An advance-fee scam is a form of fraud and is a common confidence trick. The scam typically involves promising the victim a significant share of a large sum of money, in return for a small up-front payment, which the fraudster claims will be used to obtain the large sum. If a victim makes the payment, the fraudster either invents a series of further fees for the victim to pay or simply disappears.

A scam, or a confidence trick, is an attempt to defraud a person or group after first gaining their trust. Confidence tricks exploit victims using a combination of the victim's credulity, naivety, compassion, vanity, confidence, irresponsibility, and greed. Researchers have defined confidence tricks as "a distinctive species of fraudulent conduct ... intending to further voluntary exchanges that are not mutually beneficial", as they "benefit con operators at the expense of their victims ".

Internet fraud is a type of cybercrime fraud or deception which makes use of the Internet and could involve hiding of information or providing incorrect information for the purpose of tricking victims out of money, property, and inheritance. Internet fraud is not considered a single, distinctive crime but covers a range of illegal and illicit actions that are committed in cyberspace. It is differentiated from theft since, in this case, the victim voluntarily and knowingly provides the information, money or property to the perpetrator. It is also distinguished by the way it involves temporally and spatially separated offenders.

419eater.com is a scam baiting website which focuses on advance-fee fraud. The name 419 comes from "419 fraud", another name for advance fee fraud, and itself derived from the relevant section of the Nigerian criminal code. The website founder, Michael Berry, goes by the alias Shiver Metimbers. As of 2013, the 419 Eater forum had over 55,000 registered accounts. According to one member, "Every minute the scammer I'm communicating with is spending on me is a minute he is not scamming a real potential victim."

A lottery scam is a type of advance-fee fraud which begins with an unexpected email notification, phone call, or mailing explaining that "You have won!" a large sum of money in a lottery. The recipient of the message—the target of the scam—is usually told to keep the notice secret, "due to a mix-up in some of the names and numbers," and to contact a "claims agent." After contacting the agent, the target of the scam will be asked to pay "processing fees" or "transfer charges" so that the winnings can be distributed, but will never receive any lottery payment. Many email lottery scams use the names of legitimate lottery organizations or other legitimate corporations/companies, but this does not mean the legitimate organizations are in any way involved with the scams.

The United States Postal Inspection Service (USPIS), or the Postal Inspectors, is the federal law enforcement arm of the United States Postal Service. It supports and protects the U.S. Postal Service, its employees, infrastructure, and customers by enforcing the laws that defend the United States' mail system from illegal or dangerous use. Its jurisdiction covers any crimes that may adversely affect or fraudulently use the U.S. Mail, the postal system, or postal employees. With roots going back to the late 18th century, the USPIS is the country's oldest continuously operating federal law enforcement agency.

Gina Marie Marks is an American psychic and convicted fraudster. Using the pseudonym of Regina Milbourne, she co-authored Miami Psychic: Confessions of a Confidante, a memoir published by HarperCollins in 2006.

Miami Psychic: Confessions of a Confidante is a 2006 memoir published by the Regan Books division of HarperCollins. The authors are listed as Regina Milbourne and Yvonne Carey-Lederer.

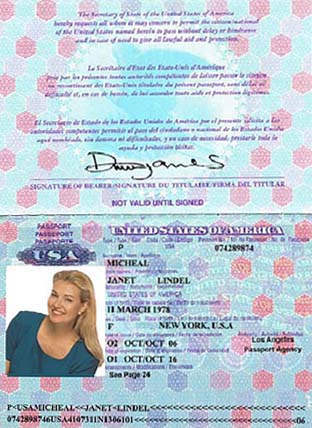

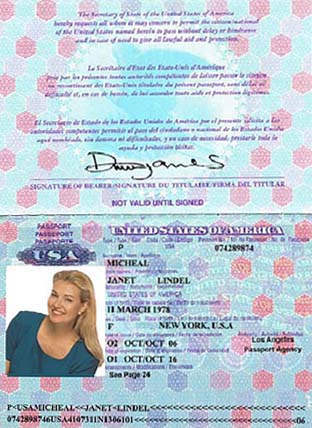

A romance scam is a confidence trick involving feigning romantic intentions towards a victim, gaining the victim's affection, and then using that goodwill to get the victim to send money to the scammer under false pretenses or to commit fraud against the victim. Fraudulent acts may involve access to the victim's money, bank accounts, credit cards, passports, Cash App, e-mail accounts, or national identification numbers; or forcing the victims to commit financial fraud on their behalf.

Voice phishing, or vishing, is the use of telephony to conduct phishing attacks.

Telemarketing fraud is fraudulent selling conducted over the telephone. The term is also used for telephone fraud not involving selling.

