Related Research Articles

The Kyoto Protocol is an international treaty which extends the 1992 United Nations Framework Convention on Climate Change (UNFCCC) that commits state parties to reduce greenhouse gas emissions, based on the scientific consensus that (part one) global warming is occurring and (part two) that human-made CO2 emissions are driving it. The Kyoto Protocol was adopted in Kyoto, Japan, on 11 December 1997 and entered into force on 16 February 2005. There are currently 192 parties (Canada withdrew from the protocol, effective December 2012) to the Protocol.

A Tobin tax was originally defined as a tax on all spot conversions of one currency into another. It was suggested by James Tobin, an economist who won the Nobel Memorial Prize in Economic Sciences. Tobin's tax was originally intended to penalize short-term financial round-trip excursions into another currency. By the late 1990s, the term Tobin tax was being, contrary to its original use, used to apply to all forms of short term transaction taxation, whether across currencies or not. Another term for these broader tax schemes is Robin Hood tax, due to tax revenues from the speculator funding general revenue. More exact terms, however, apply to different scopes of tax.

The United Nations Framework Convention on Climate Change (UNFCCC) is an international environmental treaty addressing climate change, negotiated and signed by 154 states at the United Nations Conference on Environment and Development (UNCED), informally known as the Earth Summit, held in Rio de Janeiro from 3 to 14 June 1992. It established a Secretariat headquartered in Bonn and entered into force on 21 March 1994. The Kyoto Protocol, which was signed in 1997 and which entered into force in 2005, was the first implementation of measures under the UNFCCC until 31 December 2020. The protocol was superseded by the Paris Agreement, which entered into force in 2016. As of 2020, the UNFCCC has 197 signatory parties. Its supreme decision-making body, the Conference of the Parties (COP), meets annually to assess progress in dealing with climate change.

Emissions trading is a market-based approach to controlling pollution by providing economic incentives for reducing the emissions of pollutants.

Environmental finance is a field within finance that employs market-based environmental policy instruments to improve the ecological impact of investment strategies. The primary objective of environmental finance is to regress the negative impacts of climate change through pricing and trading schemes. The field of environmental finance was established in response to the poor management of economic crises by government bodies globally. Environmental finance aims to reallocate a businesses resources to improve the sustainability of investments whilst also retaining profit margins.

A carbon tax is a tax levied on the carbon content of goods and services, predominantly in the transport and energy sectors. Carbon taxes intend to reduce carbon dioxide emissions by increasing prices, thereby decreasing demand for such goods and services. David Gordon Wilson first proposed a carbon tax in 1973. Carbon taxes are a form of carbon pricing. The term carbon tax is also used to refer to a carbon dioxide equivalent tax, which can be placed on any other greenhouse gas (GHG) or combination of greenhouse gases.

A carbon credit is a generic term for any tradable certificate or permit representing the right to emit one tonne of carbon dioxide or the equivalent amount of a different greenhouse gas (tCO2e).

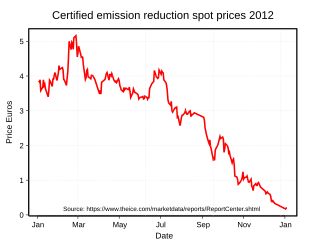

The Clean Development Mechanism (CDM) is one of the Flexible Mechanisms defined in the Kyoto Protocol that provides for emissions reduction projects which generate Certified Emission Reduction units (CERs) which may be traded in emissions trading schemes. The market crashed in 2012 when the value of credits collapsed and thousands of projects were left with unclaimed credits. The struggle about what to do with the old credits sank the 2019 COP 25 in Madrid.

Flexible mechanisms, also sometimes known as Flexibility Mechanisms or Kyoto Mechanisms, refers to Emissions Trading, the Clean Development Mechanism and Joint Implementation. These are mechanisms defined under the Kyoto Protocol intended to lower the overall costs of achieving its emissions targets. These mechanisms enable Parties to achieve emission reductions or to remove carbon from the atmosphere cost-effectively in other countries. While the cost of limiting emissions varies considerably from region to region, the benefit for the atmosphere is in principle the same, wherever the action is taken.

A low-carbon economy (LCE), low-fossil-fuel economy (LFFE), or decarbonised economy is an economy based on low-carbon power sources that therefore has a minimal output of greenhouse gas (GHG) emissions into the atmosphere, specifically carbon dioxide. GHG emissions due to anthropogenic (human) activity are the dominant cause of observed global warming since the mid-20th century. Continued emission of greenhouse gases may cause long-lasting changes around the world, increasing the likelihood of severe, pervasive, and irreversible effects for people and ecosystems.

