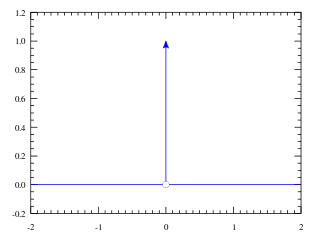

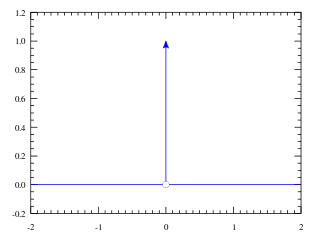

In mathematical analysis, the Dirac delta function, also known as the unit impulse, is a generalized function on the real numbers, whose value is zero everywhere except at zero, and whose integral over the entire real line is equal to one. Since there is no function having this property, to model the delta "function" rigorously involves the use of limits or, as is common in mathematics, measure theory and the theory of distributions.

Kinematics is a subfield of physics, developed in classical mechanics, that describes the motion of points, bodies (objects), and systems of bodies without considering the forces that cause them to move. Kinematics, as a field of study, is often referred to as the "geometry of motion" and is occasionally seen as a branch of mathematics. A kinematics problem begins by describing the geometry of the system and declaring the initial conditions of any known values of position, velocity and/or acceleration of points within the system. Then, using arguments from geometry, the position, velocity and acceleration of any unknown parts of the system can be determined. The study of how forces act on bodies falls within kinetics, not kinematics. For further details, see analytical dynamics.

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics.

In mathematics, a recurrence relation is an equation according to which the th term of a sequence of numbers is equal to some combination of the previous terms. Often, only previous terms of the sequence appear in the equation, for a parameter that is independent of ; this number is called the order of the relation. If the values of the first numbers in the sequence have been given, the rest of the sequence can be calculated by repeatedly applying the equation.

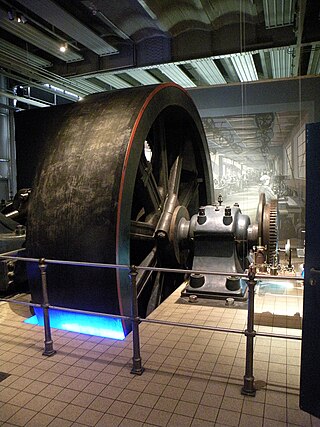

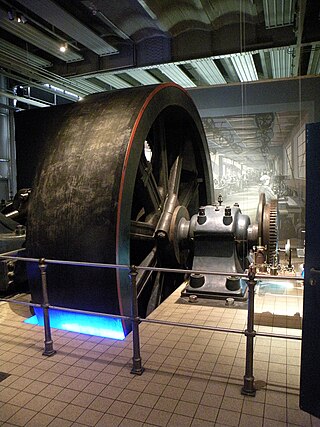

The moment of inertia, otherwise known as the mass moment of inertia, angular mass, second moment of mass, or most accurately, rotational inertia, of a rigid body is a quantity that determines the torque needed for a desired angular acceleration about a rotational axis, akin to how mass determines the force needed for a desired acceleration. It depends on the body's mass distribution and the axis chosen, with larger moments requiring more torque to change the body's rate of rotation by a given amount.

In economics, the fiscal multiplier is the ratio of change in national income arising from a change in government spending. More generally, the exogenous spending multiplier is the ratio of change in national income arising from any autonomous change in spending. When this multiplier exceeds one, the enhanced effect on national income may be called the multiplier effect. The mechanism that can give rise to a multiplier effect is that an initial incremental amount of spending can lead to increased income and hence increased consumption spending, increasing income further and hence further increasing consumption, etc., resulting in an overall increase in national income greater than the initial incremental amount of spending. In other words, an initial change in aggregate demand may cause a change in aggregate output that is a multiple of the initial change.

In vector calculus, Green's theorem relates a line integral around a simple closed curve C to a double integral over the plane region D bounded by C. It is the two-dimensional special case of Stokes' theorem.

In thermodynamics, the Helmholtz free energy is a thermodynamic potential that measures the useful work obtainable from a closed thermodynamic system at a constant temperature (isothermal). The change in the Helmholtz energy during a process is equal to the maximum amount of work that the system can perform in a thermodynamic process in which temperature is held constant. At constant temperature, the Helmholtz free energy is minimized at equilibrium.

In mathematics, the Hodge star operator or Hodge star is a linear map defined on the exterior algebra of a finite-dimensional oriented vector space endowed with a nondegenerate symmetric bilinear form. Applying the operator to an element of the algebra produces the Hodge dual of the element. This map was introduced by W. V. D. Hodge.