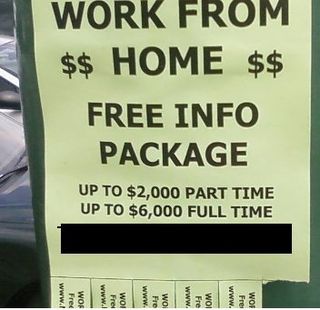

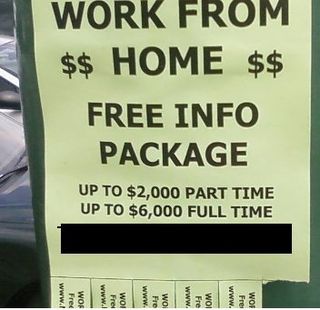

A work-at-home scheme is a get-rich-quick scam in which a victim is lured by an offer to be employed at home, very often doing some simple task in a minimal amount of time with a large amount of income that far exceeds the market rate for the type of work. The true purpose of such an offer is for the perpetrator to extort money from the victim, either by charging a fee to join the scheme, or requiring the victim to invest in products whose resale value is misrepresented.

Maria Duval was the woman at the origin of the Maria Duval psychic scam. Claiming to have psychic powers, she gained some fame before her name became associated with a vast and sophisticated mail scam.

A scam letter is a document, distributed electronically or otherwise, to a recipient misrepresenting the truth with the aim of gaining an advantage in a fraudulent manner.

Fortune telling fraud, also called the bujo or egg curse scam, is a type of confidence trick, based on a claim of secret or occult information. The basic feature of the scam involves diagnosing the victim with some sort of secret problem that only the grifter can detect or diagnose, and then charging the mark for ineffectual treatments. The archetypical grifter working the scam is a fortune teller who announces that the mark is suffering from a curse that their magic can relieve, while threatening dire consequences if the curse is not lifted.

A technical support scam, or tech support scam, is a type of scam in which a scammer claims to offer a legitimate technical support service. Victims contact scammers in a variety of ways, often through fake pop-ups resembling error messages or via fake "help lines" advertised on websites owned by the scammers. Technical support scammers use social engineering and a variety of confidence tricks to persuade their victim of the presence of problems on their computer or mobile device, such as a malware infection, when there are no issues with the victim's device. The scammer will then persuade the victim to pay to fix the fictitious "problems" that they claim to have found. Payment is made to the scammer via gift cards or cryptocurrency, which are hard to trace and have few consumer protections in place. Technical support scams have occurred as early as 2008. A 2017 study of technical support scams found that of the IPs that could be geolocated, 85% could be traced to locations in India, 7% to locations in the United States and 3% to locations in Costa Rica. Research into tech support scams suggests that millennials and those in generation Z have the highest exposure to such scams; however, senior citizens are more likely to fall for these scams and lose money to them. Technical support scams were named by Norton as the top phishing threat to consumers in October 2021; Microsoft found that 60% of consumers who took part in a survey had been exposed to a technical support scam within the previous twelve months. Responses to technical support scams include lawsuits brought against companies responsible for running fraudulent call centres and scam baiting.

An IRS impersonation scam is a class of telecommunications fraud and scam which targets American taxpayers by masquerading as Internal Revenue Service (IRS) collection officers. The scammers operate by placing disturbing official-sounding calls to unsuspecting citizens, threatening them with arrest and frozen assets if thousands of dollars are not paid immediately, usually via gift cards or money orders. According to the IRS, over 1,029,601 Americans have received threatening calls, and $29,100,604 has been reported lost to these call scams as of March 2016. The problem has been assigned to the Treasury Inspector General for Tax Administration. Studies highlight that most victims of these scams are aged 20-29 years old and women are more affected than men. One way to decrease the risks of an individual falling victim to IRS impersonation scams is through awareness programs.

Bob Nygaard is an American private investigator (PI) specializing in the investigation of confidence crimes, most notably psychic fraud. He has been instrumental in the arrest and conviction of numerous psychics, helping their victims obtain justice including financial restitution amounting to millions of dollars. He has consulted for ABC News and 20/20 as a specialist in psychic fraud. Nygaard previously was a member of the New York City Transit Police and Nassau County Police Department, retiring from service in 2008.

An SSA impersonation scam, or SSA scam, is a class of telecommunications scam targeting citizens of the United States by impersonating Social Security Administration employees. SSA scams are typically initiated through pre-recorded messages, or robocalls, that use social engineering to make victims panic and ensure they follow instructions given to them. In 2018, over 35,000 instances of SSA scam robocalls were reported to the Better Business Bureau with over $10 million lost by victims. Approximately 47% of Americans were subject to an SSA scam robocall during a three-month period between mid- to late 2020, and 21% of seniors were subject to at least three robocalls during the same time period.