| Foreign exchange |

|---|

| Exchange rates |

| Markets |

| Assets |

| Historical agreements |

| See also |

A fixed exchange rate, sometimes called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed against either the value of another single currency, a basket of other currencies, or another measure of value, such as gold.

A currency, in the most specific sense is money in any form when in use or circulation as a medium of exchange, especially circulating banknotes and coins. A more general definition is that a currency is a system of money in common use, especially for people in a nation. Under this definition, US dollars (US$), pounds sterling (£), Australian dollars (A$), European euros (€), Russian rubles (₽) and Indian Rupees (₹) are examples of currencies. These various currencies are recognized as stores of value and are traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are defined by governments, and each type has limited boundaries of acceptance.

A currency basket is a portfolio of selected currencies with different weightings. A currency basket is commonly used to minimize the risk of currency fluctuations. An example of a currency basket is the European Currency Unit that was used by the European Community member states as the unit of account before being replaced by the euro. Another example is the special drawing rights of the International Monetary Fund.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. Three types can be distinguished: specie, bullion, and exchange.

Contents

- History

- Chronology

- Gold standard

- Bretton Woods system

- Current monetary regimes

- Mechanisms

- Open market trading

- Fiat

- Open market mechanism example

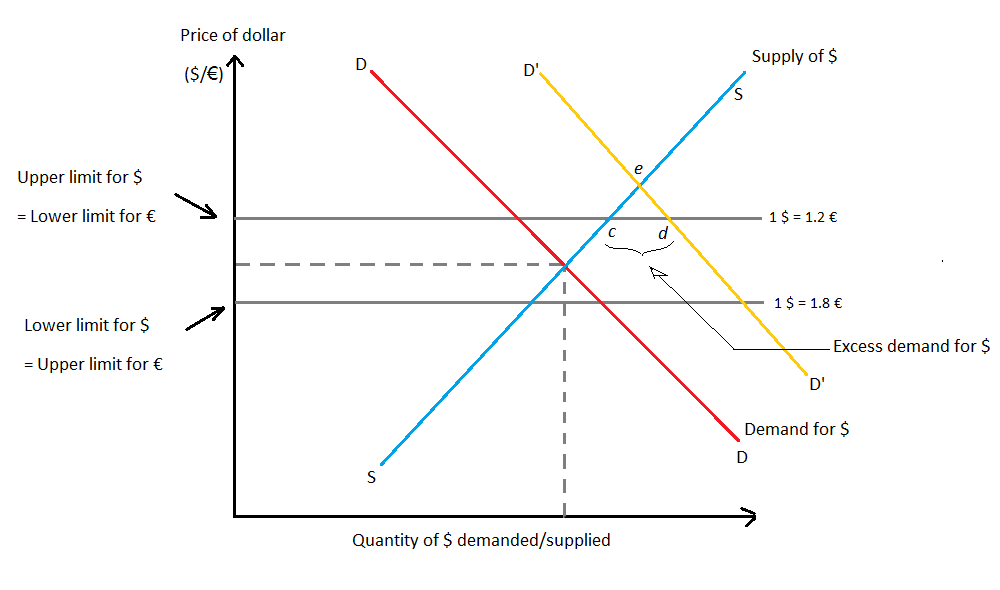

- Excess demand for dollars

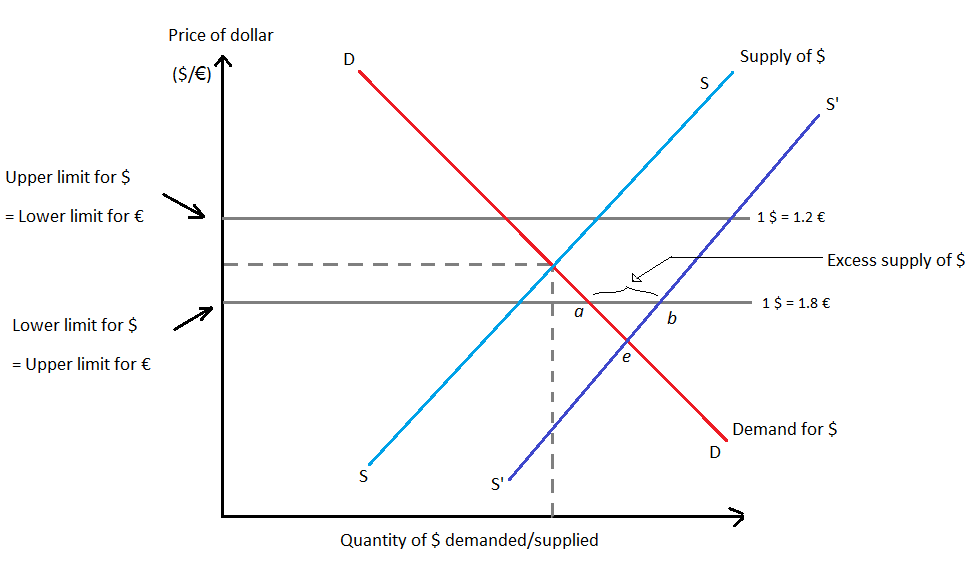

- Excess supply of dollars

- Types of fixed exchange rate systems

- The gold standard

- Price specie flow mechanism

- Reserve currency standard

- Gold exchange standard

- Hybrid exchange rate systems

- Basket-of-currencies

- Crawling pegs

- Pegged within a band

- Currency boards

- Currency substitution

- Monetary co-operation

- Advantages

- Disadvantages

- Lack of automatic rebalancing

- Currency crisis

- Freedom to conduct monetary and fiscal policy

- Other disadvantages

- Fixed exchange rate regime versus capital control

- FIX Line: Trade-off between symmetry of shocks and integration

- See also

- References

- External links

- News articles

There are benefits and risks to using a fixed exchange rate. A fixed exchange rate is typically used to stabilize the value of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the value is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a flexible exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow primarily in foreign currency and in which external trade forms a large part of their GDP.

