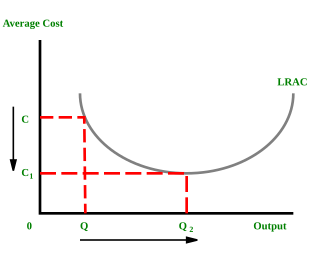

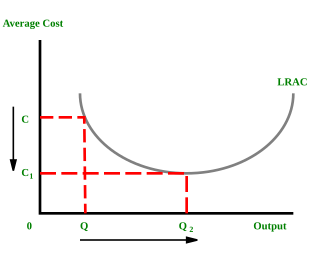

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of output produced. A decrease in cost per unit of output enables an increase in scale. At the basis of economies of scale there may be technical, statistical, organizational or related factors to the degree of market control.

This aims to be a complete article list of economics topics:

In economics, a production function gives the technological relation between quantities of physical inputs and quantities of output of goods. The production function is one of the key concepts of mainstream neoclassical theories, used to define marginal product and to distinguish allocative efficiency, a key focus of economics. One important purpose of the production function is to address allocative efficiency in the use of factor inputs in production and the resulting distribution of income to those factors, while abstracting away from the technological problems of achieving technical efficiency, as an engineer or professional manager might understand it.

The big push model is a concept in development economics or welfare economics that emphasizes that a firm's decision whether to industrialize or not depends on its expectation of what other firms will do. It assumes economies of scale and oligopolistic market structure and explains when industrialization would happen.

The organic composition of capital (OCC) is a concept created by Karl Marx in his theory of capitalism, which was simultaneously his critique of the political economy of his time. It is a special concept derived from his more basic concepts of 'value composition of capital' and 'technical composition of capital'. Marx defines the organic composition of capital as "the value-composition of capital, in so far as it is determined by its technical composition and mirrors the changes of the latter". The 'technical composition of capital' measures the relation between the elements of constant capital and variable capital. It is 'technical' because no valuation is here involved. In contrast, the 'value composition of capital' is the ratio between the value of the elements of constant capital involved in production and the value of the labor. Marx found that the special concept of 'organic composition of capital' was sometimes useful in analysis, since it assumes that the relative values of all the elements of capital are constant.

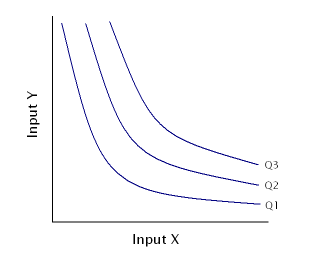

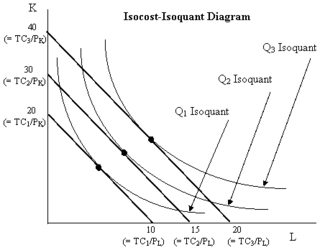

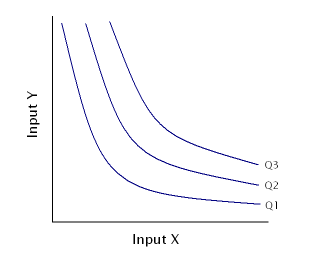

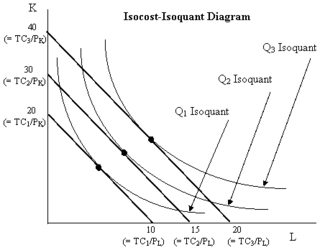

An isoquant, in microeconomics, is a contour line drawn through the set of points at which the same quantity of output is produced while changing the quantities of two or more inputs. The x and y axis on an isoquant represent two relevant inputs, which are usually a factor of production such as labour, capital, land, or organisation. An isoquant may also be known as an “Iso-Product Curve”, or an “Equal Product Curve”.

In economics an isocost line shows all combinations of inputs which cost the same total amount. Although similar to the budget constraint in consumer theory, the use of the isocost line pertains to cost-minimization in production, as opposed to utility-maximization. For the two production inputs labour and capital, with fixed unit costs of the inputs, the equation of the isocost line is

The Heckscher–Ohlin model is a general equilibrium mathematical model of international trade, developed by Eli Heckscher and Bertil Ohlin at the Stockholm School of Economics. It builds on David Ricardo's theory of comparative advantage by predicting patterns of commerce and production based on the factor endowments of a trading region. The model essentially says that countries export the products which use their abundant and cheap factors of production, and import the products which use the countries' scarce factors.

