Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference." An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships." Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today.

Economic data are data describing an actual economy, past or present. These are typically found in time-series form, that is, covering more than one time period or in cross-sectional data in one time period. Data may also be collected from surveys of for example individuals and firms or aggregated to sectors and industries of a single economy or for the international economy. A collection of such data in table form comprises a data set.

Herman Ole Andreas Wold was a Norwegian-born econometrician and statistician who had a long career in Sweden. Wold was known for his work in mathematical economics, in time series analysis, and in econometric statistics.

Sir Clive William John Granger was a British econometrician known for his contributions to nonlinear time series analysis. He taught in Britain, at the University of Nottingham and in the United States, at the University of California, San Diego. Granger was awarded the Nobel Memorial Prize in Economic Sciences in 2003 in recognition of the contributions that he and his co-winner, Robert F. Engle, had made to the analysis of time series data. This work fundamentally changed the way in which economists analyse financial and macroeconomic data.

Agricultural economics is an applied field of economics concerned with the application of economic theory in optimizing the production and distribution of food and fiber products. Agricultural economics began as a branch of economics that specifically dealt with land usage. It focused on maximizing the crop yield while maintaining a good soil ecosystem. Throughout the 20th century the discipline expanded and the current scope of the discipline is much broader. Agricultural economics today includes a variety of applied areas, having considerable overlap with conventional economics. Agricultural economists have made substantial contributions to research in economics, econometrics, development economics, and environmental economics. Agricultural economics influences food policy, agricultural policy, and environmental policy.

Economic forecasting is the process of making predictions about the economy. Forecasts can be carried out at a high level of aggregation—for example for GDP, inflation, unemployment or the fiscal deficit—or at a more disaggregated level, for specific sectors of the economy or even specific firms. Economic forecasting is a measure to find out the future prosperity of a pattern of investment and is the key activity in economic analysis. Many institutions engage in economic forecasting: national governments, banks and central banks, consultants and private sector entities such as think-tanks, companies and international organizations such as the International Monetary Fund, World Bank and the OECD. A broad range of forecasts are collected and compiled by "Consensus Economics". Some forecasts are produced annually, but many are updated more frequently.

Computational economics is an interdisciplinary research discipline that combines methods in computational science and economics to solve complex economic problems. This subject encompasses computational modeling of economic systems. Some of these areas are unique, while others established areas of economics by allowing robust data analytics and solutions of problems that would be arduous to research without computers and associated numerical methods.

Economic methodology is the study of methods, especially the scientific method, in relation to economics, including principles underlying economic reasoning. In contemporary English, 'methodology' may reference theoretical or systematic aspects of a method. Philosophy and economics also takes up methodology at the intersection of the two subjects.

The Journal of Business & Economic Statistics is a quarterly peer-reviewed academic journal published by the American Statistical Association. The journal covers a broad range of applied problems in business and economic statistics, including forecasting, seasonal adjustment, applied demand and cost analysis, applied econometric modeling, empirical finance, analysis of survey and longitudinal data related to business and economic problems, the impact of discrimination on wages and productivity, the returns to education and training, the effects of unionization, and applications of stochastic control theory to business and economic problems.

Arnold Zellner was an American economist and statistician specializing in the fields of Bayesian probability and econometrics. Zellner contributed pioneering work in the field of Bayesian analysis and econometric modeling.

William Arnold Barnett is an American economist, whose current work is in the fields of chaos, bifurcation, and nonlinear dynamics in socioeconomic contexts, econometric modeling of consumption and production, and the study of the aggregation problem and the challenges of measurement in economics.

Enrico Giovannini is an Italian economist, statistician and academic, member of the Club of Rome. Since February 2021, he has been serving as Minister of Infrastructure and Sustainable Mobility in the Draghi Government. From April 2013 to February 2014, he served as Minister of Labour and Social Policies in the Letta Government. From 2009 to 2013, he held the office of President of the Italian National Institute of Statistics (Istat).

Bayesian econometrics is a branch of econometrics which applies Bayesian principles to economic modelling. Bayesianism is based on a degree-of-belief interpretation of probability, as opposed to a relative-frequency interpretation.

The methodology of econometrics is the study of the range of differing approaches to undertaking econometric analysis.

A consensus forecast is a prediction of the future created by combining several separate forecasts which have often been created using different methodologies. They are used in a number of sciences, ranging from econometrics to meteorology, and are also known as combining forecasts, forecast averaging or model averaging and committee machines, ensemble averaging or expert aggregation.

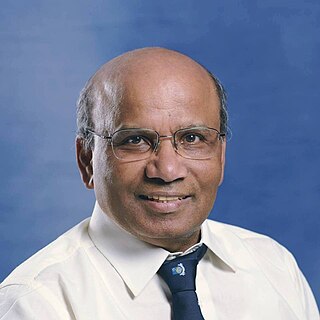

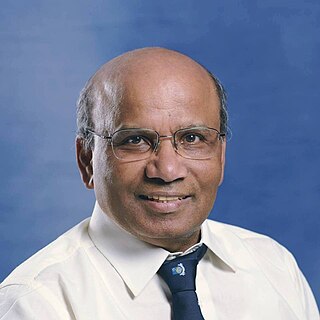

Anil K. Bera is an Indian-American econometrician. He is Professor of Economics at University of Illinois at Urbana–Champaign's Department of Economics. He is most noted for his work with Carlos Jarque on the Jarque–Bera test.

Edward Emory Leamer is a professor of economics and statistics at UCLA. He is Chauncey J. Medberry Professor of Management and director of the UCLA Anderson Forecast.

Causation in economics has a long history with Adam Smith explicitly acknowledging its importance via his (1776) An Inquiry into the Nature and Causes of the Wealth of Nations and David Hume and John Stuart Mill (1848) both offering important contributions with more philosophical discussions. Hoover (2006) suggests that a useful way of classifying approaches to causation in economics might be to distinguish between approaches that emphasize structure and those that emphasize process and to add to this a distinction between approaches that adopt a priori reasoning and those that seek to infer causation from the evidence provided by data. He represented by this little table which useful identifies key works in each of the four categories.

Agustín Maravall Herrero is a Spanish economist. He is known for his contributions to the analysis of statistics and econometrics, particularly in seasonal adjustment and the estimation of signals in economic time series. He created a methodology and several computer programs for such analysis that are used throughout the world by analysts, researchers, and data producers. Maravall retired in December 2014 from the Bank of Spain.

Francesca Molinari is an Italian economist and economic statististician specializing in theoretical and applied econometrics, whose research topics include risk aversion, survey methodology, and set identification. She is H. T. Warshow and Robert Irving Warshow Professor of Economics and Professor of Statistics at Cornell University.