Alexander Hamilton was a Nevisian-born American military officer, statesman, and Founding Father who served as the first United States secretary of the treasury from 1789 to 1795.

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants.

Corporate personhood or juridical personality is the legal notion that a juridical person such as a corporation, separately from its associated human beings, has at least some of the legal rights and responsibilities enjoyed by natural persons. In most countries, a corporation has the same rights as a natural person to hold property, enter into contracts, and to sue or be sued.

The President, Directors and Company of the Bank of the United States, commonly known as the First Bank of the United States, was a national bank, chartered for a term of twenty years, by the United States Congress on February 25, 1791. It followed the Bank of North America, the nation's first de facto national bank. However, neither served the functions of a modern central bank: They did not set monetary policy, regulate private banks, hold their excess reserves, or act as a lender of last resort. They were national insofar as they were allowed to have branches in multiple states and lend money to the US government. Other banks in the US were each chartered by, and only allowed to have branches in, a single state.

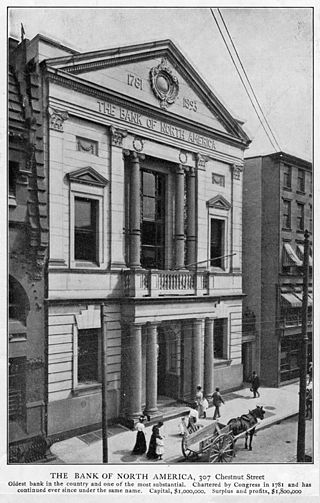

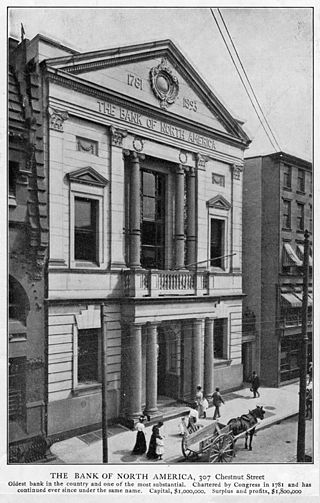

The Bank of North America was the first chartered bank in the United States, and served as the country's first de facto central bank. Chartered by the Congress of the Confederation on May 26, 1781, and opened in Philadelphia on January 7, 1782, it was based upon a plan presented by Superintendent of Finance Robert Morris on May 17, 1781, based on recommendations by Revolutionary era figure Alexander Hamilton. Although Hamilton later noted its "essential" contribution to the war effort, the Pennsylvania government objected to its privileges and reincorporated it under state law, making it unsuitable as a national bank under the federal Constitution. Instead Congress chartered a new bank, the First Bank of the United States, in 1791, while the Bank of North America continued as a private concern.

The 1st United States Congress, comprising the United States Senate and the United States House of Representatives, met from March 4, 1789, to March 4, 1791, during the first two years of George Washington's presidency, first at Federal Hall in New York City and later at Congress Hall in Philadelphia. With the initial meeting of the First Congress, the United States federal government officially began operations under the new frame of government established by the 1787 Constitution. The apportionment of seats in the House of Representatives was based on the provisions of Article I, Section 2, Clause 3 of the Constitution. Both chambers had a Pro-Administration majority. Twelve articles of amendment to the Constitution were passed by this Congress and sent to the states for ratification; the ten ratified as additions to the Constitution on December 15, 1791, are collectively known as the Bill of Rights, with an additional amendment ratified more than two centuries later to become the Twenty-seventh Amendment to the United States Constitution.

Robert Morris Jr. was an English-born merchant and a Founding Father of the United States. He served as a member of the Pennsylvania legislature, the Second Continental Congress, and the United States Senate, and he was a signer of the Declaration of Independence, the Articles of Confederation, and the United States Constitution. From 1781 to 1784, he served as the Superintendent of Finance of the United States, becoming known as the "Financier of the Revolution." Along with Alexander Hamilton and Albert Gallatin, he is widely regarded as one of the founders of the financial system of the United States.

A bearer instrument is a document that entitles the holder of the document to rights of ownership or title to the underlying property, such as shares or bonds. Unlike normal registered instruments, no record is kept of who owns bearer instruments or of transactions involving transfer of ownership, enabling the owner, as well as a purchaser, to deal with the property anonymously. Whoever physically holds the bearer document is assumed to be the owner of the property, and the rights arising therefrom, such as dividends.

A Demand Note is a type of United States paper money that was issued from August 1861 to April 1862 during the American Civil War in denominations of 5, 10, and 20 US$. Demand Notes were the first issue of paper money by the United States that achieved wide circulation and they are still in circulation today, though they are now extremely rare. The U.S. government placed the Demand Notes into circulation by using them to pay expenses incurred during the Civil War including the salaries of its workers and military personnel.

