 [lower-alpha 4] | $11.25/10.25. $12.00 for all on July 1, 2024 [lower-alpha 4] [1] | |

| $7.25 | $7.25 | $7.25 | |

| $13.00/11.90 [lower-alpha 5] | $14.13/11.90 [lower-alpha 5] | $15.13/ 13.73 [lower-alpha 5] [1] | |

| $11.50 | $12.00 | $12.00 | |

| $13.20 | $14.20 | $15.00 | |

| $7.25 | $7.25 | $7.25 | |

| $7.25 | $7.25 | $7.25 | |

| $9.30/7.25 [17] [lower-alpha 6] | $10.10/7.25 [17] [lower-alpha 6] | $10.45/7.25 [lower-alpha 6] [1] | |

| $7.25 | $7.25 | $7.25/2.00. [lower-alpha 7] [1] | |

| $13.50 | $14.20 | $14.20 until July 1, 2024 (the new rate is not yet determined). [18] | |

| $7.25 | $7.25 | $7.25 | |

| $12.25 | $13.00 | $14.00 | |

| $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | |

| $9.95 | $10.80 | $11.20 | |

| $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | |

| $7.25 | $7.25 | $7.25 | |

| $7.25 | $7.25 | $7.25 | |

| $12.55 | $13.18 | $13.67 | |

| $11.00 | $12.00 | $12.00 | |

| $14.49 | $15.74 | $16.28 | |

| $16.10 [19] | $17.00 [20] | $17.00 until July 1, 2024 (the new rate is not yet determined). | |

| $8.75/7.25 [lower-alpha 8] | $8.75/7.25 [lower-alpha 8] | $8.75/7.25 [lower-alpha 8] [1] | |

| $7.25 | $7.25 | $7.25 | |

| $5.15 (Employers subject to the Fair Labor Standards Act must pay the $7.25 federal minimum wage) | $5.15 (Employers subject to the Fair Labor Standards Act must pay the $7.25 federal minimum wage) | $5.15 (Employers subject to the Fair Labor Standards Act must pay the $7.25 federal minimum wage) |

| State | 2019 [3] | 2020 | 2021 |

|---|---|---|---|

| $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | |

| $9.89 | $10.19 | $10.34 | |

| $11.00 | $12.00 | $12.15 | |

| $9.25 | $10.00 | $11.00 | |

| $12.00 | $13.00 | $14.00 | |

| $11.10 | $12.00 | $12.32 | |

| $11.00 | $12.00 | $13.00 | |

| $8.75 | $9.25 | $9.25 | |

| $8.46 [21] | $8.56 | $10.00 | |

| $5.15 (Employers subject to the Fair Labor Standards Act must pay the $7.25 federal minimum wage) | $5.15 (Employers subject to the Fair Labor Standards Act must pay the $7.25 federal minimum wage) | $5.15 (Employers subject to the Fair Labor Standards Act must pay the $7.25 federal minimum wage) | |

| $10.10 | $10.10 | $10.10 | |

| $7.25 | $7.25 | $7.25 | |

| $9.25 | $10.00 | $11.00 | |

| $7.25 | $7.25 | $7.25 | |

| $7.25 | $7.25 | $7.25 | |

| $7.25 | $7.25 | $7.25 | |

| $7.25 | $7.25 | $7.25 | |

| $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | |

| $11.00 | $12.00 | $12.15 | |

| $10.10 | $11.00 | $11.75 | |

| $12.00 | $12.75 | $13.50 | |

| $9.45 | $9.65 | $9.65 | |

| $9.86/8.04 [lower-alpha 2] | $10.00/8.15 [lower-alpha 2] | $10.08/8.21 [lower-alpha 2] | |

| $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | |

| $8.60 | $9.45 | $10.30 | |

| $8.50 | $8.65 | $8.75 | |

| $9.00 | $9.00 | $9.00 | |

| $8.25/7.25 [lower-alpha 4] | $9.00/8.00 [lower-alpha 4] | $9.75/8.75 [lower-alpha 4] | |

| $7.25 | $7.25 | $7.25 | |

| $10.00 | $11.00 | $12.00 | |

| $7.50 | $9.00 | $10.50 | |

| $11.10 | $11.80 | $12.50 | |

| $7.25 | $7.25 | $7.25 | |

| $7.25 | $7.25 | $7.25 | |

| $8.55/7.25 [22] [lower-alpha 6] | $8.70/7.25 [25] [lower-alpha 6] | $8.80/7.25 [24] [lower-alpha 6] | |

| $7.25 | $7.25 | $7.25 | |

| $11.25 | $12.00 | $12.75 | |

| $7.25 | $7.25 | $7.25 | |

| $10.50 | $11.50 | $11.50 | |

| $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | |

| $9.10 | $9.30 | $9.45 | |

| $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | $7.25 (Federal, no state minimum) | |

