Related Research Articles

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as floating, or going public, a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded.

Chemdex Corporation, later known as Ventro Corporation and then NexPrise, Inc., was a B2B e-commerce company that first operated an online marketplace for products related to the life sciences industry such as laboratory chemicals, enzymes, and equipment, but later expanded into a few other industries. It was notable for its $7 billion market capitalization during the dot-com bubble despite minimal revenues.

TPG Inc., previously known as Texas Pacific Group and TPG Capital, is an American private equity firm based in Fort Worth, Texas. TPG manages investment funds in growth capital, venture capital, public equity, and debt investments. The firm invests in a range of industries including consumer/retail, media and telecommunications, industrials, technology, travel, leisure, and health care. TPG became a public company in January 2022, trading on the NASDAQ under the ticker symbol “TPG”.

A special purpose acquisition company, also known as a "blank check company", is a shell corporation listed on a stock exchange with the purpose of acquiring a private company, thus making the private company public without going through the initial public offering process, which often carries significant procedural and regulatory burdens. According to the U.S. Securities and Exchange Commission (SEC), SPACs are created specifically to pool funds to finance a future merger or acquisition opportunity within a set timeframe; these opportunities usually have yet to be identified while raising funds.

Accel, formerly known as Accel Partners, is an American venture capital firm. Accel works with startups in seed, early and growth-stage investments. The company has offices in Palo Alto, California and San Francisco, California, with additional operating funds in London, India and China.

Qualtrics is an American experience management company, with co-headquarters in Seattle, Washington, and Provo, Utah, in the United States. The company was founded in 2002 by Scott M. Smith, Ryan Smith, Jared Smith, and Stuart Orgill.

Block, Inc. is a U.S. listed company founded by Jack Dorsey and Jim McKelvey in 2009. It is a financial technology conglomerate. The company reportedly serves 56 million users and 4 million businesses, and processes payments worth US$228 billion annually as of 2023.

Slack Technologies, LLC is an American software company founded in 2009 in Vancouver, British Columbia, known for its proprietary communication platform Slack. Outside its headquarters in San Francisco, California, Slack also operates offices in New York City, Denver, Toronto, London, Paris, Tokyo, Dublin, Vancouver, Pune, and Melbourne.

The technology company Facebook, Inc., held its initial public offering (IPO) on Friday, May 18, 2012. The IPO was one of the biggest in technology and Internet history, with a peak market capitalization of over $104 billion.

Chamath Palihapitiya is a Sri Lankan-born Canadian and American venture capitalist, engineer, SPAC sponsor, founder and CEO of Social Capital. Palihapitiya was an early senior executive at Facebook, working at the company from 2007 to 2011. Following his departure from Facebook, Palihapitiya started The Social+Capital Partnership, through which he invested in several companies, including Yammer and Slack. He is a co-host of a technology podcast, All-In, along with David Sacks, Jason Calacanis, and David Friedberg.

David M. Wehner is the Chief Strategy Officer (CSO) of Meta Platforms.

Sprinklr is an American software company based in New York City that develops a SaaS customer experience management (CXM) platform. The company's software, also called Sprinklr, combines different applications for social media marketing, social advertising, content management, collaboration, employee advocacy, customer care, social media research, and social media monitoring.

Luca Maestri is an Italian businessman. He is the chief financial officer (CFO) of Apple Inc..

Snowflake Inc. is an American cloud computing–based data cloud company based in Bozeman, Montana. It was founded in July 2012 and was publicly launched in October 2014 after two years in stealth mode.

Allbirds, Inc. is a New Zealand and American company that sells footwear and apparel. Allbirds is headquartered in San Francisco, California. The footwear company mostly uses a direct-to-consumer model in conjunction with distribution via select additional stores in addition to select Nordstrom and Dick's Sporting Goods locations.

