Related Research Articles

Operant conditioning, also called instrumental conditioning, is a learning process where voluntary behaviors are modified by association with the addition of reward or aversive stimuli. The frequency or duration of the behavior may increase through reinforcement or decrease through punishment or extinction.

In behavioral psychology, reinforcement refers to consequences that increase the likelihood of an organism's future behavior, typically in the presence of a particular antecedent stimulus. For example, a rat can be trained to push a lever to receive food whenever a light is turned on. In this example, the light is the antecedent stimulus, the lever pushing is the operant behavior, and the food is the reinforcer. Likewise, a student that receives attention and praise when answering a teacher's question will be more likely to answer future questions in class. The teacher's question is the antecedent, the student's response is the behavior, and the praise and attention are the reinforcements.

In economics, time preference is the current relative valuation placed on receiving a good or some cash at an earlier date compared with receiving it at a later date.

Radical behaviorism is a "philosophy of the science of behavior" developed by B. F. Skinner. It refers to the philosophy behind behavior analysis, and is to be distinguished from methodological behaviorism—which has an intense emphasis on observable behaviors—by its inclusion of thinking, feeling, and other private events in the analysis of human and animal psychology. The research in behavior analysis is called the experimental analysis of behavior and the application of the field is called applied behavior analysis (ABA), which was originally termed "behavior modification."

Richard Julius Herrnstein was an American psychologist at Harvard University. He was an active researcher in animal learning in the Skinnerian tradition. Herrnstein was the Edgar Pierce Professor of Psychology until his death, and previously chaired the Harvard Department of Psychology for five years. With political scientist Charles Murray, he co-wrote The Bell Curve, a controversial 1994 book on human intelligence. He was one of the founders of the Society for Quantitative Analysis of Behavior.

The experimental analysis of behavior is a science that studies the behavior of individuals across a variety of species. A key early scientist was B. F. Skinner who discovered operant behavior, reinforcers, secondary reinforcers, contingencies of reinforcement, stimulus control, shaping, intermittent schedules, discrimination, and generalization. A central method was the examination of functional relations between environment and behavior, as opposed to hypothetico-deductive learning theory that had grown up in the comparative psychology of the 1920–1950 period. Skinner's approach was characterized by observation of measurable behavior which could be predicted and controlled. It owed its early success to the effectiveness of Skinner's procedures of operant conditioning, both in the laboratory and in behavior therapy.

Kleptomania is the inability to resist the urge to steal items, usually for reasons other than personal use or financial gain. First described in 1816, kleptomania is classified in psychiatry as an impulse control disorder. Some of the main characteristics of the disorder suggest that kleptomania could be an obsessive-compulsive spectrum disorder, but also share similarities with addictive and mood disorders.

Behaviorism is a systematic approach to understand the behavior of humans and other animals. It assumes that behavior is either a reflex elicited by the pairing of certain antecedent stimuli in the environment, or a consequence of that individual's history, including especially reinforcement and punishment contingencies, together with the individual's current motivational state and controlling stimuli. Although behaviorists generally accept the important role of heredity in determining behavior, they focus primarily on environmental events. The cognitive revolution of the late 20th century largely replaced behaviorism as an explanatory theory with cognitive psychology, which unlike behaviorism views internal mental states as explanations for observable behavior.

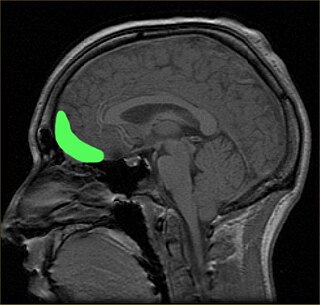

In economics, hyperbolic discounting is a time-inconsistent model of delay discounting. It is one of the cornerstones of behavioral economics and its brain-basis is actively being studied by neuroeconomics researchers.

The law of effect, or Thorndike's law, is a psychology principle advanced by Edward Thorndike in 1898 on the matter of behavioral conditioning which states that "responses that produce a satisfying effect in a particular situation become more likely to occur again in that situation, and responses that produce a discomforting effect become less likely to occur again in that situation."