| $7.25 | $7.25 | $7.25 | |

| $7.25 | $7.25 | $7.25 | |

| $10.78 | $10.96 | $11.75 | |

| $7.25 | $7.25 | $9.50 | |

| $12.00 | $13.50 | $13.69 | |

| $14.00 | $15.00 | $15.20 | |

| $8.75/7.25 [lower-alpha 8] | $8.75/7.25 [lower-alpha 8] | $8.75/7.25 [lower-alpha 8] | |

| $7.25 | $7.25 | $7.25 | |

| $5.15 (Employers subject to the Fair Labor Standards Act must pay the $7.25 federal minimum wage) | $5.15 (Employers subject to the Fair Labor Standards Act must pay the $7.25 federal minimum wage) | $5.15 (Employers subject to the Fair Labor Standards Act must pay the $7.25 federal minimum wage) |

This section breaks it down further by state. These are the main exceptions to the main rates in some states. There are many more exceptions in the sources. [1] [5] [26]

Below is a compact table of the minimum wages by U.S. state, U.S. territory, and the District of Columbia. This table is an exact duplicate of the Department of Labor source page ("Consolidated Minimum Wage Table"). So it may be out of date at times. See date on table at source. [7] The federal minimum wage applies in states with no state minimum wage or a minimum wage lower than the federal rate (column titled "No state MW or state MW is lower than $7.25."). Some of the state rates below are higher than the rate on the main table above. That is because the main table does not use the rate for cities or regions. See the main U.S. Department of Labor source for details. [1]

Notes:

| Greater than federal MW | Equals federal MW of $7.25 | No state MW or state MW is lower than $7.25. Employers covered by the FLSA must pay the federal MW of $7.25. |

|---|---|---|

| AK $11.73 | CNMI | AL |

| AR $11.00 | GA | |

| AZ $14.35 | IA | LA |

| CA $16.00 | ID | MS |

| CO $14.42 | IN | SC |

| CT $15.69 | KS | TN |

| DC $17.00 | KY | WY |

| DE $13.25 | NC | AS |

| FL $12.00 | ND | |

| HI $14.00 | NH | |

| IL $14.00 | OK | |

| MA $15.00 | PA | |

| MD $15.00 | TX | |

| ME $14.15 | UT | |

| MI $10.33 | WI | |

| MN $10.85 or $8.85 | ||

| MO $12.30 | ||

| MT $10.30 or $4.00 | ||

| NE $12.00 | ||

| NJ $15.13 or $13.73 | ||

| NM $12.00 | ||

| NV $11.25 or $10.25 | ||

| NY $16.00 or $15.00 | ||

| OH $10.45 or $7.00 | ||

| OR $15.45 or $14.20 or $13.20 | ||

| PR $9.50 | ||

| RI $14.00 | ||

| SD $11.20 | ||

| VA $12.00 | ||

| VT $13.67 | ||

| WA $16.28 | ||

| WV $8.75 | ||

| VI $10.50 | ||

| GU $9.25 | ||

| 30 States + DC, GU, PR& VI | 13 States + CNMI | 7 States + AS |

See the date at the top of the map.

A minimum wage is the lowest remuneration that employers can legally pay their employees—the price floor below which employees may not sell their labor. Most countries had introduced minimum wage legislation by the end of the 20th century. Because minimum wages increase the cost of labor, companies often try to avoid minimum wage laws by using gig workers, by moving labor to locations with lower or nonexistent minimum wages, or by automating job functions. Minimum wage policies can vary significantly between countries or even within a country, with different regions, sectors, or age groups having their own minimum wage rates. These variations are often influenced by factors such as the cost of living, regional economic conditions, and industry-specific factors.

Overtime is the amount of time someone works beyond normal working hours. The term is also used for the pay received for this time. Normal hours may be determined in several ways:

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as minimum wage, prevailing wage, and yearly bonuses, and remunerative payments such as prizes and tip payouts. Wages are part of the expenses that are involved in running a business. It is an obligation to the employee regardless of the profitability of the company.

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital, such as higher education.

Under the Constitution of Canada, the responsibility for enacting and enforcing labour laws, including the minimum wage, rests primarily with the ten Provinces of Canada. The three Territories of Canada have a similar power, delegated to them by federal legislation. Some provinces allow lower wages to be paid to liquor servers and other gratuity earners or to inexperienced employees.

Three key types of withholding tax are imposed at various levels in the United States:

The Fair Minimum Wage Act of 2007 is a US Act of Congress that amended the Fair Labor Standards Act of 1938 to gradually raise the federal minimum wage from $5.15 per hour to $7.25 per hour. It was signed into law on May 25, 2007 as part of the U.S. Troop Readiness, Veterans' Care, Katrina Recovery, and Iraq Accountability Appropriations Act, 2007. The act raised the federal minimum wage in 3 increments: to $5.85 per hour 60 days after enactment, to $6.55 per hour a year later, and finally to $7.25 per hour two years later. In addition, the act provided for the Northern Mariana Islands and American Samoa to make the transition to the federal minimum wage on alternate timetables.

