Related Research Articles

Multnomah County is one of the 36 counties in the U.S. state of Oregon. As of the 2020 census, the county's population was 815,428. Multnomah County is part of the Portland–Vancouver–Hillsboro, OR–WA metropolitan statistical area. The state's smallest and most populous county, its county seat, Portland, is the state's largest city.

Proposition 13 is an amendment of the Constitution of California enacted during 1978, by means of the initiative process, to cap property taxes and limit property reassessments to when the property changes ownership, as well as require a 2/3 majority for tax increases in the state legislature. The initiative was approved by California voters in a primary election on June 6, 1978 by a nearly two to one margin. It was upheld by the Supreme Court in 1992 in Nordlinger v. Hahn, 505 U.S. 1 (1992). Proposition 13 is embodied in Article XIII A of the Constitution of the State of California.

Ballot Measure 47 was an initiative in the U.S. state of Oregon that passed in 1996, affecting the assessment of property taxes and instituting a double majority provision for tax legislation. Measure 50 was a revised version of the law, which also passed, after being referred to the voters by the 1997 state legislature.

The Oregon tax revolt is a political movement in Oregon which advocates for lower taxes. This movement is part of a larger anti-tax movement in the western United States which began with the enactment of Proposition 13 in California. The tax revolt, carried out in large part by a series of citizens' initiatives and referendums, has reshaped the debate about taxes and public services in Oregon.

Metro is the regional government for the Oregon portion of the Portland metropolitan area, covering portions of Clackamas, Multnomah, and Washington Counties. It is the only directly elected regional government and metropolitan planning organization in the United States. Metro is responsible for overseeing the Portland region's solid waste system, general planning of land use and transportation, maintaining certain regional parks and natural areas, and operating the Oregon Zoo, Oregon Convention Center, Portland's Centers for the Arts, and the Portland Expo Center. It also distributes money from two voter-approved tax measures: one for homeless services and one for affordable housing.

The Oregon Historical Society(OHS) is an organization that encourages and promotes the study and understanding of the history of the Oregon Country, within the broader context of U.S. history. Incorporated in 1898, the Society collects, preserves, and makes available materials of historical character and interest, and collaborates with other groups and individuals with similar aims. The society operates the Oregon History Center that includes the Oregon Historical Society Museum in downtown Portland.

Bill Sizemore is an American political activist and writer in Redmond, Oregon, United States. Sizemore has never held elected office, but has nonetheless been a major political figure in Oregon since the 1990s. He is considered one of the main proponents of the Oregon tax revolt, a movement that seeks to reduce taxes in the state. Oregon Taxpayers United, a political action committee he founded in 1993, has advanced numerous ballot initiatives limiting taxation, and has opposed spending initiatives. Sizemore made an unsuccessful run for Governor of Oregon in 1998. He also announced his intention to run for governor in 2010, but was indicted by the state on charges of tax evasion. The charges were later amended to failure to file tax returns.

David Douglas School District No. 40 is a school district in eastern Portland, Oregon, United States. Its administrative offices are at 11300 NE Halsey St. Portland, OR 97220.

Randall Edwards is an American politician who most recently served as the state treasurer of the state of Oregon. A Democrat, Edwards was elected as treasurer in 2000 and reelected in 2004, after serving two terms in the Oregon Legislative Assembly. He served as a manager and senior advisor at the Oregon State Treasury from 1992–1996, and was an International Trade Analyst for the U.S. Commerce Department.

The Regional Arts & Culture Council (RACC) is an organization that administers arts grants in Multnomah, Washington, and Clackamas Counties that also do advocacy in the Portland metropolitan area in Oregon, United States. It evolved from the city’s Metropolitan Arts Commission agency in the 1990s. In 1995, the Metropolitan Arts Commission became the RACC as an independent non-profit organization. It's board of director ousted the executive director Carol Tatch in November 2023 following an outside investigation.

Oregon ballot measure 48 was one of two unsuccessful ballot measures sponsored by the Taxpayers Association of Oregon (TAO) on the November 7, 2006 general election ballot. Measure 48 was an initiated constitutional amendment ballot measure. Oregon statute currently limits state appropriations to 8% of projected personal income in Oregon. If Governor declares emergency, legislature may exceed current statutory appropriations limit by 60% vote of each house. This measure would have added a constitutional provision limiting any increase in state spending from one biennium to next biennium to the percentage increase in state population, plus inflation, over previous two years. Certain exceptions to limit, including spending of: federal, donated funds; proceeds from selling certain bonds, real property; money to fund emergency funds; money to fund tax, "kicker," other refunds were included in the provisions of the measure. It also would have provided that spending limit may be exceeded by amount approved by two-thirds of each house of legislature and approved by majority of voters voting in general election.