Delayed gratification, or deferred gratification, is the ability to resist the temptation of an immediate reward in favor of a more valuable and long-lasting reward later. It involves forgoing a smaller, immediate pleasure to achieve a larger or more enduring benefit in the future. A growing body of literature has linked the ability to delay gratification to a host of other positive outcomes, including academic success, physical health, psychological health, and social competence.

Contingency management (CM) is the application of the three-term contingency, which uses stimulus control and consequences to change behavior. CM originally derived from the science of applied behavior analysis (ABA), but it is sometimes implemented from a cognitive-behavioral therapy (CBT) framework as well.

In operant conditioning, the matching law is a quantitative relationship that holds between the relative rates of response and the relative rates of reinforcement in concurrent schedules of reinforcement. For example, if two response alternatives A and B are offered to an organism, the ratio of response rates to A and B equals the ratio of reinforcements yielded by each response. This law applies fairly well when non-human subjects are exposed to concurrent variable interval schedules ; its applicability in other situations is less clear, depending on the assumptions made and the details of the experimental situation. The generality of applicability of the matching law is subject of current debate.

Behavioral momentum is a theory in quantitative analysis of behavior and is a behavioral metaphor based on physical momentum. It describes the general relation between resistance to change and the rate of reinforcement obtained in a given situation.

Melioration theory in behavioral psychology is a theoretical algorithm that predicts the matching law. Melioration theory is used as an explanation for why an organism makes choices based on the rewards or reinforcers it receives. The principle of melioration states that animals will invest increasing amounts of time and/or effort into whichever alternative is better. To meliorate essentially means to "make better".

Howard Rachlin (1935–2021) was an American psychologist and the founder of teleological behaviorism. He was Emeritus Research Professor of Psychology, Department of Psychology at Stony Brook University in New York. His initial work was in the quantitative analysis of operant behavior in pigeons, on which he worked with William M. Baum, developing ideas from Richard Herrnstein's matching law. He subsequently became one of the founders of Behavioral Economics.

Quantitative analysis of behavior is the application of mathematical models--conceptualized from the robust corpus of environment-behavior-consequence interactions in published behavioral science--to the experimental analysis of behavior. The aim is to describe and/or predict relations between varying levels of independent environmental variables and dependent behavioral variables. The parameters in the models hopefully have theoretical meaning beyond their use in fitting models to data. The field was founded by Richard Herrnstein (1961) when he introduced the matching law to quantify the behavior of organisms working on concurrent schedules of reinforcement.

In behavioral psychology, stimulus control is a phenomenon in operant conditioning that occurs when an organism behaves in one way in the presence of a given stimulus and another way in its absence. A stimulus that modifies behavior in this manner is either a discriminative stimulus or stimulus delta. For example, the presence of a stop sign at a traffic intersection alerts the driver to stop driving and increases the probability that braking behavior occurs. Stimulus control does not force behavior to occur, as it is a direct result of historical reinforcement contingencies, as opposed to reflexive behavior elicited through classical conditioning.

In psychology, impulsivity is a tendency to act on a whim, displaying behavior characterized by little or no forethought, reflection, or consideration of the consequences. Impulsive actions are typically "poorly conceived, prematurely expressed, unduly risky, or inappropriate to the situation that often result in undesirable consequences," which imperil long-term goals and strategies for success. Impulsivity can be classified as a multifactorial construct. A functional variety of impulsivity has also been suggested, which involves action without much forethought in appropriate situations that can and does result in desirable consequences. "When such actions have positive outcomes, they tend not to be seen as signs of impulsivity, but as indicators of boldness, quickness, spontaneity, courageousness, or unconventionality." Thus, the construct of impulsivity includes at least two independent components: first, acting without an appropriate amount of deliberation, which may or may not be functional; and second, choosing short-term gains over long-term ones.

Behavioral game theory seeks to examine how people's strategic decision-making behavior is shaped by social preferences, social utility and other psychological factors. Behavioral game theory analyzes interactive strategic decisions and behavior using the methods of game theory, experimental economics, and experimental psychology. Experiments include testing deviations from typical simplifications of economic theory such as the independence axiom and neglect of altruism, fairness, and framing effects. As a research program, the subject is a development of the last three decades.