Related Research Articles

Comparative advantage in an economic model is the advantage over others in producing a particular good. A good can be produced at a lower relative opportunity cost or autarky price, i.e. at a lower relative marginal cost prior to trade. Comparative advantage describes the economic reality of the gains from trade for individuals, firms, or nations, which arise from differences in their factor endowments or technological progress.

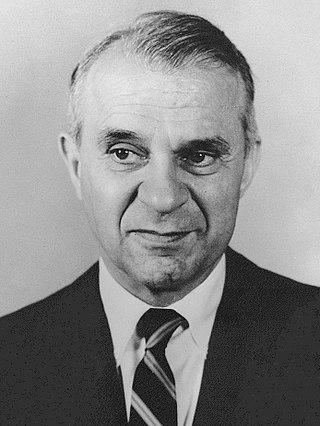

Bertil Gotthard Ohlin was a Swedish economist and politician. He was a professor of economics at the Stockholm School of Economics from 1929 to 1965. He was also leader of the People's Party, a social-liberal party which at the time was the largest party in opposition to the governing Social Democratic Party, from 1944 to 1967. He served briefly as Minister of Commerce and Industry from 1944 to 1945 in the Swedish coalition government during World War II. He was President of the Nordic Council in 1959 and 1964.

In economics, internationalization or internationalisation is the process of increasing involvement of enterprises in international markets, although there is no agreed definition of internationalization. Internationalization is a crucial strategy not only for companies that seek horizontal integration globally but also for countries that addresses the sustainability of its development in different manufacturing as well as service sectors especially in higher education which is a very important context that needs internationalization to bridge the gap between different cultures and countries. There are several internationalization theories which try to explain why there are international activities.

This is a list of international trade topics.

Wassily Wassilyevich Leontief, was a Soviet-American economist known for his research on input–output analysis and how changes in one economic sector may affect other sectors.

The Stolper–Samuelson theorem is a theorem in Heckscher–Ohlin trade theory. It describes the relationship between relative prices of output and relative factor returns—specifically, real wages and real returns to capital.

Eli Filip Heckscher was a Swedish political economist and economic historian who was a professor at the Stockholm School of Economics.

In economics, the principle of absolute advantage is the ability of a party to produce a good or service more efficiently than its competitors. The Scottish economist Adam Smith first described the principle of absolute advantage in the context of international trade in 1776, using labor as the only input. Since absolute advantage is determined by a simple comparison of labor productiveness, it is possible for a party to have no absolute advantage in anything.

The Rybczynski theorem was developed in 1955 by the Polish-born English economist Tadeusz Rybczynski (1923–1998). It states that at constant relative goods prices, a rise in the endowment of one factor will lead to a more than proportional expansion of the output in the sector which uses that factor intensively, and an absolute decline of the output of the other good.

The Heckscher–Ohlin model is a general equilibrium mathematical model of international trade, developed by Eli Heckscher and Bertil Ohlin at the Stockholm School of Economics. It builds on David Ricardo's theory of comparative advantage by predicting patterns of commerce and production based on the resources of a trading region. The model essentially says that countries export the products which use their relatively abundant and cheap factors of production, and import the products which use the countries' relatively scarce factors.

International economics is concerned with the effects upon economic activity from international differences in productive resources and consumer preferences and the international institutions that affect them. It seeks to explain the patterns and consequences of transactions and interactions between the inhabitants of different countries, including trade, investment and transaction.

New trade theory (NTT) is a collection of economic models in international trade theory which focuses on the role of increasing returns to scale and network effects, which were originally developed in the late 1970s and early 1980s. The main motivation for the development of NTT was that, contrary to what traditional trade models would suggest, the majority of the world trade takes place between countries that are similar in terms of development, structure, and factor endowments.

The Heckscher–Ohlin theorem is one of the four critical theorems of the Heckscher–Ohlin model, developed by Swedish economist Eli Heckscher and Bertil Ohlin. In the two-factor case, it states: "A capital-abundant country will export the capital-intensive good, while the labor-abundant country will export the labor-intensive good."

