A Condorcet method is one of several election methods that elects the candidate that wins a majority of the vote in every head-to-head election against each of the other candidates, that is, a candidate preferred by more voters than any others, whenever there is such a candidate. A candidate with this property, the pairwise champion or beats-all winner, is formally called the Condorcet winner. Note that the head-to-head elections aren't necessarily done separately; a voter's preference between every pair of candidates can be found by asking them to rank the candidates, and then assuming they would vote for the candidate they ranked higher for each pairing.

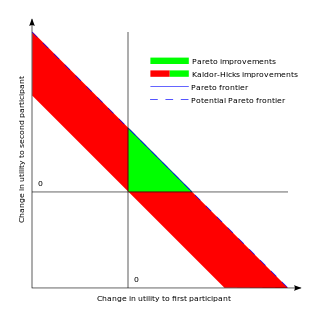

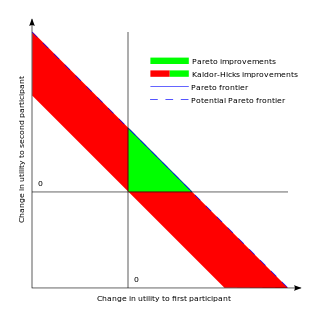

Pareto efficiency or Pareto optimality is a situation where no individual or preference criterion can be better off without making at least one individual or preference criterion worse off or without any loss thereof. The concept is named after Vilfredo Pareto (1848–1923), Italian engineer and economist, who used the concept in his studies of economic efficiency and income distribution. The following three concepts are closely related:

Kenneth Joseph Arrow was an American economist, mathematician, writer, and political theorist. He was the joint winner of the Nobel Memorial Prize in Economic Sciences with John Hicks in 1972.

A Kaldor–Hicks improvement, named for Nicholas Kaldor and John Hicks, is an economic re-allocation of resources among people that captures some of the intuitive appeal of a Pareto improvement, but has less stringent criteria and is hence applicable to more circumstances. A re-allocation is a Kaldor–Hicks improvement if those that are made better off could hypothetically compensate those that are made worse off and lead to a Pareto-improving outcome. The compensation does not actually have to occur and thus, a Kaldor–Hicks improvement can in fact leave some people worse off.

In social choice theory, Arrow's impossibility theorem, the general possibility theorem or Arrow's paradox is an impossibility theorem stating that when voters have three or more distinct alternatives (options), no ranked voting electoral system can convert the ranked preferences of individuals into a community-wide ranking while also meeting a specified set of criteria: unrestricted domain, non-dictatorship, Pareto efficiency, and independence of irrelevant alternatives. The theorem is often cited in discussions of voting theory as it is further interpreted by the Gibbard–Satterthwaite theorem. The theorem is named after economist and Nobel laureate Kenneth Arrow, who demonstrated the theorem in his doctoral thesis and popularized it in his 1951 book Social Choice and Individual Values. The original paper was titled "A Difficulty in the Concept of Social Welfare".

Nicholas Kaldor, Baron Kaldor, born Káldor Miklós, was a Cambridge economist in the post-war period. He developed the "compensation" criteria called Kaldor–Hicks efficiency for welfare comparisons (1939), derived the cobweb model, and argued for certain regularities observable in economic growth, which are called Kaldor's growth laws. Kaldor worked alongside Gunnar Myrdal to develop the key concept Circular Cumulative Causation, a multicausal approach where the core variables and their linkages are delineated. Both Myrdal and Kaldor examine circular relationships, where the interdependencies between factors are relatively strong, and where variables interlink in the determination of major processes. Gunnar Myrdal got the concept from Knut Wicksell and developed it alongside Nicholas Kaldor when they worked together at the United Nations Economic Commission for Europe. Myrdal concentrated on the social provisioning aspect of development, while Kaldor concentrated on demand-supply relationships to the manufacturing sector. Kaldor also coined the term "convenience yield" related to commodity markets and the so-called theory of storage, which was initially developed by Holbrook Working.

Sir John Hicks was a British economist. He is considered one of the most important and influential economists of the twentieth century. The most familiar of his many contributions in the field of economics were his statement of consumer demand theory in microeconomics, and the IS–LM model (1937), which summarised a Keynesian view of macroeconomics. His book Value and Capital (1939) significantly extended general-equilibrium and value theory. The compensated demand function is named the Hicksian demand function in memory of him.