A floating exchange rate is a type of exchange-rate regime in which a currency's value is allowed to fluctuate in response to foreign-exchange market events. A currency that uses a floating exchange rate is known as a floating currency. A floating currency is contrasted with a fixed currency whose value is tied to that of another currency, material goods or to a currency basket.

A fixed exchange-rate system can also be used to control the behavior of a currency, such as by limiting rates of inflation. However, in doing so, the pegged currency is then controlled by its reference value. As such, when the reference value rises or falls, it then follows that the value(s) of any currencies pegged to it will also rise and fall in relation to other currencies and commodities with which the pegged currency can be traded. In other words, a pegged currency is dependent on its reference value to dictate how its current worth is defined at any given time. In addition, according to the Mundell–Fleming model, with perfect capital mobility, a fixed exchange rate prevents a government from using domestic monetary policy to achieve macroeconomic stability.

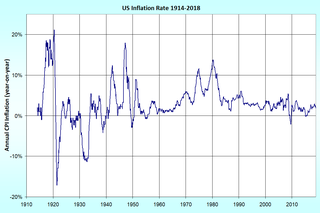

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. The measure of inflation is the inflation rate, the annualized percentage change in a general price index, usually the consumer price index, over time. The opposite of inflation is deflation.

The Mundell–Fleming model, also known as the IS-LM-BoP model, is an economic model first set forth (independently) by Robert Mundell and Marcus Fleming. The model is an extension of the IS-LM model. Whereas the traditional IS-LM model deals with economy under autarky, the Mundell–Fleming model describes a small open economy. Mundell's paper suggests that the model can be applied to Zurich, Brussels and so on.

In economics, capital consists of an asset that can enhance one's power to perform economically useful work. For example, in a fundamental sense a stone or an arrow is capital for a caveman who can use it as a hunting instrument, while roads are capital for inhabitants of a city.

In a fixed exchange-rate system, a country’s central bank typically uses an open market mechanism and is committed at all times to buy and/or sell its currency at a fixed price in order to maintain its pegged ratio and, hence, the stable value of its currency in relation to the reference to which it is pegged. To maintain a desired exchange rate, the central bank during a time of private sector net demand for the foreign currency, sells foreign currency from its reserves and buys back the domestic money. This creates an artificial demand for the domestic money, which increases its exchange rate value. Conversely, in the case of an insipient appreciation of the domestic money, the central bank buys back the foreign money and thus adds domestic money into the market, thereby maintaining market equilibrium at the intended fixed value of the exchange rate. [1]

A central bank, reserve bank, or monetary authority is the institution that manages the currency, money supply, and interest rates of a state or formal monetary union, and oversees their commercial banking system. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base in the state, and also generally controls the printing/coining of the national currency, which serves as the state's legal tender. A central bank also acts as a lender of last resort to the banking sector during times of financial crisis. Most central banks also have supervisory and regulatory powers to ensure the solvency of member institutions, to prevent bank runs, and to discourage reckless or fraudulent behavior by member banks.

In microeconomics, supply and demand is an economic model of price determination in a market. It postulates that, holding all else equal, in a competitive market, the unit price for a particular good, or other traded item such as labor or liquid financial assets, will vary until it settles at a point where the quantity demanded will equal the quantity supplied, resulting in an economic equilibrium for price and quantity transacted.

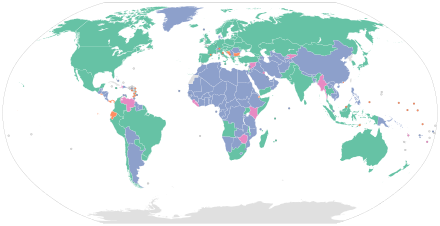

In the 21st century, the currencies associated with large economies typically do not fix (peg) their exchange rates to other currencies. The last large economy to use a fixed exchange rate system was the People's Republic of China, which, in July 2005, adopted a slightly more flexible exchange rate system, called a managed exchange rate. [2] The European Exchange Rate Mechanism is also used on a temporary basis to establish a final conversion rate against the euro from the local currencies of countries joining the Eurozone.

Managed float regime is the current international financial environment in which exchange rates fluctuate from day to day, but central banks attempt to influence their countries' exchange rates by buying and selling currencies to maintain a certain range. The peg used is known as a crawling peg.

The European Exchange Rate Mechanism (ERM) was a system introduced by the European Economic Community on 13 March 1979, as part of the European Monetary System (EMS), to reduce exchange rate variability and achieve monetary stability in Europe, in preparation for Economic and Monetary Union and the introduction of a single currency, the euro, which took place on 1 January 1999.

The eurozone, officially called the euro area, is a monetary union of 19 of the 28 European Union (EU) member states which have adopted the euro (€) as their common currency and sole legal tender. The monetary authority of the eurozone is the Eurosystem. The other nine members of the European Union continue to use their own national currencies, although most of them are obliged to adopt the euro in the future.