After the 2007 United Nations Climate Change Conference held on the island of Bali in Indonesia in December 2007, the participating nations adopted the Bali Road Map as a two-year process working towards finalizing a binding agreement at the 2009 United Nations Climate Change Conference in Copenhagen, Denmark. The conference encompassed meetings of several bodies, including the 13th Conference of the Parties to the United Nations Framework Convention on Climate Change and the third Meeting of the Parties to the Kyoto Protocol.

Carbon emissions trading is a form of emissions trading that specifically targets carbon dioxide (calculated in tonnes of carbon dioxide equivalent or tCO2) and it currently constitutes the bulk of emissions trading.

A financial transaction tax is a levy on a specific type of financial transaction for a particular purpose. The concept has been most commonly associated with the financial sector; it is not usually considered to include consumption taxes paid by consumers.

The economics of climate change mitigation is the part of the economics of climate change related to climate change mitigation, that is actions that are designed to limit the amount of long-term climate change. Mitigation may be achieved through the reduction of greenhouse gas (GHG) emissions or through the enhancement of sinks that absorb GHGs, for example forests.

Reducing emissions from deforestation and forest degradation and the role of conservation, sustainable management of forests and enhancement of forest carbon stocks in developing countries (REDD+) was first negotiated under the United Nations Framework Convention on Climate Change (UNFCCC) in 2005, with the objective of mitigating climate change through reducing net emissions of greenhouse gases through enhanced forest management in developing countries. Most of the key REDD+ decisions were completed by 2013, with the final pieces of the rulebook finished in 2015.

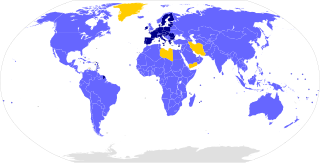

The Paris Agreement is an agreement within the United Nations Framework Convention on Climate Change (UNFCCC), on climate change mitigation, adaptation, and finance, signed in 2016. The agreement's language was negotiated by representatives of 196 state parties at the 21st Conference of the Parties of the UNFCCC in Le Bourget, near Paris, France, and adopted by consensus on 12 December 2015. As of March 2021, 191 members of the UNFCCC are parties to the agreement. Of the six UNFCCC member states which have not ratified the agreement, the only major emitters are Iran, Iraq and Turkey, though Iraq's President has approved that country's accession. The United States withdrew from the agreement in 2020, but rejoined in 2021.

The Green Climate Fund (GCF) is a fund established within the framework of the UNFCCC as an operating entity of the Financial Mechanism to assist developing countries in adaptation and mitigation practices to counter climate change. The GCF is based in Incheon, South Korea. It is governed by a Board of 24 members and supported by a Secretariat.

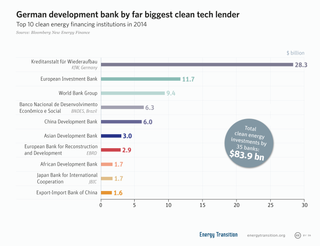

Climate finance is “finance that aims at reducing emissions, and enhancing sinks of greenhouse gases and aims at reducing vulnerability of, and maintaining and increasing the resilience of, human and ecological systems to negative climate change impacts”

The 2012 United Nations Climate Change Conference was the 18th yearly session of the Conference of the Parties (COP) to the 1992 United Nations Framework Convention on Climate Change (UNFCCC) and the 8th session of the Meeting of the Parties (CMP) to the 1997 Kyoto Protocol. The conference took place from Monday 26 November to Saturday 8 December 2012, at the Qatar National Convention Centre in Doha.

The United Nations Climate Change Conference, COP19 or CMP9 was held in Warsaw, Poland from 11 to 23 November 2013. This is the 19th yearly session of the Conference of the Parties to the 1992 United Nations Framework Convention on Climate Change (UNFCCC) and the 9th session of the Meeting of the Parties to the 1997 Kyoto Protocol. The conference delegates continue the negotiations towards a global climate agreement. UNFCCC's Executive Secretary Christiana Figueres and Poland's Minister of the Environment Marcin Korolec led the negotiations.

References

- ↑ "High Level Advisory Group on Climate Change Financing".

- ↑ https://www.un.org/apps/news/story.asp?NewsID=34937

- ↑ "The UN Boys Club tasked with redefining climate finance".

- ↑ "Civil Society's Reactions to the AGF Report". Archived from the original on 2014-12-25. Retrieved 2011-04-25.

- ↑ IMF Staff Position Paper. "Financing the Response to Climate Change" (PDF).

- ↑ Center for Global Development. "Find Me the Money: Financing Climate and Other Global Public Goods - Working Paper 248".