| Economics |

|---|

|

|

|

| By application |

|

| Lists |

| Glossary |

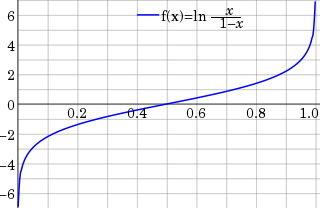

A limited dependent variable is a variable whose range of possible values is "restricted in some important way." [1] In econometrics, the term is often used when estimation of the relationship between the limited dependent variable of interest and other variables requires methods that take this restriction into account. For example, this may arise when the variable of interest is constrained to lie between zero and one, as in the case of a probability, or is constrained to be positive, as in the case of wages or hours worked.

Econometrics is the application of statistical methods to economic data in order to give empirical content to economic relationships. More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference". An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships". The first known use of the term "econometrics" was by Polish economist Paweł Ciompa in 1910. Jan Tinbergen is considered by many to be one of the founding fathers of econometrics. Ragnar Frisch is credited with coining the term in the sense in which it is used today.

Probability is the measure of the likelihood that an event will occur. See glossary of probability and statistics. Probability quantifies as a number between 0 and 1, where, loosely speaking, 0 indicates impossibility and 1 indicates certainty. The higher the probability of an event, the more likely it is that the event will occur. A simple example is the tossing of a fair (unbiased) coin. Since the coin is fair, the two outcomes are both equally probable; the probability of "heads" equals the probability of "tails"; and since no other outcomes are possible, the probability of either "heads" or "tails" is 1/2.

Contents

Limited dependent variable models include: [2]

- Censoring, where for some individuals in a data set, some data are missing but other data are present;

- Truncation, where some individuals are systematically excluded from observation (failure to take this phenomenon into account can result in selection bias);

- Discrete outcomes, such as binary decisions or qualitative data restricted to a small number of categories. Discrete choice models may have either unordered or ordered alternatives; ordered alternatives may take the form of count data or ordered rating responses (such as a Likert scale). [3]

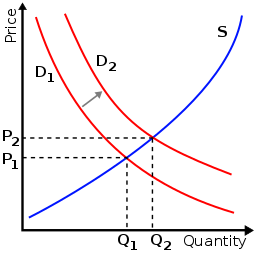

Censored regression models commonly arise in econometrics in cases where the variable of interest is only observable under certain conditions. A common example is labor supply. Data are frequently available on the hours worked by employees, and a labor supply model estimates the relationship between hours worked and characteristics of employees such as age, education and family status. However, such estimates undertaken using linear regression will be biased by the fact that for people who are unemployed it is not possible to observe the number of hours they would have worked had they had employment. Still we know age, education and family status for those observations. The censored model should not be confused with the truncated regression model, which is in general different and requires different types of estimators.

Truncated regression models arise in many applications of statistics, for example in econometrics, in cases where observations with values in the outcome variable below or above certain thresholds are systematically excluded from the sample. Therefore, whole observations are missing, so that neither the dependent nor the independent variable is known.

Selection bias is the bias introduced by the selection of individuals, groups or data for analysis in such a way that proper randomization is not achieved, thereby ensuring that the sample obtained is not representative of the population intended to be analyzed. It is sometimes referred to as the selection effect. The phrase "selection bias" most often refers to the distortion of a statistical analysis, resulting from the method of collecting samples. If the selection bias is not taken into account, then some conclusions of the study may not be accurate.