Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference." An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships." Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today.

A macroeconomic model is an analytical tool designed to describe the operation of the problems of economy of a country or a region. These models are usually designed to examine the comparative statics and dynamics of aggregate quantities such as the total amount of goods and services produced, total income earned, the level of employment of productive resources, and the level of prices.

Economic forecasting is the process of making predictions about the economy. Forecasts can be carried out at a high level of aggregation—for example for GDP, inflation, unemployment or the fiscal deficit—or at a more disaggregated level, for specific sectors of the economy or even specific firms. Economic forecasting is a measure to find out the future prosperity of a pattern of investment and is the key activity in economic analysis. Many institutions engage in economic forecasting: national governments, banks and central banks, consultants and private sector entities such as think-tanks, companies and international organizations such as the International Monetary Fund, World Bank and the OECD. A broad range of forecasts are collected and compiled by "Consensus Economics". Some forecasts are produced annually, but many are updated more frequently.

Econometric models involving data sampled at different frequencies are of general interest. Mixed-data sampling (MIDAS) is an econometric regression developed by Eric Ghysels with several co-authors. There is now a substantial literature on MIDAS regressions and their applications, including Ghysels, Santa-Clara and Valkanov (2006), Ghysels, Sinko and Valkanov, Andreou, Ghysels and Kourtellos (2010) and Andreou, Ghysels and Kourtellos (2013).

The mean absolute percentage error (MAPE), also known as mean absolute percentage deviation (MAPD), is a measure of prediction accuracy of a forecasting method in statistics. It usually expresses the accuracy as a ratio defined by the formula:

Probabilistic forecasting summarizes what is known about, or opinions about, future events. In contrast to single-valued forecasts, probabilistic forecasts assign a probability to each of a number of different outcomes, and the complete set of probabilities represents a probability forecast. Thus, probabilistic forecasting is a type of probabilistic classification.

The root-mean-square deviation (RMSD) or root-mean-square error (RMSE) is either one of two closely related and frequently used measures of the differences between true or predicted values on the one hand and observed values or an estimator on the other.

Structural estimation is a technique for estimating deep "structural" parameters of theoretical economic models. The term is inherited from the simultaneous equations model. Structural estimation is extensively using the equations from the economics theory, and in this sense is contrasted with "reduced form estimation" and other nonstructural estimations that study the statistical relationships between the observed variables while utilizing the economics theory very lightly. The idea of combining statistical and economic models dates to mid-20th century and work of the Cowles Commission.

Quantile regression is a type of regression analysis used in statistics and econometrics. Whereas the method of least squares estimates the conditional mean of the response variable across values of the predictor variables, quantile regression estimates the conditional median of the response variable. Quantile regression is an extension of linear regression used when the conditions of linear regression are not met.

Demand forecasting refers to the process of predicting the quantity of goods and services that will be demanded by consumers at a future point in time. More specifically, the methods of demand forecasting entail using predictive analytics to estimate customer demand in consideration of key economic conditions. This is an important tool in optimizing business profitability through efficient supply chain management. Demand forecasting methods are divided into two major categories, qualitative and quantitative methods. Qualitative methods are based on expert opinion and information gathered from the field. This method is mostly used in situations when there is minimal data available for analysis such as when a business or product has recently been introduced to the market. Quantitative methods, however, use available data, and analytical tools in order to produce predictions. Demand forecasting may be used in resource allocation, inventory management, assessing future capacity requirements, or making decisions on whether to enter a new market.

In statistics and econometrics, Bayesian vector autoregression (BVAR) uses Bayesian methods to estimate a vector autoregression (VAR) model. BVAR differs with standard VAR models in that the model parameters are treated as random variables, with prior probabilities, rather than fixed values.

The methodology of econometrics is the study of the range of differing approaches to undertaking econometric analysis.

Nowcasting in economics is the prediction of the very recent past, the present, and the very near future state of an economic indicator. The term is a portmanteau of "now" and "forecasting" and originates in meteorology. Typical measures used to assess the state of an economy, such as gross domestic product (GDP) or inflation, are only determined after a delay and are subject to revision. In these cases, nowcasting such indicators can provide an estimate of the variables before the true data are known. Nowcasting models have been applied most notably in Central Banks, who use the estimates to monitor the state of the economy in real-time as a proxy for official measures.

Anil K. Bera is an Indian-American econometrician. He is Professor of Economics at University of Illinois at Urbana–Champaign's Department of Economics. He is most noted for his work with Carlos Jarque on the Jarque–Bera test.