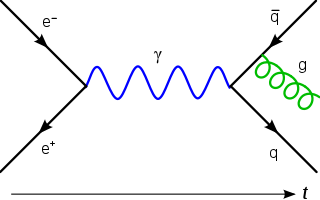

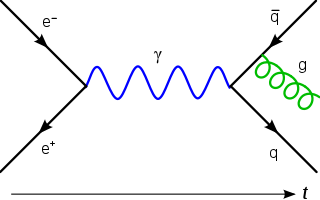

In quantum field theory, partition functions are generating functionals for correlation functions, making them key objects of study in the path integral formalism. They are the imaginary time versions of statistical mechanics partition functions, giving rise to a close connection between these two areas of physics. Partition functions can rarely be solved for exactly, although free theories do admit such solutions. Instead, a perturbative approach is usually implemented, this being equivalent to summing over Feynman diagrams.

In mathematical optimization and decision theory, a loss function or cost function is a function that maps an event or values of one or more variables onto a real number intuitively representing some "cost" associated with the event. An optimization problem seeks to minimize a loss function. An objective function is either a loss function or its opposite, in which case it is to be maximized. The loss function could include terms from several levels of the hierarchy.

In relativistic physics, Lorentz symmetry or Lorentz invariance, named after the Dutch physicist Hendrik Lorentz, is an equivalence of observation or observational symmetry due to special relativity implying that the laws of physics stay the same for all observers that are moving with respect to one another within an inertial frame. It has also been described as "the feature of nature that says experimental results are independent of the orientation or the boost velocity of the laboratory through space".

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending (consumption) occurs with an increase in disposable income. The proportion of disposable income which individuals spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend more than the extra dollar. If the extra money accessed by the individual gives more economic confidence, then the MPC of the individual may well exceed 1, as they may borrow or utilise savings.

In geometry and algebra, the triple product is a product of three 3-dimensional vectors, usually Euclidean vectors. The name "triple product" is used for two different products, the scalar-valued scalar triple product and, less often, the vector-valued vector triple product.

In mathematics, differential algebra is, broadly speaking, the area of mathematics consisting in the study of differential equations and differential operators as algebraic objects in view of deriving properties of differential equations and operators without computing the solutions, similarly as polynomial algebras are used for the study of algebraic varieties, which are solution sets of systems of polynomial equations. Weyl algebras and Lie algebras may be considered as belonging to differential algebra.

Cointegration is a statistical property of a collection (X1, X2, ..., Xk) of time series variables. First, all of the series must be integrated of order d (see Order of integration). Next, if a linear combination of this collection is integrated of order less than d, then the collection is said to be co-integrated. Formally, if (X,Y,Z) are each integrated of order d, and there exist coefficients a,b,c such that aX + bY + cZ is integrated of order less than d, then X, Y, and Z are cointegrated. Cointegration has become an important property in contemporary time series analysis. Time series often have trends—either deterministic or stochastic. In an influential paper, Charles Nelson and Charles Plosser (1982) provided statistical evidence that many US macroeconomic time series (like GNP, wages, employment, etc.) have stochastic trends.

In monetary economics, the demand for money is the desired holding of financial assets in the form of money: that is, cash or bank deposits rather than investments. It can refer to the demand for money narrowly defined as M1, or for money in the broader sense of M2 or M3.

Smoothing splines are function estimates, , obtained from a set of noisy observations of the target , in order to balance a measure of goodness of fit of to with a derivative based measure of the smoothness of . They provide a means for smoothing noisy data. The most familiar example is the cubic smoothing spline, but there are many other possibilities, including for the case where is a vector quantity.

The Abelian sandpile model (ASM) is the more popular name of the original Bak–Tang–Wiesenfeld model (BTW). The BTW model was the first discovered example of a dynamical system displaying self-organized criticality. It was introduced by Per Bak, Chao Tang and Kurt Wiesenfeld in a 1987 paper.

In mathematics, the Butcher group, named after the New Zealand mathematician John C. Butcher by Hairer & Wanner (1974), is an infinite-dimensional Lie group first introduced in numerical analysis to study solutions of non-linear ordinary differential equations by the Runge–Kutta method. It arose from an algebraic formalism involving rooted trees that provides formal power series solutions of the differential equation modeling the flow of a vector field. It was Cayley (1857), prompted by the work of Sylvester on change of variables in differential calculus, who first noted that the derivatives of a composition of functions can be conveniently expressed in terms of rooted trees and their combinatorics.