Accounting, also known as accountancy, is the process of recording and processing information about economic entities, such as businesses and corporations. Accounting measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and "financial reporting" are often used interchangeably.

International Financial Reporting Standards, commonly called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB). They constitute a standardised way of describing the company's financial performance and position so that company financial statements are understandable and comparable across international boundaries. They are particularly relevant for companies with shares or securities publicly listed.

Generally Accepted Accounting Practice in the UK, or UK GAAP or GAAP (UK), is the overall body of regulation establishing how company accounts must be prepared in the United Kingdom. Company accounts must also be prepared in accordance with applicable company law (for UK companies, the Companies Act 2006; for companies in the Channel Islands and the Isle of Man, companies law applicable to those jurisdictions).

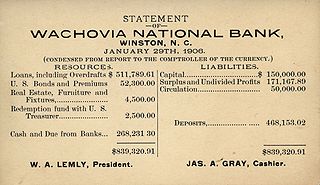

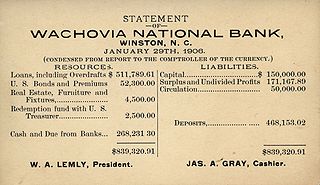

Financial statements are formal records of the financial activities and position of a business, person, or other entity.

The International Accounting Standards Committee (IASC) was founded in June 1973 in London at the initiative of Sir Henry Benson, former president of the Institute of Chartered Accountants in England and Wales. The IASC was created by national accountancy bodies from a number of countries with a view to harmonizing the international diversity of company reporting practices. Between its founding in 1973 and its dissolution in 2001, it developed a set of International Accounting Standards (IAS) that gradually acquired a degree of acceptance in countries around the world. Although the IASC came to include some organizations representing preparers and users of financial statements, it largely remained an initiative of the accountancy profession. On 1 April 2001, it was replaced by the International Accounting Standards Board (IASB), an independent standard-setting body. The IASB adopted the extant corpus of IAS which it continued to develop as International Financial Reporting Standards.

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC), and is the default accounting standard used by companies based in the United States.

Publicly traded companies typically are subject to rigorous standards. Small and midsized businesses often follow more simplified standards, plus any specific disclosures required by their specific lenders and shareholders. Some firms operate on the cash method of accounting which can often be simple and straightforward. Larger firms most often operate on an accrual basis. Accrual basis is one of the fundamental accounting assumptions and if it is followed by the company while preparing the Financial statements then no further disclosure is required. Accounting standards prescribe in considerable detail what accruals must be made, how the financial statements are to be presented, and what additional disclosures are required.

The Association of Chartered Certified Accountants (ACCA) is the global professional accounting body offering the Chartered Certified Accountant qualification (ACCA). Founded in 1904, It is now the fourth-largest professional accounting body in the world, with 252,500 members and 526,000 future members. ACCA's headquarters are in London with principal administrative office in Glasgow. ACCA works through a network of over 110 offices and centres in 51 countries - with 346 Approved Learning Partners (ALP) and more than 7,600 Approved Employers worldwide, who provide employee development.

The Institute of Chartered Accountants of India, abbreviated as ICAI, is India's largest professional accounting body under the administrative control of Ministry of Corporate Affairs, Government of India. It was established on 1 July 1949 as a statutory body under the Chartered Accountants Act, 1949 enacted by the Parliament for promotion, development and regulation of the profession of Chartered Accountancy in India.

The Canadian Institute of Chartered Accountants (CICA) was incorporated by an Act of the Parliament of Canada in 1902, which later became known as the Canadian Institute of Chartered Accountants Act.

Materiality is a concept or convention within auditing and accounting relating to the importance/significance of an amount, transaction, or discrepancy. The objective of an audit of financial statements is to enable the auditor to express an opinion on whether the financial statements are prepared, in all material respects, in conformity with an identified financial reporting framework, such as the Generally Accepted Accounting Principles (GAAP) which is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC).

The New Zealand Institute of Chartered Accountants (NZICA) was the operating name for the Institute of Chartered Accountants of New Zealand. The Institute represented over 33,000 members in New Zealand and overseas. Most accountants in New Zealand belonged to the institute.

In Bangladesh, the profession of accountancy was developed during the British colonial period. The basic requirements for financial reporting by all companies in Bangladesh were provided by the Companies Act of 1994. Today, it is represented by two professional bodies, the Institute of Cost & Management Accountants of Bangladesh (ICMAB) and the Institute of Chartered Accountants of Bangladesh (ICAB).

The convergence of accounting standards refers to the goal of establishing a single set of accounting standards that will be used internationally. Convergence in some form has been taking place for several decades, and efforts today include projects that aim to reduce the differences between accounting standards.

Management accounting principles (MAP) were developed to serve the core needs of internal management to improve decision support objectives, internal business processes, resource application, customer value, and capacity utilization needed to achieve corporate goals in an optimal manner. Another term often used for management accounting principles for these purposes is managerial costing principles. The two management accounting principles are:

- Principle of Causality and,

- Principle of Analogy.

The Accounting Standards Board (AcSB) establishes accounting standards for use by private enterprises and private sector not-for-profit organisations in Canada. The AcSB contributes to the development of International Financial Reporting Standards (IFRSs) by participating in consultations and activities of the International Accounting Standards Board (IASB) to ensure Canadian publicly accountable entities' financial reporting needs are adequately considered. The AcSB develops and participates in the development of financial reporting standards.

The Auditing and Assurance Standards Board (AASB) is an independent organization body who serves the Canadian public interest by setting the standards for financial statement audits of Canadian companies.

The accounting profession in Luxembourg is structured around Ordre des Experts-Comptables (OEC) which serves as the main accounting body in the country. Luxembourg accounting standards are inspired from neighbouring France and Belgium. Similar to France, Luxembourg has set up a Commissions des Normes Comptables (CNC) which serves as an advisor to the Ministry for Justice in respect of accounting related matters, e.g. waivers for presenting consolidated accounts.