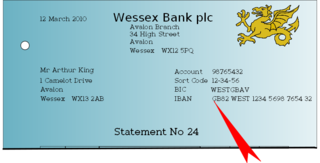

The International Bank Account Number (IBAN) is an internationally agreed upon system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errors. An IBAN uniquely identifies the account of a customer at a financial institution. It was originally adopted by the European Committee for Banking Standards (ECBS) and since 1997 as the international standard ISO 13616 under the International Organization for Standardization (ISO). The current version is ISO 13616:2020, which indicates the Society for Worldwide Interbank Financial Telecommunication (SWIFT) as the formal registrar. Initially developed to facilitate payments within the European Union, it has been implemented by most European countries and numerous countries in other parts of the world, mainly in the Middle East and the Caribbean. By July 2024, 88 countries were using the IBAN numbering system.

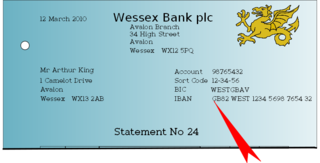

ISO 9362 is an international standard for Business Identifier Codes (BIC), a unique identifier for business institutions, approved by the International Organization for Standardization (ISO). BIC is also known as SWIFT-BIC, SWIFT ID, or SWIFT code, after the Society for Worldwide Interbank Financial Telecommunication (SWIFT), which is designated by ISO as the BIC registration authority. BIC was defined originally as Bank Identifier Code and is most often assigned to financial organizations; when it is assigned to non-financial organization, the code may also be known as Business Entity Identifier (BEI). These codes are used when transferring money between banks, particularly for international wire transfers, and also for the exchange of other messages between banks. The codes can sometimes be found on account statements.

Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account, or through a transfer of cash at a cash office.

ISO 20022 is an ISO standard for electronic data interchange between financial institutions. It describes a metadata repository containing descriptions of messages and business processes, and a maintenance process for the repository content. The standard covers financial information transferred between financial institutions that includes payment transactions, securities trading and settlement information, credit and debit card transactions and other financial information.

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, payment instruments such as payment cards, people, rules, procedures, standards, and technologies that make its exchange possible. A payment system is an operational network which links bank accounts and provides for monetary exchange using bank deposits. Some payment systems also include credit mechanisms, which are essentially a different aspect of payment.

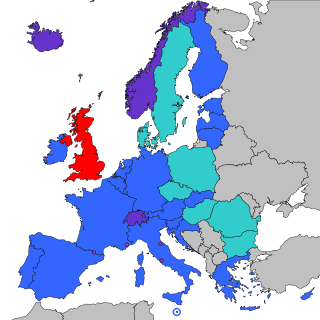

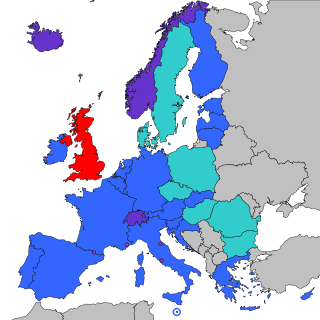

The Single Euro Payments Area (SEPA) is a payment integration initiative of the European Union for simplification of bank transfers denominated in euros. As of 2020, there were 36 members in SEPA, consisting of the 27 member states of the European Union, the four member states of the European Free Trade Association, and the United Kingdom. Some microstates participate in the technical schemes: Andorra, Monaco, San Marino, and Vatican City.

The Central Bank of the Islamic Republic of Iran, also known as Bank Markazi, was established under the Iranian Banking and Monetary Act in 1960, it serves as the banker to the Iranian government and has the exclusive right of issuing banknote and coinage. CBI is tasked with maintaining the value of Iranian rial and supervision of banks and credit institutions. It acts as custodian of the National Jewels, as well as foreign exchange and gold reserves of Iran. It is also a founding member of the Asian Clearing Union, controls gold and capital flows overseas, represents Iran in the International Monetary Fund (IMF) and internationally concludes payment agreements between Iran and other countries.

The Terrorist Finance Tracking Program (TFTP) is a United States government program to access financial transactions on the international SWIFT network that was revealed by The New York Times, The Wall Street Journal and The Los Angeles Times in June 2006. It was part of the Bush administration's War on Terrorism. After the covert action was disclosed, the so-called SWIFT Agreement was negotiated between the United States and the European Union.

