Notes

- ↑ "ISO 15022 (official website)".

- ↑ "ISO 15022 Securities — Scheme for messages" . Retrieved November 14, 2022.

ISO 15022 is an ISO standard for securities messaging used in transactions between financial institutions. Participants in the financial industry need a common representation of the financial transactions they perform and this standard defines general message schema, which in turn are used by organizations to define messages in a complete and unambiguous way. [1] This results in efficiency, lower costs, and the avoidance of errors. Prior to standardization in this area, there were overlapping standards, or ad hoc approaches where there was a functional gap and no standard.

ISO 15022 replaces the previous securities messaging standard ISO 7775. It provides two syntaxes: one compatible with the preceding standards, and one fairly compatible with EDIFACT. ISO 20022 is the successor to ISO 15022.

SWIFT is the registration authority for ISO 15022. In SWIFT financial messages, the standard is applied to variety of message types.

ISO 15022 was developed in 1992, in London, to provide the securities industry with a better tool to create message standards. The previous standard ISO 7775 contained the actual message standards themselves (like the SWIFT message types MT 520 or MT 534), which did not make it easy to make changes to these standards (because each time one needs to pass a number of time-consuming standard cycles). To avoid this, ISO 15022 does not contain the actual messages, but contains a set of rules and guidelines to build messages. If these rules and guidelines are adhered to (checked by the registration authority) the resulting message (format) is automatically an ISO 15022-compliant standard. Examples are the MT103, MT202 Cov, MT540, MT542, MT548, etc.

ISO 15022 is split into two parts:

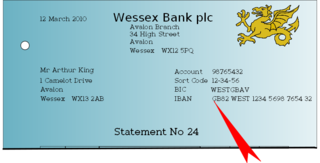

The International Bank Account Number (IBAN) is an internationally agreed upon system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errors. An IBAN uniquely identifies the account of a customer at a financial institution. It was originally adopted by the European Committee for Banking Standards (ECBS) and since 1997 as the international standard ISO 13616 under the International Organization for Standardization (ISO). The current version is ISO 13616:2020, which indicates the Society for Worldwide Interbank Financial Telecommunication (SWIFT) as the formal registrar. Initially developed to facilitate payments within the European Union, it has been implemented by most European countries and numerous countries in other parts of the world, mainly in the Middle East and the Caribbean. As of July 2023, 86 countries were using the IBAN numbering system.

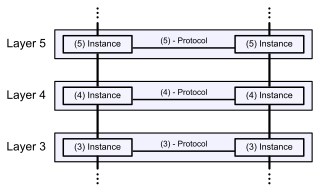

The Open Systems Interconnection model is a reference model from the International Organization for Standardization (ISO) that "provides a common basis for the coordination of standards development for the purpose of systems interconnection." In the OSI reference model, the communications between systems are split into seven different abstraction layers: Physical, Data Link, Network, Transport, Session, Presentation, and Application.

The Society for Worldwide Interbank Financial Telecommunication (Swift), legally S.W.I.F.T. SC, is a Belgian banking cooperative providing services related to the execution of financial transactions and payments between limited banks worldwide. Its principal function is to serve as the main messaging network through which limited international payments are initiated. It also sells software and services to financial institutions, mostly for use on its proprietary "SWIFTNet", and assigns ISO 9362 Business Identifier Codes (BICs), popularly known as "Swift codes".

ISO 9362 is an international standard for Business Identifier Codes (BIC), a unique identifier for business institutions, approved by the International Organization for Standardization (ISO). BIC is also known as SWIFT-BIC, SWIFT ID, or SWIFT code, after the Society for Worldwide Interbank Financial Telecommunication (SWIFT), which is designated by ISO as the BIC registration authority. BIC was defined originally as Bank Identifier Code and is most often assigned to financial organizations; when it is assigned to non-financial organization, the code may also be known as Business Entity Identifier (BEI). These codes are used when transferring money between banks, particularly for international wire transfers, and also for the exchange of other messages between banks. The codes can sometimes be found on account statements.

ISO 10962, known as Classification of Financial Instruments (CFI), is a six-letter-code used in the financial services industry to classify and describe the structure and function of a financial instrument as part of the instrument reference data. It is an international standard approved by the International Organization for Standardization (ISO). CFI have been required since 1 July 2017.

