Lawrence Robert Klein was an American economist. For his work in creating computer models to forecast economic trends in the field of econometrics in the Department of Economics at the University of Pennsylvania, he was awarded the Nobel Memorial Prize in Economic Sciences in 1980 specifically "for the creation of econometric models and their application to the analysis of economic fluctuations and economic policies." Due to his efforts, such models have become widespread among economists. Harvard University professor Martin Feldstein told the Wall Street Journal that Klein "was the first to create the statistical models that embodied Keynesian economics," tools still used by the Federal Reserve Bank and other central banks.

The Journal of Business & Economic Statistics is a quarterly peer-reviewed academic journal published by the American Statistical Association. The journal covers a broad range of applied problems in business and economic statistics, including forecasting, seasonal adjustment, applied demand and cost analysis, applied econometric modeling, empirical finance, analysis of survey and longitudinal data related to business and economic problems, the impact of discrimination on wages and productivity, the returns to education and training, the effects of unionization, and applications of stochastic control theory to business and economic problems.

The following tables compare general and technical information for a number of statistical analysis packages.

Sir David Forbes Hendry, FBA CStat is a British econometrician, currently a professor of economics and from 2001–2007 was head of the Economics Department at the University of Oxford. He is also a professorial fellow at Nuffield College, Oxford.

Neil Shephard, FBA, is an econometrician, currently Frank B. Baird, Jr. Professor of Science in the Department of Economics and the Department of Statistics at Harvard University.

Eric Ghysels is a Belgian economist with particular interest in finance and time series econometrics who works in the field of financial econometrics, and is currently the Edward M. Bernstein Distinguished Professor of Economics at the University of North Carolina and a Professor of Finance at the Kenan-Flagler Business School.

The Journal of Econometrics is a scholarly journal in econometrics. It was first published in 1973. Its current editors are A. Ronald Gallant, John Geweke, Cheng Hsiao, and Peter M. Robinson.

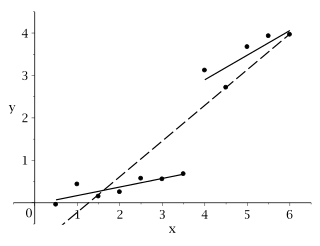

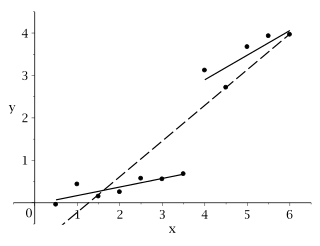

In econometrics and statistics, a structural break is an unexpected change over time in the parameters of regression models, which can lead to huge forecasting errors and unreliability of the model in general. This issue was popularised by David Hendry, who argued that lack of stability of coefficients frequently caused forecast failure, and therefore we must routinely test for structural stability. Structural stability − i.e., the time-invariance of regression coefficients − is a central issue in all applications of linear regression models.

AREMOS was a data management and econometrics software package released by Global Insight. It was most popular in the late 1980s and 1990s, when it was used by leading economists. Developed as a DOS application by Wharton Econometric Forecasting Associates - WEFA now IHS Markit, it has gone through many iterations. Thomsons' Datastream macroeconomic databases which were accessible with AREMOS, were a key selling point.

The Faculty of Informatics and Statistics, also known as the School of Informatics and Statistics, is the fourth of six faculties at University of Economics, Prague. The faculty was established in 1991, following the dissolution of the Faculty of Direction. Its academic focus is informatics, statistics, econometrics and other mathematical methods applied to business practice. The faculty has eight departments and several research laboratories, and hosts around 3,500 students across its programs.

LIMDEP is an econometric and statistical software package with a variety of estimation tools. In addition to the core econometric tools for analysis of cross sections and time series, LIMDEP supports methods for panel data analysis, frontier and efficiency estimation and discrete choice modeling. The package also provides a programming language to allow the user to specify, estimate and analyze models that are not contained in the built in menus of model forms.

Philippus Henricus Benedictus Franciscus "Philip Hans" Franses is a Dutch economist and Professor of Applied Econometrics and Marketing Research at the Erasmus University Rotterdam, and dean of the Erasmus School of Economics, especially known for his 1998 work on "Nonlinear Time Series Models in Empirical Finance."

Francis X. Diebold is an American economist known for his work in predictive econometric modeling, financial econometrics, and macroeconometrics. He earned both his B.S. and Ph.D. degrees at the University of Pennsylvania ("Penn"), where his doctoral committee included Marc Nerlove, Lawrence Klein, and Peter Pauly. He has spent most of his career at Penn, where he has mentored approximately 75 Ph.D. students. Presently he is Paul F. and Warren S. Miller Professor of Social Sciences and Professor of Economics at Penn’s School of Arts and Sciences, and Professor of Finance and Professor of Statistics at Penn’s Wharton School. He is also a Faculty Research Associate at the National Bureau of Economic Research in Cambridge, Massachusetts, and author of the No Hesitations blog.

Agustín Maravall Herrero is a Spanish economist known for his contributions in statistics and econometrics time series analysis, in particular seasonal adjustment and in the estimation of signals in economic time series. He has completed a methodology and several computer programs that are used throughout the world by analysts, researchers, and data producers. An important use is official production of series adjusted for seasonality and (perhaps) other undesirable effects such as noise, outliers, or missing observations. Maravall has received several awards and distinctions and retired in December 2014 from the Bank of Spain.