Petroleum, also known as crude oil or simply oil, is a naturally occurring yellowish-black liquid mixture of mainly hydrocarbons, and is found in geological formations. The name petroleum covers both naturally occurring unprocessed crude oil and petroleum products that consist of refined crude oil.

The Organization of the Petroleum Exporting Countries is an organization enabling the co-operation of leading oil-producing countries in order to collectively influence the global oil market and maximize profit. It was founded on 14 September 1960 in Baghdad by the first five members. The organization, which currently comprises 12 member countries, accounted for an estimated 30 percent of global oil production. A 2022 report further details that OPEC member countries were responsible for approximately 38 percent of it. Additionally, it is estimated that 79.5 percent of the world's proven oil reserves are located within OPEC nations, with the Middle East alone accounting for 67.2 percent of OPEC's total reserves.

In October 1973, the Organization of Arab Petroleum Exporting Countries (OAPEC) announced that it was implementing a total oil embargo against the countries who had supported Israel at any point during the Fourth Arab–Israeli War, which began after Egypt and Syria launched a large-scale surprise attack in an ultimately unsuccessful attempt to recover the territories that they had lost to Israel during the Third Arab–Israeli War. In an effort that was led by Faisal of Saudi Arabia, the initial countries that OAPEC targeted were Canada, Japan, the Netherlands, the United Kingdom, and the United States. This list was later expanded to include Portugal, Rhodesia, and South Africa. In March 1974, OAPEC lifted the embargo, but the price of oil had risen by nearly 300%: from US$3 per barrel ($19/m3) to nearly US$12 per barrel ($75/m3) globally. Prices in the United States were significantly higher than the global average. After it was implemented, the embargo caused an oil crisis, or "shock", with many short- and long-term effects on the global economy as well as on global politics. The 1973 embargo later came to be referred to as the "first oil shock" vis-à-vis the "second oil shock" that was the 1979 oil crisis, brought upon by the Iranian Revolution.

Petroleum politics have been an increasingly important aspect of diplomacy since the rise of the petroleum industry in the Middle East in the early 20th century. As competition continues for a vital resource, the strategic calculations of major and minor countries alike place prominent emphasis on the pumping, refining, transport, sale and use of petroleum products.

From the mid-1980s to September 2003, the inflation-adjusted price of a barrel of crude oil on NYMEX was generally under US$25/barrel in 2008 dollars. During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147.30 in July 2008. Commentators attributed these price increases to many factors, including Middle East tension, soaring demand from China, the falling value of the U.S. dollar, reports showing a decline in petroleum reserves, worries over peak oil, and financial speculation.

The Energy Policy and Conservation Act of 1975 (EPCA) is a United States Act of Congress that responded to the 1973 oil crisis by creating a comprehensive approach to federal energy policy. The primary goals of EPCA are to increase energy production and supply, reduce energy demand, provide energy efficiency, and give the executive branch additional powers to respond to disruptions in energy supply. Most notably, EPCA established the Strategic Petroleum Reserve, the Energy Conservation Program for Consumer Products, and Corporate Average Fuel Economy regulations.

The price of oil, or the oil price, generally refers to the spot price of a barrel of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC Reference Basket, Tapis crude, Bonny Light, Urals oil, Isthmus, and Western Canadian Select (WCS). Oil prices are determined by global supply and demand, rather than any country's domestic production level.

For further details see the "Energy crisis" series by Facts on File.

National Iranian Oil Refining and Distribution Company (NIORDC) is part of the Ministry of Petroleum of Iran. NIORDC was established on 8 March 1991 and undertook to perform all operations relating to refining and distribution of oil products.

