Cost accounting is defined by the Institute of Management Accountants as "a systematic set of procedures for recording and reporting measurements of the cost of manufacturing goods and performing services in the aggregate and in detail. It includes methods for recognizing, allocating, aggregating and reporting such costs and comparing them with standard costs". Often considered a subset of managerial accounting, its end goal is to advise the management on how to optimize business practices and processes based on cost efficiency and capability. Cost accounting provides the detailed cost information that management needs to control current operations and plan for the future.

In management accounting or managerial accounting, managers use accounting information in decision-making and to assist in the management and performance of their control functions.

In microeconomic theory, the opportunity cost of a choice is the value of the best alternative forgone where, given limited resources, a choice needs to be made between several mutually exclusive alternatives. Assuming the best choice is made, it is the "cost" incurred by not enjoying the benefit that would have been had if the second best available choice had been taken instead. The New Oxford American Dictionary defines it as "the loss of potential gain from other alternatives when one alternative is chosen". As a representation of the relationship between scarcity and choice, the objective of opportunity cost is to ensure efficient use of scarce resources. It incorporates all associated costs of a decision, both explicit and implicit. Thus, opportunity costs are not restricted to monetary or financial costs: the real cost of output forgone, lost time, pleasure, or any other benefit that provides utility should also be considered an opportunity cost.

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit. In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a "rational agent" which wants to maximize its total profit, which is the difference between its total revenue and its total cost.

Inventory or stock refers to the goods and materials that a business holds for the ultimate goal of resale, production or utilisation.

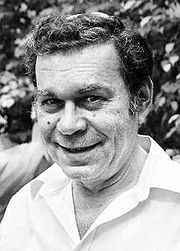

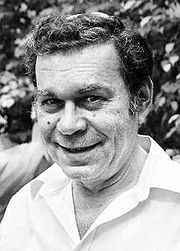

Eliyahu Moshe Goldratt was an Israeli business management guru. He was the originator of the Optimized Production Technique, the Theory of Constraints (TOC), the Thinking Processes, Drum-Buffer-Rope, Critical Chain Project Management (CCPM) and other TOC derived tools.

The theory of constraints (TOC) is a management paradigm that views any manageable system as being limited in achieving more of its goals by a very small number of constraints. There is always at least one constraint, and TOC uses a focusing process to identify the constraint and restructure the rest of the organization around it. TOC adopts the common idiom "a chain is no stronger than its weakest link". That means that organizations and processes are vulnerable because the weakest person or part can always damage or break them, or at least adversely affect the outcome.

The thinking processes in Eliyahu M. Goldratt's theory of constraints are the five methods to enable the focused improvement of any cognitive system.

Focused improvement in the theory of constraints is an ensemble of activities aimed at elevating the performance of any system, especially a business system, with respect to its goal by eliminating its constraints one by one and by not working on non-constraints.

The Goal is a management-oriented novel by Eliyahu M. Goldratt, a business consultant known for his theory of constraints, and Jeff Cox, the author of several management-oriented novels. The Goal was originally published in 1984 and has since been revised and republished. This describes a case study in operations management, focusing on the theory of constraints, and bottlenecks and how to alleviate them. In 2011, Time Magazine listed the book as one of "the 25 most influential business management books".

Activity-based costing (ABC) is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. Therefore, this model assigns more indirect costs (overhead) into direct costs compared to conventional costing.

An operating expense (opex) is an ongoing cost for running a product, business, or system. Its counterpart, a capital expenditure (capex), is the cost of developing or providing non-consumable parts for the product or system. For example, the purchase of a photocopier involves capex, and the annual paper, toner, power and maintenance costs represents opex. For larger systems like businesses, opex may also include the cost of workers and facility expenses such as rent and utilities.

Contribution margin (CM), or dollar contribution per unit, is the selling price per unit minus the variable cost per unit. "Contribution" represents the portion of sales revenue that is not consumed by variable costs and so contributes to the coverage of fixed costs. This concept is one of the key building blocks of break-even analysis.

In the field of accounting, when reporting the financial statements of a company, accounting constraints are boundaries, limitations, or guidelines.

Throughput is rate at which a product is moved through a production process and is consumed by the end-user, usually measured in the form of sales or use statistics. The goal of most organizations is to minimize the investment in inputs as well as operating expenses while increasing throughput of its production systems. Successful organizations which seek to gain market share strive to match throughput to the rate of market demand of its products.

Critical Chain is a novel by Dr. Eliyahu Goldratt using the critical chain theory of project management as the major theme. It is really a teaching method for the theory.

Supply-chain optimization (SCO) aims to ensure the optimal operation of a manufacturing and distribution supply chain. This includes the optimal placement of inventory within the supply chain, minimizing operating costs including manufacturing costs, transportation costs, and distribution costs. Optimization often involves the application of mathematical modelling techniques using computer software. It is often considered to be part of supply chain engineering, although the latter is mainly focused on mathematical modelling approaches, whereas supply chain optimization can also be undertaken using qualitative, management based approaches.

Management accounting principles (MAP) were developed to serve the core needs of internal management to improve decision support objectives, internal business processes, resource application, customer value, and capacity utilization needed to achieve corporate goals in an optimal manner. Another term often used for management accounting principles for these purposes is managerial costing principles. The two management accounting principles are:

- Principle of Causality and,

- Principle of Analogy.

Jerome Lee Nicholson was an American accountant, industrial consultant, author and educator at the New York University and Columbia University, known as pioneer in cost accounting. He is considered in the United States to be the "father of cost accounting."

Theory of constraints (TOC) is an engineering management technique used to evaluate a manageable procedure, identifying the largest constraint (bottleneck) and strategizing to reduce task time and maximise profit. It assists in determining what to change, when to change it, and how to cause the change. The theory was established by Dr. Eliyahu Goldratt through his 1984 bestselling novel The Goal. Since this time, TOC has continued to develop and evolve and is a primary management tool in the engineering industry. When Applying TOC, powerful tools are used to determine the constraint and reduce its effect on the procedure, including: