Social security is "any government system that provides monetary assistance to people with an inadequate or no income." In the United States, this is usually called welfare or a social safety net, especially when talking about Canada and European countries.

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration. The original Social Security Act was signed into law by President Franklin D. Roosevelt in 1935, and the current version of the Act, as amended, encompasses several social welfare and social insurance programs.

The welfare state is a form of government in which the state protects and promotes the economic and social well-being of the citizens, based upon the principles of equal opportunity, equitable distribution of wealth, and public responsibility for citizens unable to avail themselves of the minimal provisions for a good life. Historically, the Islamic Caliphate under Umar was the first welfare state. In modern history, late-19th-century Imperial Germany (1871–1918) was the first welfare state, which Chancellor Otto von Bismarck established with the social-welfare legislation that extended the privileges of the Junker social class to ordinary Germans. Sociologist T. H. Marshall described the modern welfare state as a distinctive combination of democracy, welfare, and capitalism.

Welfare is a type of government support for the citizens of that society. Welfare may be provided to people of any income level, as with social security, but it is usually intended to ensure that the poor can meet their basic human needs such as food and shelter. Welfare attempts to provide poor people with a minimal level of well-being, usually either a free- or a subsidized-supply of certain goods and social services, such as healthcare, education, and vocational training.

Unemployment benefits are payments made by back authorized bodies to unemployed people. In the United States, benefits are funded by a compulsory governmental insurance system, not taxes on individual citizens. Depending on the jurisdiction and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

Grupo Financiero Banamex S.A. de C.V. has its origins and is the owner of the Banco Nacional de México or Citibanamex. It is the second largest bank in Mexico. The Banamex Financial Group was purchased by Citigroup in August 2001 for $12.5 billion USD. It continues to operate as a Citigroup subsidiary.

Social welfare, assistance for the ill or otherwise disabled and the old, has long been provided in Japan by both the government and private companies. Beginning in the 1920s, the Japanese government enacted a series of welfare programs, based mainly on European models, to provide medical care and financial support. During the post-war period, a comprehensive system of social security was gradually established.

Retirement Funds Administrators are companies authorized to manage individual retirement accounts as authorized by the Secretariat of Finance and Public Credit of Mexico and overseen by Comisión Nacional del Sistema de Ahorro para el Retiro (CONSAR).

The Italian welfare state is based upon the corporatist-conservative model, as described by Gøsta Esping-Andersen, one of the world's foremost sociologists working on the analysis of welfare states.

The Chile Pension system refers to old-age, disability and survivor pensions for workers in Chile. The pension system was changed by José Piñera, during Augusto Pinochet's dictatorship, on November 4, 1980 from a PAYGO-system to a fully funded capitalization system run by private sector pension funds. Many critics and supporters see the reform as an important experiment under real conditions, that may give conclusions about the impact of the full conversion of a PAYGO-system to a capital funded system. The development was therefore internationally observed with great interest. Under Michelle Bachelet's government the Chile Pension system was reformed again.

Social security is divided by the French government into four branches: illness; old age/retirement; family; work accident; and occupational disease. From an institutional point of view, French social security is made up of diverse organismes. The system is divided into three main Regimes: the General Regime, the Farm Regime, and the Self-employed Regime. In addition there are numerous special regimes dating from prior to the creation of the state system in the mid-to-late 1940s.

The Mexican Civil Service Social Security and Services Institute is a federal government organization in Mexico that administers part of Mexico's health care and social security systems, and provides assistance in cases of disability, old age, risks in labor, and death to federal workers. Unlike the Mexican Social Security Institute, which covers workers in the private sector, the ISSSTE is charged with providing benefits for federal government workers only. Together with the IMSS, the ISSSTE provides health coverage for between 55 and 60 percent of the population of Mexico.

Welfare in France includes all systems whose purpose is to protect people against the financial consequences of social risks.

Healthcare in Chile is provided by the government via Fondo Nacional de Salud (FONASA) and by private insurers via Instituciones de Salud Previsional (ISAPREs).

Fondo Nacional de Salud, also known as FONASA, is the financial entity entrusted to collect, manage and distribute state funds for health in Chile. It is funded by the public. It was created in 1979 by Decree Law No. 2763.

Social security in Finland, or welfare in Finland, is, compared to other countries’, very comprehensive. In the late 1980s, Finland had one of the world's most advanced welfare systems, one that guaranteed decent living conditions for all Finns. Since then social security has been cut back, but still the system is one of the most comprehensive in the world. Created almost entirely during the first three decades after World War II, the social security system was an outgrowth of the traditional Nordic belief that the state was not inherently hostile to the well-being of its citizens, but could intervene benevolently on their behalf. According to some social historians, the basis of this belief was a relatively benign history that had allowed the gradual emergence of a free and independent peasantry in the Nordic countries and had curtailed the dominance of the nobility and the subsequent formation of a powerful right wing. Finland's history has been harsher than the histories of the other Nordic countries, but not harsh enough to bar the country from following their path of social development.

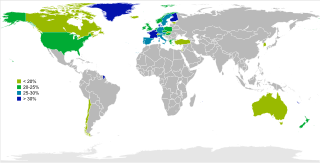

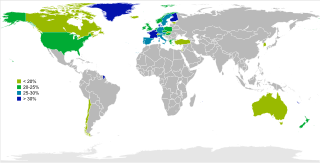

Luxembourg has an extensive welfare system. It comprises a social security, health, and pension funds. The labor market is highly regulated, and Luxembourg is a corporatist welfare state. Enrollment is mandatory in one of the welfare schemes for any employed person. Luxembourg's social security system is the Centre Commun de la Securite Sociale (CCSS). Both employees and employers make contributions to the fund at a rate of 25% of total salary, which cannot eclipse more than five times the minimum wage. Social spending accounts for 21.8% of GDP.

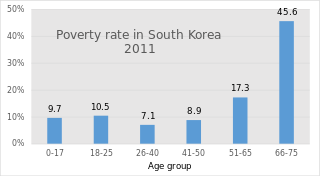

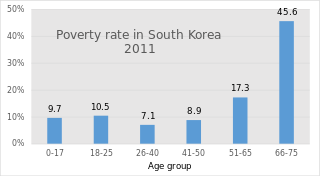

The pension scheme for elderly in South Korea developed relatively recently when compared to other democratic nations. One-half of Korea's population aged 65 and over lives in relative poverty, nearly four times higher than the OECD average of 13%. Elderly poverty is thus an urgent social problem. Furthermore, public social spending provided by general government per GDP in South Korea is the lowest among the OECD countries, a half of OECD average.

Public pensions in Greece are designed to provide incomes to Greek pensioners upon reaching retirement. For decades pensions in Greece were known to be among the most generous in the European Union, allowing many pensioners to retire earlier than pensioners in other European countries. This placed a heavy burden on Greece's public finances which made the Greek state increasingly vulnerable to external economic shocks, culminating in a recession due to the 2008 financial crisis and subsequent European debt crisis. This series of crises has forced the Greek government to implement economic reforms aimed at restructuring the pension system and eliminating inefficiencies within it. Measures in the Greek austerity packages imposed upon Greek citizens by the European Central Bank have achieved some success at reforming the pension system despite having stark ramifications for standards of living in Greece, which have seen a sharp decline since the beginning of the crisis.