Unemployment, according to the OECD, is people above a specified age not being in paid employment or self-employment but currently available for work during the reference period.

Full employment is an economic situation in which there is no cyclical or deficient-demand unemployment. Full employment does not entail the disappearance of all unemployment, as other kinds of unemployment, namely structural and frictional, may remain. For instance, workers who are "between jobs" for short periods of time as they search for better employment are not counted against full employment, as such unemployment is frictional rather than cyclical. An economy with full employment might also have unemployment or underemployment where part-time workers cannot find jobs appropriate to their skill level, as such unemployment is considered structural rather than cyclical. Full employment marks the point past which expansionary fiscal and/or monetary policy cannot reduce unemployment any further without causing inflation.

El Centro is a city and county seat of Imperial County, California, United States. El Centro is the largest city in the Imperial Valley, the east anchor of the Southern California Border Region, and the core urban area and principal city of the El Centro metropolitan area which encompasses all of Imperial County. El Centro is also the largest U.S. city to lie entirely below sea level. The city, located in southeastern California, is 113 miles (182 km) from San Diego and less than 20 miles (32 km) from the Mexican city of Mexicali.

The Phillips curve is an economic model, named after Bill Phillips, that correlates reduced unemployment with increasing wages in an economy. While Phillips did not directly link employment and inflation, this was a trivial deduction from his statistical findings. Paul Samuelson and Robert Solow made the connection explicit and subsequently Milton Friedman and Edmund Phelps put the theoretical structure in place.

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by governmental bodies to unemployed people. Depending on the country and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

The economies of Canada and the United States are similar because both are developed countries. While both countries feature in the top ten economies in the world in 2022, the U.S. is the largest economy in the world, with US$24.8 trillion, with Canada ranking ninth at US$2.2 trillion.

The Mexican peso crisis was a currency crisis sparked by the Mexican government's sudden devaluation of the peso against the U.S. dollar in December 1994, which became one of the first international financial crises ignited by capital flight.

Reserve army of labour is a concept in Karl Marx's critique of political economy. It refers to the unemployed and underemployed in capitalist society. It is synonymous with "industrial reserve army" or "relative surplus population", except that the unemployed can be defined as those actually looking for work and that the relative surplus population also includes people unable to work. The use of the word "army" refers to the workers being conscripted and regimented in the workplace in a hierarchy under the command or authority of the owners of capital.

The early 1980s recession was a severe economic recession that affected much of the world between approximately the start of 1980 and 1982. It is widely considered to have been the most severe recession since World War II until the 2007–2008 financial crisis.

Graduate unemployment, or educated unemployment, is unemployment among people with an academic degree.

Non-accelerating inflation rate of unemployment (NAIRU) is a theoretical level of unemployment below which inflation would be expected to rise. It was first introduced as NIRU by Franco Modigliani and Lucas Papademos in 1975, as an improvement over the "natural rate of unemployment" concept, which was proposed earlier by Milton Friedman.

North America was one of the focal points of the global Great Recession. While Canada has managed to return its economy nearly to the levels it enjoyed prior to the recession, the United States and Mexico are still under the influence of the worldwide economic slowdown. The cost of staple items dropped dramatically in the United States as a result of the recession.

Taxes in Indiana are almost entirely authorized at the state level, although the revenue is used to fund both local and state level government. The state of Indiana's income comes from four primary tax areas. Most state level income is from a sales tax of 7% and a flat state income tax of 3.05%. The state also collects an additional income tax for the 92 counties. Local governments are funded by a property tax that is the sum of rates set by local boards, but the total rate must be approved by the Indiana General Assembly before it can be imposed. Residential property tax rates are capped at maximum of 1% of property value. Excise tax is the fourth form of taxation and is charged on motor vehicles, alcohol, tobacco, gasoline, and certain other forms of movable property; most of the proceeds are used to fund state and local roads and health programs. The Indiana Department of Revenue collects all taxes and pays them out to the appropriate agencies and municipalities. The Indiana Tax Court deals with all tax disputes issues, but decisions can be appealed to the Indiana Supreme Court.

An unemployment extension occurs when regular unemployment benefits are exhausted and extended for additional weeks. Unemployment extensions are created by passing new legislation at the federal level, often referred to as an "unemployment extension bill". This new legislation is introduced and passed during times of high or above average unemployment rates. Unemployment extensions are set during a date range in order to estimate their federal cost. After expiration, the unemployment data is re-evaluated, and new legislation may be proposed and passed to further extend them.

Welfare culture refers to the behavioral consequences of providing poverty relief to low-income individuals. Welfare is considered a type of social protection, which may come in the form of remittances, such as 'welfare checks', or subsidized services, such as free/reduced healthcare, affordable housing, and more. Pierson (2006) has acknowledged that, like poverty, welfare creates behavioral ramifications, and that studies differ regarding whether welfare empowers individuals or breeds dependence on government aid. Pierson also acknowledges that the evidence of the behavioral effects of welfare varies across countries, because different countries implement different systems of welfare.

Statistics on unemployment in India had traditionally been collected, compiled and disseminated once every ten years by the Ministry of Labour and Employment (MLE), primarily from sample studies conducted by the National Sample Survey Office. Other than these 5-year sample studies, India had historically not collected monthly, quarterly or yearly nationwide employment and unemployment statistics on a routine basis. In 2016, the Centre for Monitoring Indian Economy, a non-governmental entity based in Mumbai, started sampling and publishing monthly unemployment in India statistics.

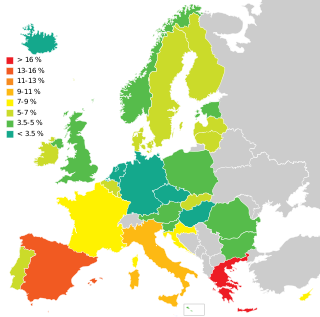

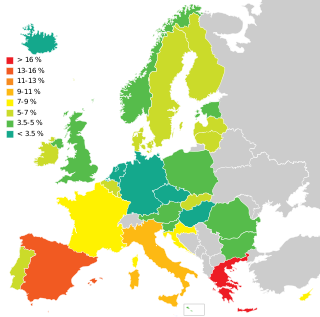

Unemployment in Poland appeared in the 19th century during industrialization, and was particularly severe during the Great Depression. Under communist rule Poland officially had close to full employment, although hidden unemployment existed. After Poland's transition to a market economy the unemployment rate sharply increased, peaking at above 16% in 1993, then dropped afterwards, but remained well above pre-1993 levels. Another period of high unemployment occurred in the early 2000s when the rate reached 20%. As Poland entered the European Union (EU) and its job market in 2004, the high unemployment set off a wave of emigration, and as a result domestic unemployment started a downward trend that continued until the onset of the 2008 Great Recession. Recent years have seen an increase in the unemployment rate from below 8% to above 10% (Eurostat) or from below 10% to 13% (GUS). The rate began dropping again in late 2013. Polish government (GUS) reported 9.6% registered unemployment in November 2015, while European Union's Eurostat gave 7.2%. According to Eurostat data, since 2008, unemployment in Poland has been constantly below the EU average. Significant regional differences in the unemployment rate exist across Poland.