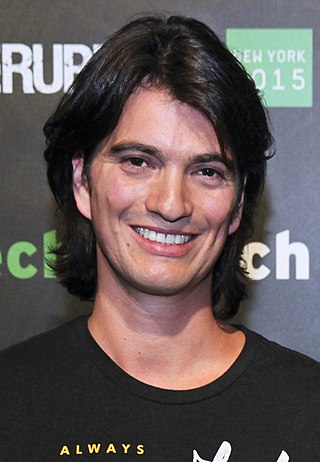

Adam Neumann is an Israeli-American billionaire businessman and investor. In 2010, he co-founded WeWork with Miguel McKelvey, where he was CEO from 2010 to 2019. In 2019, he co-founded a family office dubbed 166 2nd Financial Services with his wife, Rebekah Neumann, to manage their personal wealth, investing over a billion dollars in real estate and venture startups.

Vladimir Tenev is a Bulgarian-American entrepreneur who is the co-founder and CEO of Robinhood, a US-based financial technology services company.

Meta Platforms, Inc., doing business as Meta, and formerly named Facebook, Inc., and TheFacebook, Inc., is an American multinational technology conglomerate based in Menlo Park, California. The company owns and operates Facebook, Instagram, Threads, and WhatsApp, among other products and services. Meta ranks among the largest American information technology companies, alongside other Big Five corporations Alphabet (Google), Amazon, Apple, and Microsoft. The company was ranked #31 on the Forbes Global 2000 ranking in 2023. In 2022, Meta was the company with the third-highest expenditure on research and development worldwide, with R&D expenditure amounting to US$35.3 billion.

Zscaler, Inc. is an American cloud security company, with headquarters in San Jose, California. The company offers cloud-based services to protect enterprise networks and data.

One97 Communications Ltd is an Indian multinational technology company, headquartered in Noida. It was founded in 2000 by Vijay Shekhar Sharma. Through its subsidiaries and businesses, the company offers digital payment and financial services to consumers and merchants in India. It also provides mobile advertising, marketing and payments for merchants.

References

- 1 2 CNBC (2012-05-22). "David Ebersman". www.cnbc.com. Retrieved 2021-12-30.

- 1 2 Jennings, Katie. "Health Insurance For Mental Health Is Terrible. This $4.6 Billion Startup Is Shaking Up The Status Quo". Forbes. Retrieved 2021-12-30.

- 1 2 "Facebook hires former Genentech exec Ebersman as its new CFO". LA Times Blogs - Technology. 2009-06-29. Retrieved 2021-12-30.

- 1 2 3 4 Albergotti, Reed (2014-04-23). "Facebook CFO Ebersman to Step Down Two Years After IPO". Wall Street Journal. ISSN 0099-9660 . Retrieved 2021-12-30.

- ↑ Blodget, Henry. "We Just Found Someone Who Knew Facebook's CFO David Ebersman When He Was In High School..." Business Insider. Retrieved 2021-12-30.

- ↑ David A. Ebersman. "David Ebersman: Executive Profile & Biography – Businessweek". Investing.businessweek.com. Retrieved 2012-05-22.[ dead link ]

- ↑ "Facebook hires former Genentech exec as CFO". ZDNet. 2009-06-29. Retrieved 2012-05-22.

- ↑ "Going Public: Key Developments in Facebook's IPO – ABC News". Abcnews.go.com. 2012-02-01. Archived from the original on 2012-05-22. Retrieved 2012-05-22.

- ↑ Andrew Ross Sorkin. "DEALBOOK; The Man Behind Facebook's I.P.O. Debacle". query.nytimes.com. Retrieved 2021-12-30.

- ↑ Jennings, Katie. "Lyra Health Hits $1.1 Billion Valuation, As Coronavirus Boosts Need For Teletherapy". Forbes. Retrieved 2021-01-15.

- ↑ "David a Ebersman, Lyra Health Inc: Profile and Biography". www.bloomberg.com. Retrieved 2021-12-30.

- ↑ Jennings, Katie. "Lyra Health Hits $1.1 Billion Valuation, As Coronavirus Boosts Need For Teletherapy". Forbes. Archived from the original on August 26, 2020. Retrieved 2021-12-30.