The Linder hypothesis is an economics conjecture about international trade patterns: The more similar the demand structures of countries, the more they will trade with one another. Further, international trade will still occur between two countries having identical preferences and factor endowments.

Intra-industry trade refers to the exchange of similar products belonging to the same industry. The term is usually applied to international trade, where the same types of goods or services are both imported and exported.

The gravity model of international trade in international economics is a model that, in its traditional form, predicts bilateral trade flows based on the economic sizes and distance between two units. Research shows that there is "overwhelming evidence that trade tends to fall with distance."

The Product Space is a network that formalizes the idea of relatedness between products traded in the global economy. The network first appeared in the July 2007 issue of Science in the article "The Product Space Conditions the Development of Nations," written by Cesar A. Hidalgo, Bailey Klinger, Ricardo Hausmann, and Albert-László Barabási. The Product Space network has considerable implications for economic policy, as its structure helps elucidate why some countries undergo steady economic growth while others become stagnant and are unable to develop. The concept has been further developed and extended by The Observatory of Economic Complexity, through visualizations such as the Product Exports Treemaps and new indexes such as the Economic Complexity Index (ECI), which have been condensed into the Atlas of Economic Complexity. From the new analytic tools developed, Hausmann, Hidalgo and their team have been able to elaborate predictions of future economic growth.

Edward Emory Leamer is a professor of economics and statistics at UCLA. He is Chauncey J. Medberry Professor of Management and director of the UCLA Anderson Forecast.

International trade theory is a sub-field of economics which analyzes the patterns of international trade, its origins, and its welfare implications. International trade policy has been highly controversial since the 18th century. International trade theory and economics itself have developed as means to evaluate the effects of trade policies.

The Ricardo–Viner model, also known as the specific factors model, is an extension of the Ricardo model used in international trade theory. It was due to Jacob Viner's interest in explaining the migration of workers from the rural to urban areas after the Industrial revolution. Unlike the Ricardian model, the specific factors model allows for the existence of factors of production besides labor. In other words, labor is mobile, while the two other factors of production are immobile as opposed to the Ricardian model where labor is immobile internationally, but mobile between two sectors of an economy.

References

- ↑ Leontief, Wassily (1953). "Domestic Production and Foreign Trade; The American Capital Position Re-Examined". Proceedings of the American Philosophical Society . 97 (4): 332–349. JSTOR 3149288.

- ↑ "Leontief Paradox" . Retrieved 2007-11-05.

- ↑ Baldwin, Robert E. (1971). "Determinants of the Commodity Structure of U.S. Trade". The American Economic Review . 61 (1): 126–146. JSTOR 1910546.

- ↑ Leamer, Edward E. (1980). "The Leontief Paradox, Reconsidered". Journal of Political Economy . 88 (3): 495–503. doi:10.1086/260882. JSTOR 1831928. S2CID 153956765.

- ↑ Duchin, Faye (2000). "International Trade: Evolution in the Thought and Analysis of Wassily Leontief" (PDF). p. 3.

- ↑ "Leontief paradox and the role of factor intensity measurement". 2005.

- ↑ Trefler, Daniel. (1993). "International Factor Price Differences: Leontief Was Right". Journal of Political Economy . 101 (6): 961–987. doi:10.1086/261911.

- ↑ Fisher, Eric O'N & Marshall, Kathryn G (2011), "The Structure of the American Economy" (PDF), Review of International Economics, 19 (1): 15–31, doi:10.1111/j.1467-9396.2010.00928.x, hdl: 10419/26340

- ↑ Guo, Baoping (2024). "Leontief Paradox vs. Leontief Trade and Localized Factor Prices vs. Localized Trade Patterns". Int Adv Econ Res. 30 (1): 83–105. doi:10.1007/s11294-024-09886-1.