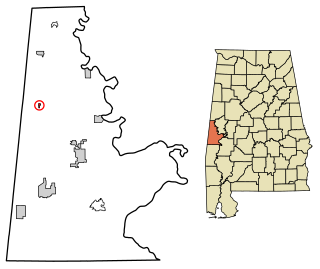

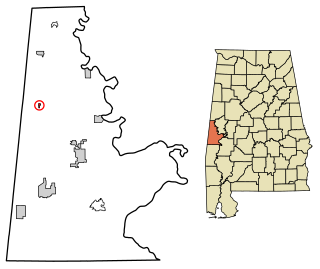

Emelle is a town in Sumter County, Alabama, United States. It was named after the daughters of the man who donated the land for the town. The town was started in the 19th century but not incorporated until 1981. The daughters of the man who donated were named Emma Dial and Ella Dial, so he combined the two names to create Emelle. Emelle was famous for its great cotton. The first mayor of Emelle was James Dailey. He served two terms. The current mayor is Roy Willingham Sr. The population was 32 at the 2020 census.

The Dormant Commerce Clause, or Negative Commerce Clause, in American constitutional law, is a legal doctrine that courts in the United States have inferred from the Commerce Clause in Article I of the US Constitution. The primary focus of the doctrine is barring state protectionism. The Dormant Commerce Clause is used to prohibit state legislation that discriminates against, or unduly burdens, interstate or international commerce. Courts first determine whether a state regulation discriminates on its face against interstate commerce or whether it has the purpose or effect of discriminating against interstate commerce. If the statute is discriminatory, the state has the burden to justify both the local benefits flowing from the statute and to show the state has no other means of advancing the legitimate local purpose.

The term market participant is another term for economic agent, an actor and more specifically a decision maker in a model of some aspect of the economy. For example, buyers and sellers are two common types of agents in partial equilibrium models of a single market. The term market participant is also used in United States constitutional law to describe a U.S. State which is acting as a producer or supplier of a marketable good or service.

City of Philadelphia v. New Jersey, 437 U.S. 617 (1978), was a case in which the Supreme Court of the United States held that states could not discriminate against another state's articles of commerce.

DaimlerChrysler Corp. v. Cuno, 547 U.S. 332 (2006), is a United States Supreme Court case involving the standing of taxpayers to challenge state tax laws in federal court. The Court unanimously ruled that state taxpayers did not have standing under Article III of the United States Constitution to challenge state tax or spending decisions simply by virtue of their status as taxpayers. Chief Justice John Roberts delivered the majority opinion, which was joined by all of the justices except for Ruth Bader Ginsburg, who concurred separately.

C&A Carbone, Inc. v. Town of Clarkstown, New York, 511 U.S. 383 (1994), was a case before the United States Supreme Court in which the plaintiff, a private recycler with business in Clarkstown, New York, sought to ship its non-recyclable waste to cheaper waste processors out-of-state. Clarkstown opposed the move, and the company then brought suit, raising the unconstitutionality of Clarkstown's "flow control ordinance," which required solid wastes that were not recyclable or hazardous to be deposited at a particular private company's transfer facility. The ordinance involved fees that were above market rates. The Supreme Court sided with the plaintiff, concluding that Clarkstown's ordinance violated the Dormant Commerce Clause.

INDOPCO, Inc. v. Commissioner, 503 U.S. 79 (1992), was a United States Supreme Court case in which the Court held that expenditures incurred by a target corporation in the course of a friendly takeover are nondeductible capital expenditures.

Texas Monthly v. Bullock, 489 U.S. 1 (1989), was a case brought before the US Supreme Court in November 1988. The case was to test the legality of a Texas statute that exempted religious publications from paying state sales tax.

J. E. B. v. Alabama ex rel. T. B., 511 U.S. 127 (1994), was a landmark decision of the Supreme Court of the United States holding that peremptory challenges based solely on a prospective juror's sex are unconstitutional. J.E.B. extended the court's existing precedent in Batson v. Kentucky (1986), which found race-based peremptory challenges in criminal trials unconstitutional, and Edmonson v. Leesville Concrete Company (1991), which extended that principle to civil trials. As in Batson, the court found that sex-based challenges violate the Equal Protection Clause.

