Identity theft, identity piracy or identity infringement occurs when someone uses another's personal identifying information, like their name, identifying number, or credit card number, without their permission, to commit fraud or other crimes. The term identity theft was coined in 1964. Since that time, the definition of identity theft has been legally defined throughout both the U.K. and the U.S. as the theft of personally identifiable information. Identity theft deliberately uses someone else's identity as a method to gain financial advantages or obtain credit and other benefits. The person whose identity has been stolen may suffer adverse consequences, especially if they are falsely held responsible for the perpetrator's actions. Personally identifiable information generally includes a person's name, date of birth, social security number, driver's license number, bank account or credit card numbers, PINs, electronic signatures, fingerprints, passwords, or any other information that can be used to access a person's financial resources.

A dishonoured cheque is a cheque that the bank on which it is drawn declines to pay (“honour”). There are a number of reasons why a bank might refuse to honour a cheque, with non-sufficient funds (NSF) being the most common, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF check may be referred to as a bad check, dishonored check, bounced check, cold check, rubber check, returned item, or hot check. Lost or bounced checks result in late payments and affect the relationship with customers. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed “Present again”, by which time the funds should have cleared.

EMV is a payment method based on a technical standard for smart payment cards and for payment terminals and automated teller machines which can accept them. EMV stands for "Europay, Mastercard, and Visa", the three companies that created the standard.

Online banking, also known as internet banking, virtual banking, web banking or home banking, is a system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution's website or mobile app. Since the early 2000s this has become the most common way that customers access their bank accounts.

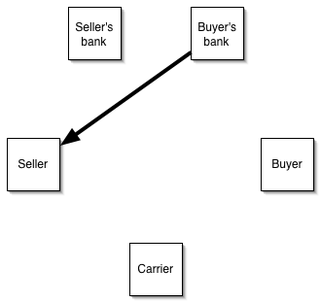

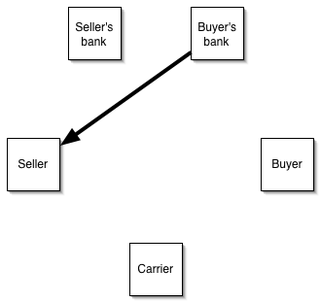

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods.

A cheque is a document that orders a bank, building society to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

A permanent account number (PAN) is a ten-character alphanumeric identifier Foundational ID, issued in the form of a laminated "PAN card", by the Indian Income Tax Department, to any person who applies for it or to whom the department allots the number without an application. It can also be obtained in the form of a PDF file known as e-PAN from the website of the Indian Income Tax Department.

An e-commerce payment system facilitates the acceptance of electronic payment for offline transfer, also known as a subcomponent of electronic data interchange (EDI), e-commerce payment systems have become increasingly popular due to the widespread use of the internet-based shopping and banking.

Friendly fraud, also known as chargeback fraud occurs when a consumer makes an online shopping purchase with their own credit card, and then requests a chargeback from the issuing bank after receiving the purchased goods or services. Once approved, the chargeback cancels the financial transaction, and the consumer receives a refund of the money they spent. Dependent on the payment method used, the merchant can be accountable when a chargeback occurs.

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer with a payment terminal and access automated teller machines (ATMs). Such cards are known by a variety of names, including bank cards, ATM cards, client cards, key cards or cash cards.

Electronic authentication is the process of establishing confidence in user identities electronically presented to an information system. Digital authentication, or e-authentication, may be used synonymously when referring to the authentication process that confirms or certifies a person's identity and works. When used in conjunction with an electronic signature, it can provide evidence of whether data received has been tampered with after being signed by its original sender. Electronic authentication can reduce the risk of fraud and identity theft by verifying that a person is who they say they are when performing transactions online.

A demand guarantee is a guarantee that must be honoured by the guarantor upon beneficiary's demand. The beneficiary is not required to first make a claim or take any action against the obligor of the guaranteed obligation that the guarantee supports. A demand guarantee is enforceable notwithstanding any deficiencies in the enforceability of the underlying obligation.

Credit card fraud is an inclusive term for fraud committed using a payment card, such as a credit card or debit card. The purpose may be to obtain goods or services or to make payment to another account, which is controlled by a criminal. The Payment Card Industry Data Security Standard is the data security standard created to help financial institutions process card payments securely and reduce card fraud.

A credit card is a payment card, usually issued by a bank, allowing its users to purchase goods or services or withdraw cash on credit. Using the card thus accrues debt that has to be repaid later. Credit cards are one of the most widely used forms of payment across the world.

National Electronic Funds Transfer (NEFT) is an electronic funds transfer system maintained by the Reserve Bank of India (RBI). Started in November 2005, the setup was established and maintained by Institute for Development and Research in Banking Technology. NEFT enables bank customers in India to transfer funds between any two NEFT-enabled bank accounts on a one-to-one basis. It is done via electronic messages.

Trade finance is a phrase used to describe different strategies that are employed to make international trade easier. It signifies financing for trade, and it concerns both domestic and international trade transactions. A trade transaction requires a seller of goods and services as well as a buyer. Various intermediaries such as banks and financial institutions can facilitate these transactions by financing the trade. Trade finance manifests itself in the form of letters of credit (LOC), guarantees, or insurance, and is usually provided by intermediaries.

A proof of funds (POF) is a document such as a bank statement proving that a person or a company has the financial ability to perform a transaction or meet a potential future liability. The POF can be issued by a bank, a financial institution or a trade finance provider.

The Lebanese identity card is a compulsory Identity document issued to citizens of the Republic of Lebanon by the police on behalf of the Lebanese Ministry of Interior or in Lebanese embassies/consulates (abroad) free of charge. It is proof of identity, citizenship and residence of the Lebanese citizens.

Ration cards are an official document issued by state governments in India to households that are eligible to purchase subsidised food grain from the Public Distribution System under the National Food Security Act (NFSA). They also serve as a common form of identification for many Indians.

The Punjab National Bank Fraud Case relates to fraudulent letter of undertaking worth ₹12,000 crore issued by the Punjab National Bank at its Brady House branch in Fort, Mumbai; making Punjab National Bank liable for the amount. The fraud was allegedly organized by jeweller and designer Nirav Modi. Nirav, his wife Ami Modi, brother Nishal Modi and uncle Mehul Choksi, all partners of the firms, M/s Diamond R US, M/s Solar Exports and M/s Stellar Diamonds; along with PNB officials and employees, and directors of Nirav Modi and Mehul Choksi's firms have all been named in a charge sheet by the CBI. Nirav Modi and his family absconded in early 2018, days before the news of the scam broke in India.