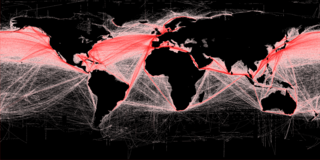

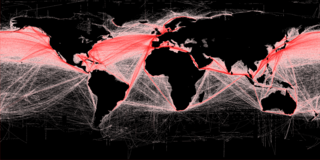

Freight transport, also referred as freight forwarding, is the physical process of transporting commodities and merchandise goods and cargo. The term shipping originally referred to transport by sea but in American English, it has been extended to refer to transport by land or air as well. "Logistics", a term borrowed from the military environment, is also used in the same sense.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price or delivery price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

A container ship is a cargo ship that carries all of its load in truck-size intermodal containers, in a technique called containerization. Container ships are a common means of commercial intermodal freight transport and now carry most seagoing non-bulk cargo.

In transportation, freight refers to goods conveyed by land, water or air, while cargo refers specifically to freight when conveyed via water or air. In economics, freight refers to goods transported at a freight rate for commercial gain. The term cargo is also used in case of goods in the cold-chain, because the perishable inventory is always in transit towards a final end-use, even when it is held in cold storage or other similar climate-controlled facilities, including warehouses.

Frontline PLC is the world's fourth largest oil tanker shipping company, based in Limassol, Cyprus and controlled by John Fredriksen. Its primary business is transporting crude oil. As of 2008 the company had one of the world's largest tanker fleets consisting of VLCC, Suezmax and Suezmax OBO carriers.

A boat or ship engaged in the tramp trade is one which does not have a fixed schedule, itinerary nor published ports of call, and trades on the spot market as opposed to freight liners. A steamship engaged in the tramp trade is sometimes called a tramp steamer; similar terms, such as tramp freighter and tramper, are also used. Chartering is done chiefly on London, New York, and Singapore shipbroking exchanges. The Baltic Exchange serves as a type of stock market index for the trade.

The Baltic Exchange is a membership organisation for the maritime industry, and freight market information provider for the trading and settlement of physical and derivative contracts.

Shipbroking is a financial service, which forms part of the global shipping industry. Shipbrokers are specialist intermediaries/negotiators between shipowners and charterers who use ships to transport cargo, or between buyers and sellers of vessels.

Chartering is an activity within the shipping industry whereby a shipowner hires out the use of their vessel to a charterer. The contract between the parties is called a charterparty. The three main types of charter are: demise charter, voyage charter, and time charter.

A freight rate is a price at which a certain cargo is delivered from one point to another. The price depends on the form of the cargo, the mode of transport, the weight of the cargo, and the distance to the delivery destination. Many shipping services, especially air carriers, use dimensional weight for calculating the price, which takes into account both weight and volume of the cargo.

The Baltic Dry Index (BDI) is a shipping freight-cost index issued daily by the London-based Baltic Exchange. The BDI is a composite of the Capesize, Panamax and Supramax timecharter averages. It is reported around the world as a proxy for dry bulk shipping stocks as well as a general shipping market bellwether.

The Compagnie Maritime Belge (CMB) is one of the oldest Antwerp ship-owners. It is controlled by the Saverys family who also own major stakes in the Exmar and Euronav groups.

An oil tanker, also known as a petroleum tanker, is a ship designed for the bulk transport of oil or its products. There are two basic types of oil tankers: crude tankers and product tankers. Crude tankers move large quantities of unrefined crude oil from its point of extraction to refineries. Product tankers, generally much smaller, are designed to move refined products from refineries to points near consuming markets.

LCH is a financial market infrastructure company headquartered in London that provides clearing services to major international exchanges and to a range of OTC markets. The LCH Group includes two main entities: LCH Limited based in London and LCH SA based in Paris.

Excel Maritime Carriers Ltd. is a shipping company specializing in the transport of dry bulk cargo such as iron ore, coal and grains, as well as bauxite, fertilizers and steel products. As of May 2009, it is the largest bulk carrier by DWT of any U.S.-listed company. Approximately one-third of all seaborne trade is dry bulk related. Excel Maritime was a component of the NYSE Composite Index and the PHLX Marine Shipping Index. The stock has been de-listed from the exchanges as per their rules of listing

A forward freight agreement (FFA) is a financial forward contract that allows ship owners, charterers and speculators to hedge against the volatility of freight rates. It gives the contract owner the right to buy and sell the price of freight for future dates. FFAs are built on an index composed of a shipping route for tanker or a basket of routes for dry bulk, contracts are traded ‘over the counter’ on a principal-to-principal basis and can be cleared through a clearing house.

Container Freight Swap Agreements are a financial futures contract that allow for hedging and speculating against the volatility of seaborne, intermodal container box-rates.

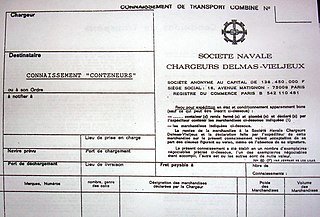

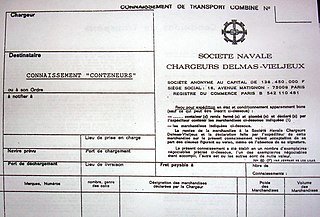

A bill of lading is a document issued by a carrier to acknowledge receipt of cargo for shipment. Although the term is historically related only to carriage by sea, a bill of lading may today be used for any type of carriage of goods. Bills of lading are one of three crucial documents used in international trade to ensure that exporters receive payment and importers receive the merchandise. The other two documents are a policy of insurance and an invoice. Whereas a bill of lading is negotiable, both a policy and an invoice are assignable. In international trade outside the United States, bills of lading are distinct from waybills in that the latter are not transferable and do not confer title. Nevertheless, the UK Carriage of Goods by Sea Act 1992 grants "all rights of suit under the contract of carriage" to the lawful holder of a bill of lading, or to the consignee under a sea waybill or a ship's delivery order.

Indonesia Commodity and Derivatives Exchange (ICDX) provides facilities and infrastructure to its members to conduct prime commodity transactions and enforce laws and regulations to create a fair, transparent, cost effective, and well-organized market as a platform to form accountable and credible prices, and as a hedging tool. With abundant natural resources in Indonesia, ICDX is able to facilitate national interest as a global trading center for prime commodities such as Gold, Crude Oil, Foreign Exchange, Crude Palm Oil (CPO) and Tin. ICDX collaborates with PT Indonesia Clearing House (ICH) and PT ICDX Logistik Berikat (ILB). ICH has a role as the guarantor institution for all transactions including managing risk management, margin, and transaction settlement. Meanwhile, ILB plays a role in physical transactions to eliminate country risk and also integrated logistics management system as end-to-end services.