Minimum wage law is the body of law which prohibits employers from hiring employees or workers for less than a given hourly, daily or monthly minimum wage. More than 90% of all countries have some kind of minimum wage legislation.

In the United States, the minimum wage is set by U.S. labor law and a range of state and local laws. The first federal minimum wage was instituted in the National Industrial Recovery Act of 1933, signed into law by President Franklin D. Roosevelt, but later found to be unconstitutional. In 1938, the Fair Labor Standards Act established it at 25¢ an hour. Its purchasing power peaked in 1968, at $1.60 In 2009, it was increased to $7.25 per hour, and has not been increased since.

The history of minimum wage is about the attempts and measures governments have made to introduce a standard amount of periodic pay below which employers could not compensate their workers.

An hourly worker or hourly employee is an employee paid an hourly wage for their services, as opposed to a fixed salary. Hourly workers may often be found in service and manufacturing occupations, but are common across a variety of fields. Hourly employment is often associated but not synonymous with at-will employment. As of September 2017, the minimum wage in the United States for hourly workers is $7.25 per hour, or $2.13 per hour for a tipped employee. As a tipped employee, wages plus tips must equal the standard minimum wage or the employer is required to provide the difference.

The New York State Department of Labor is the department of the New York state government that enforces labor law and administers unemployment benefits.

The Fair Labor Standards Act of 1938 29 U.S.C. § 203 (FLSA) is a United States labor law that creates the right to a minimum wage, and "time-and-a-half" overtime pay when people work over forty hours a week. It also prohibits employment of minors in "oppressive child labor". It applies to employees engaged in interstate commerce or employed by an enterprise engaged in commerce or in the production of goods for commerce, unless the employer can claim an exemption from coverage. The Act was enacted by the 75th Congress and signed into law by President Franklin D. Roosevelt in 1938.

The Davis–Bacon Act of 1931 is a United States federal law that establishes the requirement for paying the local prevailing wages on public works projects for laborers and mechanics. It applies to "contractors and subcontractors performing on federally funded or assisted contracts in excess of $2,000 for the construction, alteration, or repair of public buildings or public works".

The Wage and Hour Division (WHD) of the United States Department of Labor is the federal office responsible for enforcing federal labor laws. The Division was formed with the enactment of the Fair Labor Standards Act of 1938. The Wage and Hour mission is to promote and achieve compliance with labor standards to protect and enhance the welfare of the Nation's workforce. WHD protects over 144 million workers in more than 9.8 million establishments throughout the United States and its territories. The Wage and Hour Division enforces over 13 laws, most notably the Fair Labor Standards Act and the Family Medical Leave Act. In FY18, WHD recovered $304,000,000 in back wages for over 240,000 workers and followed up FY19, with a record-breaking $322,000,000 for over 300,000 workers.

Wage theft is the failing to pay wages or provide employee benefits owed to an employee by contract or law. It can be conducted by employers in various ways, among them failing to pay overtime; violating minimum-wage laws; the misclassification of employees as independent contractors; illegal deductions in pay; forcing employees to work "off the clock", not paying annual leave or holiday entitlements, or simply not paying an employee at all.

The tipped wage is base wage paid to an employee in the United States who receives a substantial portion of their compensation from tips. According to a common labor law provision referred to as a "tip credit", the employee must earn at least the state's minimum wage when tips and wages are combined or the employer is required to increase the wage to fulfill that threshold. This ensures that all tipped employees earn at least the minimum wage: significantly more than the tipped minimum wage.

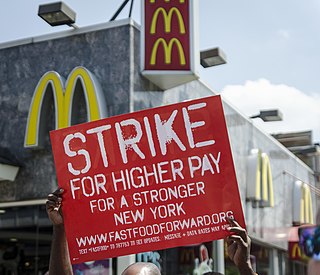

The Fight for $15 is an American political movement advocating for the minimum wage to be raised to USD$15 per hour. The federal minimum wage was last set at $7.25 per hour in 2009. The movement has involved strikes by child care, home healthcare, airport, gas station, convenience store, and fast food workers for increased wages and the right to form a labor union. The "Fight for $15" movement started in 2012, in response to workers' inability to cover their costs on such a low salary, as well as the stressful work conditions of many of the service jobs which pay the minimum wage.

The Minimum Wage Fairness Act is a bill that would amend the Fair Labor Standards Act of 1938 (FLSA) to increase the federal minimum wage for employees to $10.10 per hour over the course of a two-year period. The bill was strongly supported by President Barack Obama and many of the Democratic Senators, but strongly opposed by Republicans in the Senate and House.

The Raise the Wage Act is a proposed United States law that would increase the federal minimum wage to US$15. It has been introduced in each United States Congress since 2017.