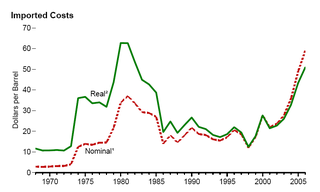

The 1980s oil glut was a significant surplus of crude oil caused by falling demand following the 1970s energy crisis. The world price of oil had peaked in 1980 at over US$35 per barrel ; it fell in 1986 from $27 to below $10. The glut began in the early 1980s as a result of slowed economic activity in industrial countries due to the crises of the 1970s, especially in 1973 and 1979, and the energy conservation spurred by high fuel prices. The inflation-adjusted real 2004 dollar value of oil fell from an average of $78.2 in 1981 to an average of $26.8 per barrel in 1986.

Petroleum has been a major industry in the United States since shortly after the oil discovery in the Oil Creek area of Titusville, Pennsylvania, in 1859. The industry includes exploration, production, processing (refining), transportation, and marketing of natural gas and petroleum products. In 2018, the U.S. became the world's largest crude oil producer, producing 15% of global crude oil, surpassing Russia and Saudi Arabia. The leading oil-producing area in the United States in 2019 was Texas, followed by the offshore federal zone of the Gulf of Mexico, North Dakota and New Mexico. In 2020, the top five U.S. oil-producing states were Texas (43%), North Dakota (10.4%), New Mexico (9.2%), Oklahoma (4.1%), and Colorado (4.0%).

From the mid-1980s to September 2003, the inflation adjusted price of a barrel of crude oil on NYMEX was generally under $25/barrel. Then, during 2004, the price rose above $40, and then $60. A series of events led the price to exceed $60 by August 11, 2005, leading to a record-speed hike that reached $75 by the middle of 2006. Prices then dropped back to $60/barrel by the early part of 2007 before rising steeply again to $92/barrel by October 2007, and $99.29/barrel for December futures in New York on November 21, 2007. Throughout the first half of 2008, oil regularly reached record high prices. Prices on June 27, 2008, touched $141.71/barrel, for August delivery in the New York Mercantile Exchange, amid Libya's threat to cut output, and OPEC's president predicted prices may reach $170 by the Northern summer. The highest recorded price per barrel maximum of $147.02 was reached on July 11, 2008. After falling below $100 in the late summer of 2008, prices rose again in late September. On September 22, oil rose over $25 to $130 before settling again to $120.92, marking a record one-day gain of $16.37. Electronic crude oil trading was temporarily halted by NYMEX when the daily price rise limit of $10 was reached, but the limit was reset seconds later and trading resumed. By October 16, prices had fallen again to below $70, and on November 6 oil closed below $60. Then in 2009, prices went slightly higher, although not to the extent of the 2005–2007 crisis, exceeding $100 in 2011 and most of 2012. Since late 2013 the oil price has fallen below the $100 mark, plummeting below the $50 mark one year later.

Sources include: Dow Jones (DJ), New York Times (NYT), Wall Street Journal (WSJ), and the Washington Post (WP).

The 1970s energy crisis occurred when the Western world, particularly the United States, Canada, Western Europe, Australia, and New Zealand, faced substantial petroleum shortages as well as elevated prices. The two worst crises of this period were the 1973 oil crisis and the 1979 energy crisis, when, respectively, the Yom Kippur War and the Iranian Revolution triggered interruptions in Middle Eastern oil exports.

Iran is an energy superpower and the petroleum industry in Iran plays an important part in it. In 2004, Iran produced 5.1 percent of the world's total crude oil, which generated revenues of US$25 billion to US$30 billion and was the country's primary source of foreign currency. At 2006 levels of production, oil proceeds represented about 18.7% of gross domestic product (GDP). However, the importance of the hydrocarbon sector to Iran's economy has been far greater. The oil and gas industry has been the engine of economic growth, directly affecting public development projects, the government's annual budget, and most foreign exchange sources.

The 2010s oil glut was a significant surplus of crude oil that started in 2014–2015 and accelerated in 2016, with multiple causes. They include general oversupply as unconventional US and Canadian tight oil production reached critical volumes, geopolitical rivalries among oil-producing nations, falling demand across commodities markets due to the deceleration of the Chinese economy, and possible restraint of long-term demand as environmental policy promotes fuel efficiency and steers an increasing share of energy consumption away from fossil fuels.