| Type | Stock exchange, resource exchange |

|---|---|

| Location | New York City, United States |

| Founded | 1883 |

| Closed | 1885 |

The National Petroleum Exchange was a resource exchange in New York City founded in 1882. [1] In 1883 the National Petroleum Exchange and the New York Mining Stock Exchange were consolidated, [2] becoming the New-York Mining Stock and National Petroleum Exchange. [3] After several other exchange mergers with competitors, the exchange became the Consolidated Stock and Petroleum Exchange of New York, which in 1885 became the Consolidated Stock Exchange of New York. [4]

On December 18, 1882, the National Petroleum Exchange was opened. Sales that day equated to 150,000 barrels. [1] On March 24, 1883, the New-York Mining and National Petroleum Exchange had a membership of 479. [5] In 1883 the National Petroleum Exchange and the New York Mining Stock Exchange were consolidated, at which point Charles G. Wilson was elected president and held the office until 1900. [2] The new exchange was named the New-York Mining Stock and National Petroleum Exchange. [3]

By December 1883, the New York Times wrote that "much interest" was being shown in a proposed consolidation between the competing New-York Petroleum Exchange and the New-York Mining Stock and National Petroleum Exchange. The matter was voted on by both exchange members on December 22, 1883. [3] At the vote, members of the New-York Mining Stock and National Petroleum Exchange largely favored consolidation. However, the New-York Petroleum Exchange saw 269 in favor and 250 against, out of a total membership of around 688. Afterwards, a joint committee of three members from each Exchange was proposed, for the drafting of a new constitution and by-laws prior to any consolidation. [6] On March 11, 1884, it was reported that the governing board of the New-York Mining Stock and National Petroleum Exchange had voted against consolidation 29 to 2. One of the reasons given was that the National Exchange treasury contained $204,000, while the New-York Petroleum Exchange only had $74,570. However, a resolution was passed that members of the New-York Petroleum Exchange could join the National Exchange. [7]

The New-York Mining and National Petroleum Exchange merged with the competing New-York Petroleum Exchange and Stock Board on February 28, 1885. [5] After several other exchange merges with competitors such as the Miscellaneous Security Board, the exchange became known as the Consolidated Stock and Petroleum Exchange of New York. [4]

The New York Stock Exchange is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is the largest stock exchange in the world by market capitalization.

William Nelson Cromwell was an American attorney active in promotion of the Panama Canal and other major ventures especially in cooperation with Philippe Bunau-Varilla.

Anthony Nicholas Brady was an American businessman who amassed great wealth and at one time was the largest shareholder in the American Tobacco Company.

William Sylvester Silkworth, referred to in the U.S. press as "W. S. Silkworth", was an American financier known being president of the Consolidated Stock Exchange of New York and being forced to resign because of scandal. starting in 1919. He was also a sport shooter who competed in the 1924 Summer Olympics. In 1924, he won the gold medal as member of the American team in the team clay pigeons competition. Silkworth aggressively and successfully pursued new business for the exchange, and his career as president reached its peak in February 1922, when all trading records at the exchange were broken, ensuring that "Silkworth, not [NYSE president] McCormick, was the talk of Wall Street." Silkworth resigned on June 21, 1923, after an investigation into Consolidated insider corruption discovered irregularities in his personal finances. He later did time for mail fraud. By 1926, Silkworth was best known internationally as a member of the Olympic trap shooting team.

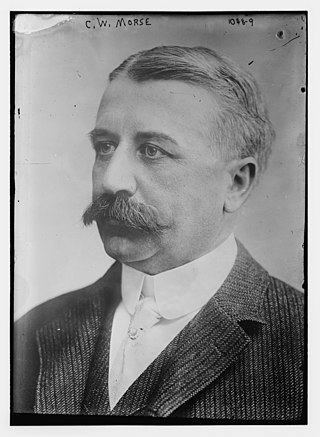

Charles Wyman Morse was an American businessman and speculator who committed frauds and engaged in corrupt business practices. At one time he controlled 13 banks. Known as the "Ice King" early in his career out of New York City, through Tammany Hall corruption he established a monopoly in New York's ice business, before buying several shipping companies and moving into high finance. His attempt to manipulate the price of copper-shares set off a wave of selling that developed into the Panic of 1907. Jailed for violating federal banking laws, he faked serious illness and was released. Later he was indicted for war profiteering and fraud.

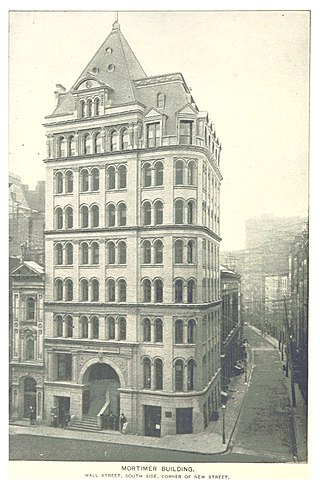

The Mortimer Building was a 19th-century building located at Wall Street and New Street in the Financial District of Manhattan, New York City. It was built by W.Y. Mortimer beginning on June 1, 1884, and completed for occupancy in March 1885. The architect was George B. Post. It fronted Wall Street for a distance of 57 feet (17 m) and New Street for 65 feet (20 m). Used entirely as an office building, the structure adjoined the New York Stock Exchange Building on the west and south. Tenants included lawyers, brokers, and bankers. The building was used as the general headquarters of the Industrial Workers of the World at its peak between 1912 and 1917.