The Oregon tax rebate, commonly referred to as the kicker, is a rebate calculated for both individual and corporate taxpayers in the U.S. state of Oregon when a revenue surplus exists. The Oregon Constitution mandates that the rebate be issued when the calculated revenue for a given biennium exceeds the forecast revenue by at least two percent. The law was first enacted by ballot measure in 1980, and was entered into the Oregon Constitution with the enactment of Ballot Measure 86 in 2000.

Multnomah County Library is the public library system serving Portland and Multnomah County, Oregon, United States. A continuation of the Library Association of Portland, established in 1864, the system now has 19 branches offering books, magazines, DVDs, and computers. It is the largest library system in Oregon, serving a population of 724,680, with more than 425,000 registered borrowers. According to the Public Library Association, it ranks second among U.S. libraries, based on circulation of books and materials, and ranks first among libraries serving fewer than one million residents. In this respect, it is the busiest in the nation.

The 75th Oregon Legislative Assembly convened beginning on January 12, 2009, for its biennial regular session. All of the 60 seats in the House of Representatives and half of the 30 seats in the State Senate were up for election in 2008; the general election for those seats took place on November 4.

Edward Tevis Wheeler is an American politician who has served as the mayor of Portland, Oregon since 2017. He was Oregon State Treasurer from 2010 to 2016.

Jeffrey Scott Cogen is an American businessman, lawyer, and former politician in the U.S. state of Oregon. From 2016 to 2019, he was Executive Director of Impact NW, a social service and anti-poverty organization headquartered in Portland, Oregon. He served as chairman of the Multnomah County Board of Commissioners from 2010 to 2013.

Deborah Kafoury is a politician in the U.S. state of Oregon.

Delta Dome was a proposed indoor sports venue in Portland, Oregon. Plans for the domed stadium were proposed in 1963. It would have had at least 46,000 seats with plexi-glass skylights and a 17,000 vehicle parking lot. Inspiration for the building's architecture came from the Harris County Domed Stadium in Houston, Texas, which was under construction at the time.

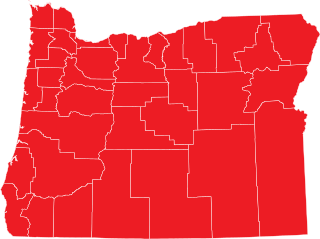

Oregon Ballot Measure 97 was a ballot measure in the 2016 election in the U.S. state of Oregon. The initiative asked voters to determine whether or not to impose a 2.5 percent gross receipts tax on C corporations with Oregon sales exceeding $25 million. S corporations and benefit companies would be exempt from the tax. It was estimated the measure would raise $3 billion annually for the state, if passed.

California Proposition 15 was a failed citizen-initiated proposition on the November 3, 2020, ballot. It would have provided $6.5 billion to $11.5 billion in new funding for public schools, community colleges, and local government services by creating a "split roll" system that increased taxes on large commercial properties by assessing them at market value, without changing property taxes for small business owners or residential properties for homeowners or renters. The measure failed by a small margin of about four percentage points.

References

- ↑ "Don McIntire, activist who led property tax revolt, dies at 74". The Oregonian . Portland, Oregon: Oregonian Media Group. October 12, 2012.

- 1 2 Sokolow, Alvin, D. (Winter 1998). "The Changing Property Tax and State-Local Relations: The State of American Federalism, 1997-1998". Publius. 28 (1). Oxford, England: Oxford University Press: 165–187. doi:10.2307/3331014. JSTOR 3331014.

{{cite journal}}: CS1 maint: multiple names: authors list (link) - 1 2 Graces, Bill (September 26, 1993). "Schools: Teaching within our means". The Oregonian . Oregonian Media Group.

- ↑ Moore, Elizabeth (December 24, 1990). "Multnomah County officials mull effect of cap on taxes". The Oregonian . Portland, Oregon: Oregonian Media Group.