Oregon Waste Systems, Inc. v. Department of Environmental Quality of Oregon, 511 U.S. 93 (1994), is a United States Supreme Court decision focused on the aspect of state power and the interpretation of the Commerce Clause as a limitation on states' regulatory power. In this particular case, the Supreme Court considered whether the Oregon Department of Environmental Quality's alleged cost-based surcharge on the disposal of out-of-state waste violated the dormant commerce clause.

Coit v. Green, 404 U.S. 997 (1971), was a case in which the United States Supreme Court affirmed a decision that a private school which practiced racial discrimination could not be eligible for a tax exemption.

Bates v. Dow Agrosciences LLC, 544 U.S. 431 (2005), was a case in which the Supreme Court of the United States held that the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) did not preempt state law claims, brought by a group of Texas farmers, alleging that one of Dow's pesticides damaged their peanut crop.

Arizona Public Service Co. v. Snead, 441 U.S. 141 (1979), was a United States Supreme Court case in which the Court held that a New Mexico tax on the generation of electricity was invalid under the Supremacy Clause of the United States Constitution. Snead was the director of the New Mexico Taxation and Revenue Department.

Reeves, Inc. v. Stake, 447 U.S. 429 (1980), was a United States Supreme Court case in which the Court held that individual states, when acting as producers or suppliers rather than as market regulators, may discriminate preferentially against out-of-state residents. This "market participant" doctrine is an exception to the so-called negative commerce clause, which ordinarily deems state regulations invalid where they discriminate against interstate commerce in favor of intrastate commerce for the purpose of economic protectionism.

Article I, § 10, clause 2 of the United States Constitution, known as the Import-Export Clause, prevents the states, without the consent of Congress, from imposing tariffs on imports and exports above what is necessary for their inspection laws and secures for the federal government the revenues from all tariffs on imports and exports. Several nineteenth century Supreme Court cases applied this clause to duties and imposts on interstate imports and exports. In 1869, the United States Supreme Court ruled that the Import-Export Clause only applied to imports and exports with foreign nations and did not apply to imports and exports with other states, although this interpretation has been questioned by modern legal scholars.

Brown v. Maryland, 25 U.S. 419 (1827), was a significant United States Supreme Court case which interpreted the Import-Export and Commerce Clauses of the U.S. Constitution to prohibit discriminatory taxation by states against imported items after importation, rather than only at the time of importation. The state of Maryland passed a law requiring importers of foreign goods to obtain a license for selling their products. Brown was charged under this law and appealed. It was the first case in which the U.S. Supreme Court construed the Import-Export Clause. Chief Justice John Marshall delivered the opinion of the court, ruling that Maryland's statute violated the Import-Export and Commerce Clauses and the federal law was supreme. He alleged that the power of a state to tax goods did not apply if they remained in their "original package". A license tax on the importer was essentially the same as a tax on an import itself. Despite arguing the case for Maryland, future chief justice Roger Taney admitted that the case was correctly decided.

Grable & Sons Metal Products, Inc. v. Darue Engineering & Mfg., 545 U.S. 308 (2005), was a United States Supreme Court decision involving the jurisdiction of the federal district courts under 28 U.S.C. § 1331.

Zauderer v. Office of Disciplinary Counsel of Supreme Court of Ohio, 471 U.S. 626 (1985), was a United States Supreme Court case in which the Court held that states can require an advertiser to disclose certain information without violating the advertiser's First Amendment free speech protections as long as the disclosure requirements are reasonably related to the State's interest in preventing deception of consumers. The decision effected identified that some commercial speech may have weaker First Amendment free speech protections than non-commercial speech and that states can compel such commercial speech to protect their interests; future cases have relied on the "Zauderer standard" to determine the constitutionality of state laws that compel commercial speech as long as the information to be disclosed is "purely factual and uncontroversial".

Metropolitan Life Insurance Co. v. Ward, 470 U.S. 869 (1985), was a case in which the Supreme Court of the United States held that a state cannot tax out-of-state insurance companies at a greater rate than domestic insurance companies under the Privileges and Immunities Clause of Article Four of the United States Constitution.

Ohralik v. Ohio State Bar Association, 436 US 447 (1978), was a decision by the Supreme Court of the United States that in-person solicitation of clients by lawyers was not protected speech under the First Amendment of the U.S. Constitution.