A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to fund government spending and various public expenditures, and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labour equivalent.

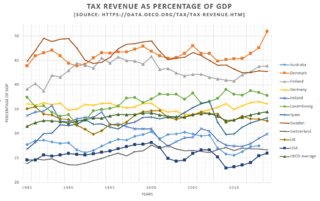

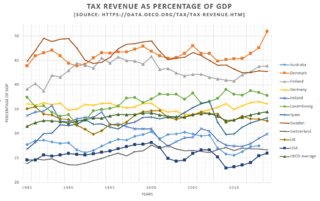

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey.

Excise tax in the United States is an indirect tax on listed items. Excise taxes can be and are made by federal, state and local governments and are not uniform throughout the United States. Certain goods, such as gasoline, diesel fuel, alcohol, and tobacco products, are taxed by multiple governments simultaneously. Some excise taxes are collected from the producer or retailer and not paid directly by the consumer, and as such often remain "hidden" in the price of a product or service, rather than being listed separately.

Taxation in the United Kingdom may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion.

A use tax is a type of tax levied in the United States by numerous state governments. It is essentially the same as a sales tax but is applied not where a product or service was sold but where a merchant bought a product or service and then converted it for its own use, without having paid tax when it was initially purchased. Use taxes are functionally equivalent to sales taxes. They are typically levied upon the use, storage, enjoyment, or other consumption in the state of tangible personal property that has not been subjected to a sales tax.

An indirect tax is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity who pays taxes to the tax collecting authority does not suffer a corresponding reduction in income, i.e., impact and tax incidence are not on the same entity meaning that tax can be shifted or passed on, then the tax is indirect.

The Revenue Act of 1862, was a bill the United States Congress passed to help fund the American Civil War. President Abraham Lincoln signed the act into law on July 1, 1862. The act established the office of the Commissioner of Internal Revenue, a department in charge of the collection of taxes, and levied excise taxes on most items consumed and traded in the United States. The act also introduced the United States' first progressive tax with the intent of raising millions of dollars for the Union.

Taxation in France is determined by the yearly budget vote by the French Parliament, which determines which kinds of taxes can be levied and which rates can be applied.

Income taxes in Canada constitute the majority of the annual revenues of the Government of Canada, and of the governments of the Provinces of Canada. In the fiscal year ending 31 March 2018, the federal government collected just over three times more revenue from personal income taxes than it did from corporate income taxes.

Income taxes are the most significant form of taxation in Australia, and collected by the federal government through the Australian Taxation Office. Australian GST revenue is collected by the Federal government, and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission.

This is a table of the total federal tax revenue by state, federal district, and territory collected by the U.S. Internal Revenue Service.

In the United States cigarettes are taxed at both the federal and state levels, in addition to any state and local sales taxes and local cigarette-specific taxes. Cigarette taxation has appeared throughout American history and is still a contested issue today.

In Austria, taxes are levied by the state and the tax revenue in Austria was 42.7% of GDP in 2016 according to the World Bank The most important revenue source for the government is the income tax, corporate tax, social security contributions, value added tax and tax on goods and services. Another important taxes are municipal tax, real-estate tax, vehicle insurance tax, property tax, tobacco tax. There exists no property tax. The gift tax and inheritance tax were cancelled in 2008. Furthermore, self-employed persons can use a tax allowance of €3,900 per year. The tax period is set for a calendar year. However, there is a possibility of having an exception but a permission of the tax authority must be received. The Financial Secrecy Index ranks Austria as the 35th safest tax haven in the world.

Taxation in Puerto Rico consists of taxes paid to the United States federal government and taxes paid to the Government of the Commonwealth of Puerto Rico. Payment of taxes to the federal government, both personal and corporate, is done through the federal Internal Revenue Service (IRS), while payment of taxes to the Commonwealth government is done through the Puerto Rico Department of Treasury.

Taxes in Germany are levied by the federal government, the states (Länder) as well as the municipalities (Städte/Gemeinden). Many direct and indirect taxes exist in Germany; income tax and VAT are the most significant.

Taxation may involve payments to a minimum of two different levels of government: central government through SARS or to local government. Prior to 2001 the South African tax system was "source-based", where in income is taxed in the country where it originates. Since January 2001, the tax system was changed to "residence-based" wherein taxpayers residing in South Africa are taxed on their income irrespective of its source. Non residents are only subject to domestic taxes.

Taxes provide an important source of revenue for various levels of the Government of the Republic of China. The tax revenue of Taiwan in 2015 amounted NT$2.1 trillion.

Taxation in New Mexico comprises the taxation programs of the U.S state of New Mexico. All taxes are administered on state- and city-levels by the New Mexico Taxation and Revenue Department, a state agency. The principal taxes levied include state income tax, a state gross receipts tax, gross receipts taxes in local jurisdictions, state and local property taxes, and several taxes related to production and processing of oil, gas, and other natural resources.

Taxes in Lithuania are levied by the central and the local governments. Most important revenue sources include the value added tax, personal income tax, excise tax and corporate income tax, which are all applied on the central level. In addition, social security contributions are collected in a social security fund, outside the national budget. Taxes in Lithuania are administered by the State Tax Inspectorate, the Customs Department and the State Social Insurance Fund Board. In 2019, the total government revenue in Lithuania was 30.3% of GDP.

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities.