A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a state or formal monetary union, and oversees their commercial banking system. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Most central banks also have supervisory and regulatory powers to ensure the stability of member institutions, to prevent bank runs, and to discourage reckless or fraudulent behavior by member banks.

The krona is the official currency of Sweden. Both the ISO code "SEK" and currency sign "kr" are in common use; the former precedes or follows the value, the latter usually follows it but, especially in the past, it sometimes preceded the value. In English, the currency is sometimes referred to as the Swedish crown, as krona means "crown" in Swedish. The Swedish krona was the ninth-most traded currency in the world by value in April 2016.

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed. The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed.

Monetary policy of The United States concerns those policies related to the minting & printing of money, policies governing the legal exchange of currency, demand deposits, the money supply, etc. In the United States, the central bank, The Federal Reserve System, colloquially known as "The Fed" is the monetary authority.

In macroeconomics, the money supply refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation and demand deposits. The central bank of a country may use a definition of what constitutes legal tender for its purposes.

The svenska riksdaler was the name of a Swedish coin first minted in 1604. Between 1777 and 1873, it was the currency of Sweden. The daler, like the dollar, was named after the German Thaler. The similarly named Reichsthaler, rijksdaalder, and rigsdaler were used in Germany and Austria-Hungary, the Netherlands, and Denmark-Norway, respectively. Riksdaler is still used as a colloquial term for Sweden's modern-day currency.

The Swedish National Debt Office was founded by Gustav III at the Riksdag of the Estates in 1789, through the Act of union and security. It is a Swedish Government agency. The first task of the Debt Office was to finance the ongoing War against Russia.

The monetary policy of Sweden is decided by Sveriges Riksbank, the central bank of Sweden. The monetary policy is instrumental in determining how the Swedish currency is valued.

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing or the money supply, often as an attempt to reduce inflation or the interest rate, to ensure price stability and general trust of the value and stability of the nation's currency.

The Scandinavian Monetary Union was a monetary union formed by Denmark and Sweden on 5 May 1873, with Norway joining in 1875. It established a common currency unit, the krone/krona, based on the gold standard. It was one of the few tangible results of the Scandinavian political movement of the 19th century. The union ended during World War I.

In macroeconomics, an open market operation (OMO) is an activity by a central bank to give liquidity in its currency to a bank or a group of banks. The central bank can either buy or sell government bonds in the open market or, in what is now mostly the preferred solution, enter into a repo or secured lending transaction with a commercial bank: the central bank gives the money as a deposit for a defined period and synchronously takes an eligible asset as collateral.

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the central bank on the basis of a specified proportion of deposit liabilities of the bank. This rate is commonly referred to as the reserve ratio. Though the definitions vary, the commercial bank's reserves normally consist of cash held by the bank and stored physically in the bank vault, plus the amount of the bank's balance in that bank's account with the central bank. A bank is at liberty to hold in reserve sums above this minimum requirement, commonly referred to as excess reserves.

Money creation, or money issuance, is the process by which the money supply of a country, or of an economic or monetary region, is increased. In most modern economies, money creation is controlled by the central banks. Money issued by central banks is termed base money. Central banks can increase the quantity of base money directly, by engaging in open market operations. However, the majority of the money supply is created by the commercial banking system in the form of bank deposits. Bank loans issued by commercial banks that practice fractional reserve banking expands the quantity of broad money to more than the original amount of base money issued by the central bank.

Stockholms Banco was the first European bank to print banknotes. It was founded in 1657 by Johan Palmstruch in Stockholm, began printing banknotes in 1661, but ran into financial difficulties and was liquidated in 1667. Stockholms Banco was the immediate precursor to the central bank of Sweden, founded in 1668 as Riksens Ständers Bank and renamed in 1866 as Sveriges Riksbank, which is the world's oldest surviving central bank.

Bank rate, also known as discount rate in American English, is the rate of interest which a central bank charges on its loans and advances to a commercial bank. The bank rate is known by a number of different terms depending on the country, and has changed over time in some countries as the mechanisms used to manage the rate have changed.

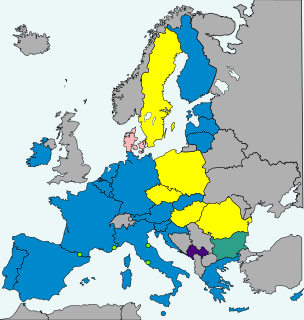

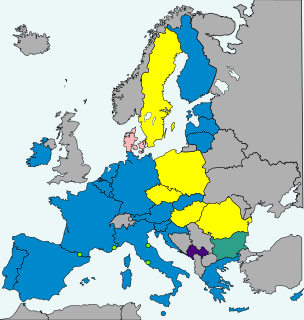

Sweden does not currently use the euro as its currency and has no plans to replace the existing Swedish krona in the near future. Sweden's Treaty of Accession of 1994 made it subject to the Treaty of Maastricht, which obliges states to join the eurozone once they meet the necessary conditions. Sweden maintains that joining the European Exchange Rate Mechanism II, participation in which for at least two years is a requirement for euro adoption, is voluntary, and has chosen to remain outside pending public approval by a referendum, thereby intentionally avoiding the fulfilment of the adoption requirements.

Central bank liquidity swap is a type of currency swap used by a country's central bank to provide liquidity of its currency to another country's central bank. In a liquidity swap, the lending central bank uses its currency to buy the currency of another borrowing central bank at the market exchange rate, and agrees to sell the borrower's currency back at a rate that reflects the interest accrued on the loan. The borrower's currency serves as collateral.

Lars Johan Heikensten, born 13 September 1950, is a former governor of Sveriges Riksbank and Doctor of Economics.

Monetary policy is the process by which the monetary authority of a country, generally central bank, controls the supply of money in the economy by its control over interest rates in order to maintain price stability and achieve high economic growth. In India, the central monetary authority is the Reserve Bank of India (RBI).