The Pittsburgh Stock Exchange was a large regional stock market located in Pittsburgh, Pennsylvania from November 11, 1864 until closing on August 23, 1974. It was alternatively named the Pittsburgh Coal Exchange starting on May 27, 1870, and the Pittsburgh Oil Exchange on July 21, 1878 with 180 members. On July 25, 1896 the Exchange formally took the name Pittsburgh Stock Exchange though it had been referred to by that name since the spring of 1894. The Exchange, like many modern day exchanges, was forced to close during sharp economic crashes or crises. On December 24, 1969 The Philadelphia-Baltimore-Washington Stock Exchange bought the Pittsburgh Stock Exchange. At its height the exchange traded over 1,200 companies, but by the last trading day in 1974 only Pittsburgh Brewing Company, Williams & Company and Westinghouse remained listed.

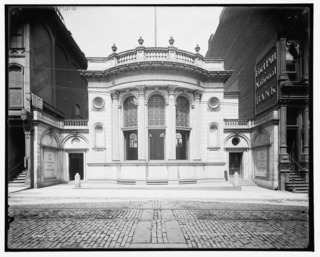

The New York Produce Exchange was a commodities exchange headquartered in the Financial District of Lower Manhattan in New York City. It served a network of produce and commodities dealers across the United States. Founded in 1861 as the New York Commercial Association, it was originally headquartered at Whitehall Street in a building owned by the New York Produce Exchange Company. The Association was renamed the New York Produce Exchange in 1868 and took over the original building in 1872.

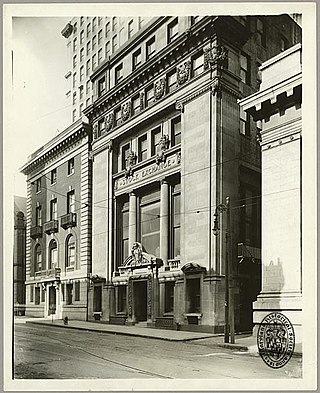

The Consolidated Stock Exchange of New York, also known as the New York Consolidated Stock Exchange or Consolidated, was a stock exchange in New York City, New York, in direct competition to the New York Stock Exchange (NYSE) from 1885 to 1926. It was formed from the merger of other smaller exchanges, and was referred to in the industry and press as the "Little Board." By its official formation in 1885, its membership of 2403 was considered the second largest membership of any exchange in the United States.

Consolidated National Bank of New York was a bank operating in New York City. Also referred to in the press as Consolidated National Bank, the institution was organized on July 1, 1902, with capital of $1 million. Wrote The New York Times, the bank was "founded with the idea of cornering the business of the Consolidated Exchange and its brokers." The bank opened for business at 57 Broadway on September 22, 1902, and a year later the bank took out a five-year lease at the Exchange Court Building. In 1906, the Consolidated Stock Exchange withdrew its deposits with the Consolidated National Bank. In 1909, the bank voted to acquire the assets of Oriental Bank and merge them with Consolidated, creating the National Reserve Bank. The Consolidated name was operative for a short time afterwards.

Mortimer Hartwell Wagar was an American banker and businessperson. Wagar was a member of the Consolidated Exchange for 33 years. He was president from 1900 until 1903. He retired from the exchange in June 1923, at which point he was vice president. He also helped organize the Clearing House of the Consolidated Exchange, where he was president.

The American Mining and Stock Exchange was a commodities and stock exchange in New York City. In 1877 it absorbed the competing New-York Open Gold and Stock Exchange. The New York Mining Stock Exchange absorbed the members of the American Mining and Stock Exchange, which had been operating for around fifteen months, on July 26, 1877.

The New-York Petroleum Exchange and Stock Board was a resource and stock exchange in New York City. Founded as the New-York Petroleum Exchange, in 1884 the exchange reported oil clearances amounting to 2,373,582,000 barrels, averaging 7,782,000 barrels per day. That year the exchange also began trading in stocks, bonds, and other securities. The institution merged with the competing exchange New-York Mining and National Petroleum Exchange on February 28, 1885, forming the Consolidated Stock and Petroleum Exchange.

Charles G. Wilson was an American financier and businessman. Wilson was president of the Consolidated Stock and Petroleum Exchange of New York from 1883 until 1900. As of December 1894, he was serving as President of the New York City Board of Health as well.

The Baltimore Stock Exchange was a regional stock exchange based in Baltimore, Maryland. Opened prior to 1881, The exchange's building was destroyed by the Great Baltimore Fire of 1904, and was then located at 210 East Redwood Street in Baltimore's old financial district. In 1918, the exchange had 87 members, with six or seven members at the time serving the United States in World War I. The Baltimore Stock Exchange was acquired by the Philadelphia Stock Exchange in 1949, becoming the Philadelphia-Baltimore Stock Exchange. The Baltimore Stock Exchange Building was sold and renamed the Totman Building.

The Washington Stock Exchange was a regional stock exchange based in Washington, D.C. Active as early as the 1880s, on July 21, 1953, members of the Washington Stock Exchange board unanimously voted to merge with the Philadelphia-Baltimore Stock Exchange. The merge occurred in 1954, creating the Philadelphia-Baltimore-Washington Stock Exchange.

The San Francisco Stock and Bond Exchange was a regional stock exchange based in San Francisco, California, United States. Founded in 1882, in 1928 the exchange purchased and began using the name San Francisco Stock Exchange, while the old San Francisco Stock Exchange was renamed the San Francisco Mining Exchange. The San Francisco Curb Exchange was absorbed by the San Francisco Stock Exchange in 1938. In 1956 the San Francisco Stock Exchange merged with the Los Angeles Oil Exchange to create the Pacific Coast Stock Exchange.

The St. Louis Stock Exchange was a regional stock exchange located in St. Louis, Missouri. Opened in 1899, in September 1949, the St. Louis Stock Exchange was acquired by the Chicago Stock Exchange, and renamed the Midwest Stock Exchange.