In law and economics, the Coase theorem describes the economic efficiency of an economic allocation or outcome in the presence of externalities. The theorem states that if trade in an externality is possible and there are sufficiently low transaction costs, bargaining will lead to a Pareto efficient outcome regardless of the initial allocation of property. In practice, obstacles to bargaining or poorly defined property rights can prevent Coasean bargaining. This 'theorem' is commonly attributed to Nobel Memorial Prize in Economic Sciences winner Ronald Coase during his tenure at the London School of Economics, SUNY at Buffalo, University of Virginia, and University of Chicago.

Cost–benefit analysis (CBA), sometimes also called benefit–cost analysis, is a systematic approach to estimating the strengths and weaknesses of alternatives used to determine options which provide the best approach to achieving benefits while preserving savings. A CBA may be used to compare completed or potential courses of actions, or to estimate the value against the cost of a decision, project, or policy. It is commonly used in commercial transactions, business or policy decisions, and project investments. For example, the U.S. Securities and Exchange Commission has to conduct cost-benefit analysis before instituting regulations or de-regulations.

Welfare economics is a branch of economics that uses microeconomic techniques to evaluate well-being (welfare) at the aggregate (economy-wide) level.

Allocative efficiency is a state of the economy in which production represents consumer preferences; in particular, every good or service is produced up to the point where the last unit provides a marginal benefit to consumers equal to the marginal cost of producing.

The term inefficiency generally refers to an absence of efficiency. It has several meanings depending on the context in which it is used:

The participation criterion is a voting system criterion. Voting systems that fail the participation criterion are said to exhibit the no show paradox and allow a particularly unusual strategy of tactical voting: abstaining from an election can help a voter's preferred choice win. The criterion has been defined as follows:

Social choice theory or social choice is a theoretical framework for analysis of combining individual opinions, preferences, interests, or welfares to reach a collective decision or social welfare in some sense. A non-theoretical example of a collective decision is enacting a law or set of laws under a constitution. Social choice theory dates from Condorcet's formulation of the voting paradox. Kenneth Arrow's Social Choice and Individual Values (1951) and Arrow's impossibility theorem in it are generally acknowledged as the basis of the modern social choice theory. In addition to Arrow's theorem and the voting paradox, the Gibbard–Satterthwaite theorem, the Condorcet jury theorem, the median voter theorem, and May's theorem are among the more well known results from social choice theory.

In economics, compensating variation (CV) is a measure of utility change introduced by John Hicks (1939). 'Compensating variation' refers to the amount of additional money an agent would need to reach their initial utility after a change in prices, a change in product quality, or the introduction of new products. Compensating variation can be used to find the effect of a price change on an agent's net welfare. CV reflects new prices and the old utility level. It is often written using an expenditure function, e(p,u):

Tibor de Scitovsky, also known as Tibor Scitovsky, was a Hungarian born, American economist who was best known for his writing on the nature of people's happiness in relation to consumption. He was Associate Professor and Professor of Economics at Stanford University from 1946 through 1958 and Eberle Professor of Economics from 1970 until his retirement in 1976, when he became Professor Emeritus. In honor of his deep contributions to economic analysis, he was elected Distinguished Fellow of the American Economic Association, Fellow of the Royal Economic Society, member of the American Academy of Arts and Sciences, and Corresponding Fellow of the British Academy.

In welfare economics, the compensation principle refers to a decision rule used to select between pairs of alternative feasible social states. One of these states is the hypothetical point of departure. According to the compensation principle, if the prospective gainers could compensate (any) prospective losers and leave no one worse off, the alternate state is to be selected. An example of a compensation principle is the Pareto criterion in which a change in states entails that such compensation is not merely feasible but required. Two variants are:

Fair item allocation is a kind of a fair division problem in which the items to divide are discrete rather than continuous. The items have to be divided among several partners who value them differently, and each item has to be given as a whole to a single person. This situation arises in various real-life scenarios:

Rental harmony is a kind of a fair division problem in which indivisible items and a fixed monetary cost have to be divided simultaneously. The housemates problem and room-assignment-rent-division are alternative names to the same problem.