There have been a number of international sanctions against Iran imposed by a number of countries, especially the United States, and international entities. Iran was the most sanctioned country in the world until it was surpassed by Russia, following Russia's invasion of neighboring Ukraine in February 2022.

The Electronic Banking Internet Communication Standard (EBICS) is a German transmission protocol developed by the German Banking Industry Committee for sending payment information between banks, as well as between banks and client applications, over the Internet. It grew out of the earlier BCS-FTAM protocol that was developed in 1995, with the aim of being able to use Internet connections and TCP/IP. It is mandated for use by German banks and has also been adopted by France, Switzerland and Austria. Adoptions in different countries have resulted in specific operations being permitted by some banks while being disallowed by others.

Structured Financial Messaging System (SFMS) is a secure messaging standard developed to serve as a platform for intra-bank and inter-bank applications. It is an Indian standard similar to SWIFT which is the international messaging system used for financial messaging globally.

Savings Bank "Belarusbank" is the largest bank in Belarus that occupies leading positions in the Belarusian banking system by volume of equity, assets, loans, deposits.

UNISTREAM, sometimes written UNISTREAM Bank, is an international money transfer company and bank based in Russia.

EBA Clearing is a provider of pan-European payment infrastructure wholly owned by shareholders that consist of major European banks. It derives its name from the Euro Banking Association which was instrumental in its establishment in June 1998, but has always been a separate organization.

The Cross-border Interbank Payment System (CIPS) is a Chinese payment system that offers clearing and settlement services for its participants in cross-border renminbi (RMB) payments and trade. CIPS is backed by the People's Bank of China and was launched in 2015 as part of a policy effort to internationalize the use of China’s currency.

In 2015 and 2016, a series of cyberattacks using the SWIFT banking network were reported, resulting in the successful theft of millions of dollars. The attacks were perpetrated by a hacker group known as APT 38 whose tactics, techniques and procedure overlap with the infamous Lazarus Group who are believed to be behind the Sony attacks. Experts agree that APT 38 was formed following the March 2013 sanctions and the first known operations connected to this group occurred in February 2014. If the attribution to North Korea is accurate, it would be the first known incident of a state actor using cyberattacks to steal funds.

Mir is a Russian card payment system for electronic fund transfers established by the Central Bank of Russia under a law adopted on 1 May 2017. Russian National Card Payment System, a wholly-owned subsidiary of the Central Bank of Russia. Mir does not itself issue cards, extend credit or set rates and fees for consumers; rather, Mir provides financial institutions with Mir-branded payment products that they use to offer credit, debit, or other programs to their customers. The development and implementation of Mir was spurred by the imposition of international sanctions against Russia in 2014 to circumnavigate the reliance on the likes of Visa and Mastercard, which were blocked in Russia at the time. Mir created its own digital wallet for contactless payments.

The System for Transfer of Financial Messages, abbreviated SPFS, is a Russian equivalent of the SWIFT financial transfer system, developed by the Central Bank of Russia. The system has been in development since 2014, when the United States government threatened to disconnect the Russian Federation from the SWIFT system. Since June 2024 the system is banned by the European Council for EU banks outside Russia, and in an alert issued in November 2024 the US OFAC warned that institutions that join the system after the issuance of this alert will be subject to aggressive targeting.

Dedollarisation refers to countries reducing reliance on the U.S. dollar as a reserve currency, medium of exchange or as a unit of account. It also entails the creation of an alternative global financial and technological system in order to gain more economic independence by circumventing the dependence on the Western World-controlled systems, such as SWIFT financial transfers network for the international trade and payments, which could be economically weaponised by America and its Western World allies against other nations. Since the establishment of the Bretton Woods system, the US dollar has been used as the medium for international trade. The United States Department of the Treasury exercises considerable oversight over the SWIFT financial transfers network, and consequently has a huge sway on the global financial transactions systems, with the ability to impose economic sanctions on foreign entities and individuals. Many entities, such as BRICS, are working on creating an alternative to the SWIFT for a more balanced world.

The SWIFT ban against some Russian banks is one of several international sanctions against the Russian regime imposed by the European Union and other western countries as a result of its invasion of Ukraine, aimed at weakening the country's economy to end the invasion by hindering Russian access to the SWIFT financial transaction processing system.