Related Research Articles

Capitalism is an economic system based on the private ownership of the means of production and their operation for profit. The defining characteristics of capitalism include private property, capital accumulation, competitive markets, price systems, recognition of property rights, self-interest, economic freedom, work ethic, consumer sovereignty, decentralized decision-making, profit motive, a financial infrastructure of money and investment that makes possible credit and debt, entrepreneurship, commodification, voluntary exchange, wage labor, production of commodities and services, and a strong emphasis on innovation and economic growth. In a market economy, decision-making and investments are determined by owners of wealth, property, or ability to maneuver capital or production ability in capital and financial markets—whereas prices and the distribution of goods and services are mainly determined by competition in goods and services markets.

The labor theory of value (LTV) is a theory of value that argues that the exchange value of a good or service is determined by the total amount of "socially necessary labor" required to produce it. The contrasting system is typically known as the subjective theory of value.

Anti-capitalism is a political ideology and movement encompassing a variety of attitudes and ideas that oppose capitalism. In this sense, anti-capitalists are those who wish to replace capitalism with another type of economic system, such as socialism or communism.

Thorstein Bunde Veblen was an American economist and sociologist who, during his lifetime, emerged as a well-known critic of capitalism.

In economics, capital goods or capital are "those durable produced goods that are in turn used as productive inputs for further production" of goods and services. A typical example is the machinery used in a factory. At the macroeconomic level, "the nation's capital stock includes buildings, equipment, software, and inventories during a given year."

Institutional economics focuses on understanding the role of the evolutionary process and the role of institutions in shaping economic behavior. Its original focus lay in Thorstein Veblen's instinct-oriented dichotomy between technology on the one side and the "ceremonial" sphere of society on the other. Its name and core elements trace back to a 1919 American Economic Review article by Walton H. Hamilton. Institutional economics emphasizes a broader study of institutions and views markets as a result of the complex interaction of these various institutions. The earlier tradition continues today as a leading heterodox approach to economics.

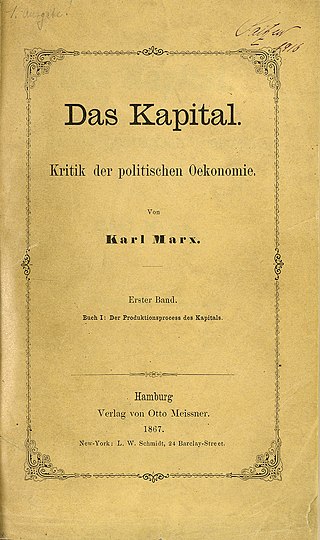

Fictitious capital is a concept used by Karl Marx in his critique of political economy. It is introduced in chapter 25 of the third volume of Capital. Fictitious capital contrasts with what Marx calls "real capital", which is capital actually invested in physical means of production and workers, and "money capital", which is actual funds being held. The market value of fictitious capital assets varies according to the expected return or yield of those assets in the future, which Marx felt was only indirectly related to the growth of real production. Effectively, fictitious capital represents "accumulated claims, legal titles, to future production" and more specifically claims to the income generated by that production.

A price signal is information conveyed to consumers and producers, via the prices offered or requested for, and the amount requested or offered of a product or service, which provides a signal to increase or decrease quantity supplied or quantity demanded. It also provides potential business opportunities. When a certain kind of product is in shortage supply and the price rises, people will pay more attention to and produce this kind of product. The information carried by prices is an essential function in the fundamental coordination of an economic system, coordinating things such as what has to be produced, how to produce it and what resources to use in its production.

Criticism of capitalism typically ranges from expressing disagreement with particular aspects or outcomes of capitalism to rejecting the principles of the capitalist system in its entirety. Criticism comes from various political and philosophical approaches, including anarchist, socialist, Marxist, religious, and nationalist viewpoints. Some believe that capitalism can only be overcome through revolution while others believe that structural change can come slowly through political reforms. Some critics believe there are merits in capitalism and wish to balance it with some form of social control, typically through government regulation.

The misery index is an economic indicator, created by economist Arthur Okun. The index helps determine how the average citizen is doing economically and is calculated by adding the seasonally adjusted unemployment rate to the annual inflation rate. It is assumed that both a higher rate of unemployment and a worsening of inflation create economic and social costs for a country.