Delivery versus payment or DvP is a common form of settlement for securities. The process involves the simultaneous delivery of all documents necessary to give effect to a transfer of securities in exchange for the receipt of the stipulated payment amount. Alternatively, it may involve transfers of two securities in such a way as to ensure that delivery of one security occurs if and only if the corresponding delivery of the other security occurs.

Registration authorities exist for many standards organizations, such as ANNA, the Object Management Group, W3C, and others. In general, registration authorities all perform a similar function, in promoting the use of a particular standard through facilitating its use. This may be by applying the standard, where appropriate, or by verifying that a particular application satisfies the standard's tenants. Maintenance agencies, in contrast, may change an element in a standard based on set rules – such as the creation or change of a currency code when a currency is created or revalued. The Object Management Group has an additional concept of certified provider, which is deemed an entity permitted to perform some functions on behalf of the registration authority, under specific processes and procedures documented within the standard for such a role.

ISO/IEC 6523Information technology – Structure for the identification of organizations and organization parts is an international standard that defines a structure for uniquely identifying organizations and parts thereof in computer data interchange and specifies the registration procedure to obtain an International Code Designator (ICD) value for an identification scheme.

ISO 20022 is an ISO standard for electronic data interchange between financial institutions. It describes a metadata repository containing descriptions of messages and business processes, and a maintenance process for the repository content. The standard covers financial information transferred between financial institutions that includes payment transactions, securities trading and settlement information, credit and debit card transactions and other financial information.

In general, compliance means conforming to a rule, such as a specification, policy, standard or law. Compliance has traditionally been explained by reference to the deterrence theory, according to which punishing a behavior will decrease the violations both by the wrongdoer and by others. This view has been supported by economic theory, which has framed punishment in terms of costs and has explained compliance in terms of a cost-benefit equilibrium. However, psychological research on motivation provides an alternative view: granting rewards or imposing fines for a certain behavior is a form of extrinsic motivation that weakens intrinsic motivation and ultimately undermines compliance.

The ISO/IEC 11179 metadata registry (MDR) standard is an international ISO/IEC standard for representing metadata for an organization in a metadata registry. It documents the standardization and registration of metadata to make data understandable and shareable.

ISO 8583 is an international standard for financial transaction card originated interchange messaging. It is the International Organization for Standardization standard for systems that exchange electronic transactions initiated by cardholders using payment cards.

Information security standards or cyber security standards are techniques generally outlined in published materials that attempt to protect the cyber environment of a user or organization. This environment includes users themselves, networks, devices, all software, processes, information in storage or transit, applications, services, and systems that can be connected directly or indirectly to networks.

Information technology risk, IT risk, IT-related risk, or cyber risk is any risk relating to information technology. While information has long been appreciated as a valuable and important asset, the rise of the knowledge economy and the Digital Revolution has led to organizations becoming increasingly dependent on information, information processing and especially IT. Various events or incidents that compromise IT in some way can therefore cause adverse impacts on the organization's business processes or mission, ranging from inconsequential to catastrophic in scale.

SWIFT message types are the format or schema used to send messages to financial institutions on the SWIFT network. The original message types were developed by SWIFT and a subset was retrospectively made into an ISO standard, ISO 15022. In many instances, SWIFT message types between custodians follow the ISO standard. This was later supplemented by a XML based version under ISO 20022.

SIX Financial Information, a subsidiary of SIX Group, is a multinational financial data vendor headquartered in Zurich, Switzerland. The company provides market data which it gathers from the world's major trading venues directly and in real-time. Its database has structured and encoded securities administration data for more than 20 million financial instruments. The firm has offices in 23 countries.

CIPURSE is an open security standard for transit fare collection systems. It makes use of smart card technologies and additional security measures.

Electronic Bank Account Management represents the automation, through software, of the following activities between banks and their corporate customers:

The Cross-Border Interbank Payment System (CIPS) is a Chinese payment system that offers clearing and settlement services for its participants in cross-border renminbi (RMB) payments and trade. Backed by the People's Bank of China (PBOC), China launched the CIPS in 2015 to internationalize RMB use. CIPS also counts several foreign banks as shareholders, including HSBC, Standard Chartered, the Bank of East Asia, DBS Bank, Citi, Australia and New Zealand Banking Group, and BNP Paribas.

MT940 is a specific SWIFT message type used by the SWIFT network to send and receive end-of-day bank account statements.