The Hamiltonian economic program was the set of measures that were proposed by American Founding Father and first Secretary of the Treasury Alexander Hamilton in four notable reports and implemented by the United States Congress during George Washington's first term. They outlined a coherent program of national mercantilism government-assisted economic development……

The Anti-Administration party was an informal political faction in the United States led by James Madison and Thomas Jefferson that opposed policies of then Secretary of the Treasury Alexander Hamilton in the first term of US President George Washington. It was not an organized political party but an unorganized faction. Most members had been Anti-Federalists in 1788, who had opposed ratification of the US Constitution. However, the situation was fluid, with members joining and leaving.

The Compromise of 1790 was a compromise between Alexander Hamilton, Thomas Jefferson, and James Madison, where Hamilton won the decision for the national government to take over and pay the state debts, and Jefferson and Madison obtained the national capital, the called the District of Columbia, for the South. This agreement resolved the deadlock in Congress. Southerners had been blocking the assumption of state debts by the Department of the Treasury, thereby destroying the Hamiltonian program for building a fiscally strong federal government. Northerners rejected the proposal, much desired by Virginians, to locate the permanent national capital on the Virginia–Maryland border.

The First Report on the Public Credit was one of four major reports on fiscal and economic policy submitted by Founding Father and first US Treasury Secretary Alexander Hamilton on the request of Congress. The report analyzed the financial standing of the United States and made recommendations to reorganize the national debt and to establish the public credit. Commissioned by the US House of Representatives on September 21, 1789, the report was presented on January 9, 1790, at the second session of the 1st US Congress.

The Second Report on the Public Credit, also referred to as The Report on a National Bank, was the second of four influential reports on fiscal and economic policy delivered to the US Congress by the US Secretary of the Treasury, Alexander Hamilton. Submitted on December 14, 1790, the report called for the establishment of a central bank with the primary purpose to expand the flow of legal tender, monetizing the national debt by issuing of federal bank notes.

The Federalist Era in American history ran from 1788 to 1800, a time when the Federalist Party and its predecessors were dominant in American politics. During this period, Federalists generally controlled Congress and enjoyed the support of President George Washington and President John Adams. The era saw the creation of a new, stronger federal government under the United States Constitution, a deepening of support for nationalism, and diminished fears of tyranny by a central government. The era began with the ratification of the United States Constitution and ended with the Democratic-Republican Party's victory in the 1800 elections.

A Treasury Note is a type of short term debt instrument issued by the United States prior to the creation of the Federal Reserve System in 1913. Without the alternatives offered by a federal paper money or a central bank, the U.S. government relied on these instruments for funding during periods of financial stress such as the War of 1812, the Panic of 1837, and the American Civil War. While the Treasury Notes, as issued, were neither legal tender nor representative money, some issues were used as money in lieu of an official federal paper money. However the motivation behind their issuance was always funding federal expenditures rather than the provision of a circulating medium. These notes typically were hand-signed, of large denomination, of large dimension, bore interest, were payable to the order of the owner, and matured in no more than three years – though some issues lacked one or more of these properties. Often they were receivable at face value by the government in payment of taxes and for purchases of publicly owned land, and thus "might to some extent be regarded as paper money." On many issues the interest rate was chosen to make interest calculations particularly easy, paying either 1, 1+1⁄2, or 2 cents per day on a $100 note.

A general welfare clause is a section that appears in many constitutions and in some charters and statutes that allows that the governing body empowered by the document to enact laws to promote the general welfare of the people, which is sometimes worded as the public welfare. In some countries, it has been used as a basis for legislation promoting the health, safety, morals, and well-being of the people governed by it.

The Funding Act of 1790, the full title of which is An Act making provision for the [payment of the] Debt of the United States, was passed on August 4, 1790, by the United States Congress as part of the Compromise of 1790, to address the issue of funding of the domestic debt incurred by the state governments, first as Thirteen Colonies, then as states in rebellion, in independence, in Confederation, and finally as members of a single federal Union. By the Act the newly-inaugurated federal government under the U.S. Constitution assumed and thereby retired the debts of each of the individual colonies in rebellion and the bonded debts of the States in Confederation, which each state had individually and independently issued on its own "full faith and credit" when each of them was, in effect, an independent nation.

The state of union is an address, in the United States, given by the president to a joint session of Congress, the United States House of Representatives and United States Senate. The United States constitution requires the president "from time to time give to the Congress Information of the State of the Union." Today the state of the union address is given as a speech, though this is not a requirement of the constitution. George Washington chose to address the congress in a speech annually, on October 25, 1791 he gave his third speech.

Tariff of 1791 or Excise Whiskey Tax of 1791 was a United States statute establishing a taxation policy to further reduce Colonial America public debt as assumed by the residuals of American Revolution. The Act of Congress imposed duties or tariffs on domestic and imported distilled spirits generating government revenue while fortifying the Federalist Era.