The Solow residual is a number describing empirical productivity growth in an economy from year to year and decade to decade. Robert Solow, the Nobel Memorial Prize in Economic Sciences-winning economist, defined rising productivity as rising output with constant capital and labor input. It is a "residual" because it is the part of growth that is not accounted for by measures of capital accumulation or increased labor input. Increased physical throughput – i.e. environmental resources – is specifically excluded from the calculation; thus some portion of the residual can be ascribed to increased physical throughput. The example used is for the intracapital substitution of aluminium fixtures for steel during which the inputs do not alter. This differs in almost every other economic circumstance in which there are many other variables. The Solow Residual is procyclical and measures of it are now called the rate of growth of multifactor productivity or total factor productivity, though Solow (1957) did not use these terms.

The dual-sector model is a model in development economics. It is commonly known as the Lewis model after its inventor W. Arthur Lewis. It explains the growth of a developing economy in terms of a labour transition between two sectors, the capitalist sector and the subsistence sector.

Development theory is a collection of theories about how desirable change in society is best achieved. Such theories draw on a variety of social science disciplines and approaches. In this article, multiple theories are discussed, as are recent developments with regard to these theories. Depending on which theory that is being looked at, there are different explanations to the process of development and their inequalities.

Okishio's theorem is a theorem formulated by Japanese economist Nobuo Okishio. It has had a major impact on debates about Marx's theory of value. Intuitively, it can be understood as saying that if one capitalist raises his profits by introducing a new technique that cuts his costs, the collective or general rate of profit in society goes up for all capitalists. In 1961, Okishio established this theorem under the assumption that the real wage remains constant. Thus, the theorem isolates the effect of pure innovation from any consequent changes in the wage.

Production is the process of combining various material inputs and immaterial inputs in order to make something for consumption (output). It is the act of creating an output, a good or service which has value and contributes to the utility of individuals. The area of economics that focuses on production is referred to as production theory, which is intertwined with the consumption theory of economics.

The AD–AS or aggregate demand–aggregate supply model is a macroeconomic model that explains price level and output through the relationship of aggregate demand and aggregate supply.

Real business-cycle theory is a class of new classical macroeconomics models in which business-cycle fluctuations are accounted for by real shocks. Unlike other leading theories of the business cycle, RBC theory sees business cycle fluctuations as the efficient response to exogenous changes in the real economic environment. That is, the level of national output necessarily maximizes expected utility, and governments should therefore concentrate on long-run structural policy changes and not intervene through discretionary fiscal or monetary policy designed to actively smooth out economic short-term fluctuations.

In the technological theory of social production, the growth of output, measured in money units, is related to achievements in technological consumption of labour and energy. This theory is based on concepts of classical political economy and neo-classical economics and appears to be a generalisation of the known economic models, such as the neo-classical model of economic growth and input-output model.

In economics and microeconomics, the economic region of production is an offshoot of the theory of production function with two variables. It is a cost-oriented theory which defines the region in which the optimal factor combination will lie. It serves as a map of the region of optimal production. Economic region of production consist of negatively sloped portion of all isoquants.

The Fei–Ranis model of economic growth is a dualism model in developmental economics or welfare economics that has been developed by John C. H. Fei and Gustav Ranis and can be understood as an extension of the Lewis model. It is also known as the Surplus Labor model. It recognizes the presence of a dual economy comprising both the modern and the primitive sector and takes the economic situation of unemployment and underemployment of resources into account, unlike many other growth models that consider underdeveloped countries to be homogenous in nature. According to this theory, the primitive sector consists of the existing agricultural sector in the economy, and the modern sector is the rapidly emerging but small industrial sector. Both the sectors co-exist in the economy, wherein lies the crux of the development problem. Development can be brought about only by a complete shift in the focal point of progress from the agricultural to the industrial economy, such that there is augmentation of industrial output. This is done by transfer of labor from the agricultural sector to the industrial one, showing that underdeveloped countries do not suffer from constraints of labor supply. At the same time, growth in the agricultural sector must not be negligible and its output should be sufficient to support the whole economy with food and raw materials. Like in the Harrod–Domar model, saving and investment become the driving forces when it comes to economic development of underdeveloped countries.

The Cambridge capital controversy, sometimes called "the capital controversy" or "the two Cambridges debate", was a dispute between proponents of two differing theoretical and mathematical positions in economics that started in the 1950s and lasted well into the 1960s. The debate concerned the nature and role of capital goods and a critique of the neoclassical vision of aggregate production and distribution. The name arises from the location of the principals involved in the controversy: the debate was largely between economists such as Joan Robinson and Piero Sraffa at the University of Cambridge in England and economists such as Paul Samuelson and Robert Solow at the Massachusetts Institute of Technology, in Cambridge, Massachusetts, United States.

Constant capital (c), is a concept created by Karl Marx and used in Marxian political economy. It refers to one of the forms of capital invested in production, which contrasts with variable capital (v). The distinction between constant and variable refers to an aspect of the economic role of factors of production in creating a new value.