Criticism of Marxism has come from various political ideologies, campaigns and academic disciplines. This includes general intellectual criticism about dogmatism, a lack of internal consistency, criticism related to materialism, arguments that Marxism is a type of historical determinism or that it necessitates a suppression of individual rights, issues with the implementation of communism and economic issues such as the distortion or absence of price signals and reduced incentives. In addition, empirical and epistemological problems are frequently identified.

Shimshon Bichler is an educator who teaches political economy at colleges and universities in Israel. Along with Jonathan Nitzan, Bichler has created a power theory of capitalism and theory of differential accumulation in their analysis of the political economy of wars, Israel, and globalization.

Differential accumulation is an approach for analysing capitalist development and crisis, tying together mergers and acquisitions, stagflation and globalization as integral facets of accumulation. The concept has been developed by Jonathan Nitzan and Shimshon Bichler.

Criticisms of the labor theory of value affect the historical concept of labor theory of value (LTV) which spans classical economics, liberal economics, Marxian economics, neo-Marxian economics, and anarchist economics. As an economic theory of value, LTV is widely attributed to Marx and Marxian economics despite Marx himself pointing out the contradictions of the theory, because Marx drew ideas from LTV and related them to the concepts of labour exploitation and surplus value; the theory itself was developed by Adam Smith and David Ricardo. LTV criticisms therefore often appear in the context of economic criticism, not only for the microeconomic theory of Marx but also for Marxism, according to which the working class is exploited under capitalism, while little to no focus is placed on those responsible for developing the theory.

Production for use is a phrase referring to the principle of economic organization and production taken as a defining criterion for a socialist economy. It is held in contrast to production for profit. This criterion is used to distinguish communism from capitalism, and is one of the fundamental defining characteristics of communism.

In Karl Marx's critique of political economy and subsequent Marxian analyses, the capitalist mode of production refers to the systems of organizing production and distribution within capitalist societies. Private money-making in various forms preceded the development of the capitalist mode of production as such. The capitalist mode of production proper, based on wage-labour and private ownership of the means of production and on industrial technology, began to grow rapidly in Western Europe from the Industrial Revolution, later extending to most of the world.

Social ownership is a type of property where an asset is recognized to be in the possession of society as a whole rather than individual members or groups within it. Social ownership of the means of production is the defining characteristic of a socialist economy, and can take the form of community ownership, state ownership, common ownership, employee ownership, cooperative ownership, and citizen ownership of equity. Within the context of socialist economics it refers particularly to the appropriation of the surplus product produced by the means of production to society at large or the workers themselves. Traditionally, social ownership implied that capital and factor markets would cease to exist under the assumption that market exchanges within the production process would be made redundant if capital goods were owned and integrated by a single entity or network of entities representing society. However, the articulation of models of market socialism where factor markets are utilized for allocating capital goods between socially owned enterprises broadened the definition to include autonomous entities within a market economy.

Marxian economics, or the Marxian school of economics, is a heterodox school of political economic thought. Its foundations can be traced back to Karl Marx's critique of political economy. However, unlike critics of political economy, Marxian economists tend to accept the concept of the economy prima facie. Marxian economics comprises several different theories and includes multiple schools of thought, which are sometimes opposed to each other; in many cases Marxian analysis is used to complement, or to supplement, other economic approaches. Because one does not necessarily have to be politically Marxist to be economically Marxian, the two adjectives coexist in usage, rather than being synonymous: They share a semantic field, while also allowing both connotative and denotative differences. An example of this can be found in the works of Soviet economists like Lev Gatovsky, who sought to apply Marxist economic theory to the objectives, needs, and political conditions of the socialist construction in the Soviet Union, contributing to the development of Soviet Political Economy.

Crisis theory, concerning the causes and consequences of the tendency for the rate of profit to fall in a capitalist system, is associated with Marxian critique of political economy, and was further popularised through Marxist economics.

Capital as Power: A Study of Order and Creorder is a 2009 book on economics by Jonathan Nitzan and Shimshon Bichler. The authors introduce what they describe as a "non-Marxist" account of capitalist society. Larudee wrote:

The problem, these authors say, is that both Marxians and neoclassicals view capital as a purely economic concept, in that its value of capital is determined in production, yet they do not and cannot have any valid way of independently measuring the value of capital.

References

- ↑ Jonathan Nitzan and Shimshon Bichler, Capital as Power: A Study of Order and Creorder, Routledge, 2009, p. 228.

- ↑ "Capitalism as a Mode of Power interviewed by Piotr Dutkiewicz" . Retrieved 1 February 2014.