Kenneth David West is the John D. MacArthur and Ragnar Frisch Professor of Economics in the Department of Economics at the University of Wisconsin. He is currently co-editor of the Journal of Money, Credit and Banking, and has previously served as co-editor of the American Economic Review. He has published widely in the fields of macroeconomics, finance, international economics and econometrics. Among his honors are the John M. Stauffer National Fellowship in Public Policy at the Hoover Institution, Alfred P. Sloan Research Fellowship, Fellow of the Econometric Society, and Abe Fellowship. He has been a research associate at the NBER since 1985.

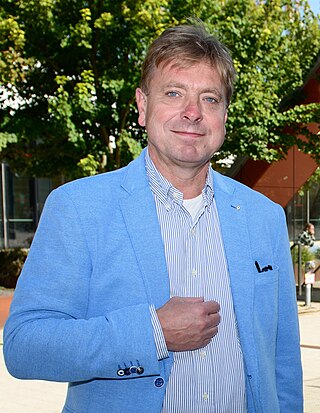

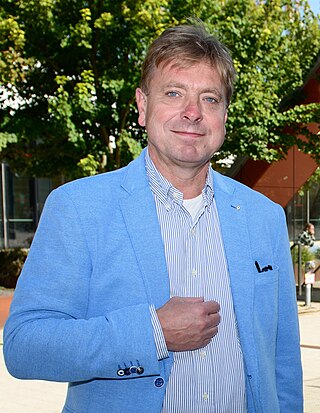

Philippus Henricus Benedictus Franciscus "Philip Hans" Franses is a Dutch economist and Professor of Applied Econometrics and Marketing Research at the Erasmus University Rotterdam, and dean of the Erasmus School of Economics, especially known for his 1998 work on "Nonlinear Time Series Models in Empirical Finance."

Quantile Regression Averaging (QRA) is a forecast combination approach to the computation of prediction intervals. It involves applying quantile regression to the point forecasts of a small number of individual forecasting models or experts. It has been introduced in 2014 by Jakub Nowotarski and Rafał Weron and originally used for probabilistic forecasting of electricity prices and loads. Despite its simplicity it has been found to perform extremely well in practice - the top two performing teams in the price track of the Global Energy Forecasting Competition (GEFCom2014) used variants of QRA.

Electricity price forecasting (EPF) is a branch of energy forecasting which focuses on predicting the spot and forward prices in wholesale electricity markets. Over the last 15 years electricity price forecasts have become a fundamental input to energy companies’ decision-making mechanisms at the corporate level.

Expert Judgment (EJ) denotes a wide variety of techniques ranging from a single undocumented opinion, through preference surveys, to formal elicitation with external validation of expert probability assessments. Recent books are . In the nuclear safety area, Rasmussen formalized EJ by documenting all steps in the expert elicitation process for scientific review. This made visible wide spreads in expert assessments and teed up questions regarding the validation and synthesis of expert judgments. The nuclear safety community later took onboard expert judgment techniques underpinned by external validation . Empirical validation is the hallmark of science, and forms the centerpiece of the classical model of probabilistic forecasting . A European Network coordinates workshops. Application areas include nuclear safety, investment banking, volcanology, public health, ecology, engineering, climate change and aeronautics/aerospace. For a survey of applications through 2006 see and give exhortatory overviews. A recent large scale implementation by the World Health Organization is described in . A long running application at the Montserrat Volcano Observatory is described in . The classical model scores expert performance in terms of statistical accuracy and informativeness . These terms should not be confused with “accuracy and precision”. Accuracy “is a description of systematic errors” while precision “is a description of random errors”. In the classical model statistical accuracy is measured as the p-value or probability with which one would falsely reject the hypotheses that an expert's probability assessments were statistically accurate. A low value means it is very unlikely that the discrepancy between an expert's probability statements and observed outcomes should arise by chance. Informativeness is measured as Shannon relative information with respect to an analyst-supplied background measure. Shannon relative information is used because it is scale invariant, tail insensitive, slow, and familiar. Parenthetically, measures with physical dimensions, such as the standard deviation, or the width of prediction intervals, raise serious problems, as a change of units would affect some variables but not others. The product of statistical accuracy and informativeness for each expert is their combined score. With an optimal choice of a statistical accuracy threshold beneath which experts are unweighted, the combined score is a long run “strictly proper scoring rule”: an expert achieves his long run maximal expected score by and only by stating his true beliefs. The classical model derives Performance Weighted (PW) combinations. These are compared with Equally Weighted (EW) combinations, and recently with Harmonically Weighted (HW) combinations, as well as with individual expert assessments.

Barbara Rossi is an ICREA professor of economics at Universitat Pompeu Fabra, a Barcelona GSE Research Professor, a CREI affiliated professor and a CEPR Fellow. She is a founding fellow of the International Association of Applied Econometrics, a fellow of the Econometric Society and a director of the International Association of Applied Econometrics.