An auction is usually a process of buying and selling goods or services by offering them up for bid, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition exist and are described in the section about different types. The branch of economic theory dealing with auction types and participants' behavior in auctions is called auction theory.

Day trading is speculation in securities, specifically buying and selling financial instruments within the same trading day, such that all positions are closed before the market closes for the trading day. Traders who trade in this capacity with the motive of profit are therefore speculators. The methods of quick trading contrast with the long-term trades underlying buy and hold and value investing strategies. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open.

A request for proposal (RFP) is a document that solicits proposal, often made through a bidding process, by an agency or company interested in procurement of a commodity, service, or valuable asset, to potential suppliers to submit business proposals. It is submitted early in the procurement cycle, either at the preliminary study, or procurement stage.

A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. The U.S. Securities and Exchange Commission defines a "market maker" as a firm that stands ready to buy and sell stock on a regular and continuous basis at a publicly quoted price.

An online auction is an auction which is held over the internet. Online auctions come in many different formats, but most popularly they are ascending English auctions, descending Dutch auctions, first-price sealed-bid, Vickrey auctions, or sometimes even a combination of multiple auctions, taking elements of one and forging them with another.

The bid–ask spread, is the difference between the prices quoted for an immediate sale (offer) and an immediate purchase (bid) for stocks, futures contracts, options, or currency pairs. The size of the bid–ask spread in a security is one measure of the liquidity of the market and of the size of the transaction cost. If the spread is 0 then it is a frictionless asset.

A Vickrey auction is a type of sealed-bid auction. Bidders submit written bids without knowing the bid of the other people in the auction. The highest bidder wins but the price paid is the second-highest bid. This type of auction is strategically similar to an English auction and gives bidders an incentive to bid their true value. The auction was first described academically by Columbia University professor William Vickrey in 1961 though it had been used by stamp collectors since 1893. In 1797 Johann Wolfgang von Goethe sold a manuscript using a sealed-bid, second-price auction.

An electronic communication network (ECN) is a type of computerized forum or network that facilitates the trading of financial products outside traditional stock exchanges. An ECN is generally an electronic system that widely disseminates orders entered by market makers to third parties and permits the orders to be executed against in whole or in part. The primary products that are traded on ECNs are stocks and currencies. ECNs are generally passive computer-driven networks that internally match limit orders and charge a very small per share transaction fee.

A bid price is the highest price that a buyer is willing to pay for a goods. It is usually referred to simply as the "bid".

In economics, a price mechanism is the manner in which the profits of goods or services affect the supply and demand of goods and services, principally by the price elasticity of demand. A price mechanism affect both buyer and seller who negotiate prices. A price mechanism, part of a market system, comprises various ways to match up buyers and sellers. Price mechanism is a mechanism where price plays a key role in directing the activities of producers, consumers, resource suppliers. An example of a price mechanism uses announced bid and ask prices. Generally speaking, when two parties wish to engage in trade, the purchaser will announce a price he is willing to pay and seller will announce a price he is willing to accept.

A financial quotation refers to specific market data relating to a security or commodity. While the term quote specifically refers to the bid price or ask price of an instrument, it may be more generically used to relate to the last price which the security traded at. This may refer to both exchange-traded and over-the-counter financial instruments.

An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or cryptocurrency exchange. These instructions can be simple or complicated, and can be sent to either a broker or directly to a trading venue via direct market access. There are some standard instructions for such orders.

A double auction is a process of buying and selling goods with multiple sellers and multiple buyers. Potential buyers submit their bids and potential sellers submit their ask prices to the market institution, and then the market institution chooses some price p that clears the market: all the sellers who asked less than p sell and all buyers who bid more than p buy at this price p. Buyers and sellers that bid or ask for exactly p are also included. A common example of a double auction is stock exchange.

Scalping, when used in reference to trading in securities, commodities and foreign exchange, may refer to

- a legitimate method of arbitrage of small price gaps created by the bid-ask spread.

- a fraudulent form of market manipulation

A multiunit auction is an auction in which several homogeneous items are sold. The units can be sold each at the same price or at different prices.

Book building is a systematic process of generating, capturing, and recording investor demand for shares. Usually, the issuer appoints a major investment bank to act as a major securities underwriter or bookrunner.

A central limit order book (CLOB) was a centralised database of limit orders proposed by the U.S. Securities and Exchange Commission in 2000. However, the concept was opposed by securities companies.

In finance, a dark pool is a private forum for trading securities, derivatives, and other financial instruments. Liquidity on these markets is called dark pool liquidity. The bulk of dark pool trades represent large trades by financial institutions that are offered away from public exchanges like the New York Stock Exchange and the NASDAQ, so that such trades remain confidential and outside the purview of the general investing public. The fragmentation of electronic trading platforms has allowed dark pools to be created, and they are normally accessed through crossing networks or directly among market participants via private contractual arrangements. Generally dark pools are not available to the public, but in some cases they may be accessed indirectly by retail investors and traders via retail brokers.

Iran Mercantile Exchange (IME) is a commodities exchange located in Tehran, Iran.

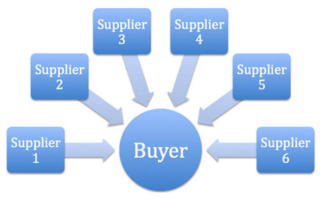

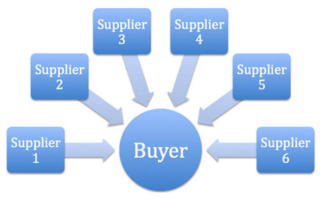

A reverse auction is a type of auction in which the traditional roles of buyer and seller are reversed. Thus, there is one buyer and many potential sellers. In an ordinary auction, buyers compete to obtain goods or services by offering increasingly higher prices. In contrast, in a reverse auction, the sellers compete to obtain business from the buyer and prices will typically decrease as the sellers underbid each other.