The Pennsylvania Liquor Control Board (PLCB) is an independent government agency that manages the beverage alcohol industry in Pennsylvania by administering the Pennsylvania Liquor Code. It is responsible for licensing the possession, sale, storage, transportation, importation and manufacture of wine, spirits and malt or brewed beverages in the commonwealth, as well as operating a system of liquor distribution (retailing) and providing education about the harmful effects of underage and dangerous drinking.

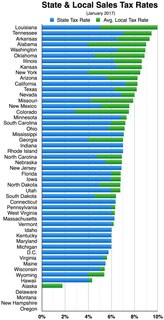

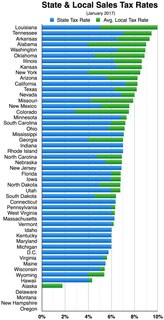

Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United States. Sales tax is governed at the state level and no national general sales tax exists. Forty-five states, the District of Columbia, the territories of the Puerto Rico, and Guam impose general sales taxes that apply to the sale or lease of most goods and some services, and states also may levy selective sales taxes on the sale or lease of particular goods or services. States may grant local governments the authority to impose additional general or selective sales taxes.

The Fairfax County Board of Supervisors, sometimes abbreviated as FCBOS, is the governing body of Fairfax County; a county of over a million in Northern Virginia. The board has nine districts, and one at-large district which is always occupied by the Chair. Members may serve unlimited number of four-year terms, as there are no term limits.

David L. Bulova is an American politician of the Democratic Party. Since 2006 he has been a member of the Virginia House of Delegates. He currently represents the 37th district, including the city of Fairfax and part of Fairfax County. He is the son of Fairfax County Board of Supervisors chairman Sharon Bulova.

A sugary drink tax or soda tax is a tax or surcharge designed to reduce consumption of drinks with added sugar. Drinks covered under a soda tax often include carbonated soft drinks, sports drinks and energy drinks.

John Cook is the supervisor for the Braddock District of Fairfax County. He represents his district on the Fairfax County Board of Supervisors. He is a partner in the Fairfax-based law firm of Cook Kitts & Francuzenko, PLLC. He attended Gettysburg College and received his Juris Doctorate from George Washington University.

Frederick Augustus Babson, Jr. was an attorney and politician from Fairfax County, Virginia who was the inaugural holder of the position of Chairman of the Fairfax County Board of Supervisors, a job he held from 1968 to 1970.

The No Sales Tax for Alcohol Question, also known as Question 1, was on the November 2, 2010 ballot in Massachusetts. The measure asked voters whether or not to repeal a sales tax on alcohol sales. The ballot measure for the 2010 ballot was added after the Massachusetts State Legislature increased the sales tax in the state from 5% to 6.25% and eliminated an exemption for alcohol sold in liquor stores.

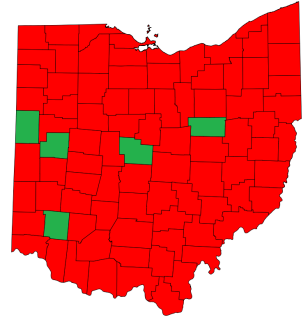

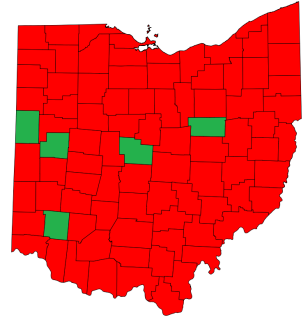

The Ohio Collective Bargaining Limit Repeal appeared on the November 8, 2011 general election ballot in the state of Ohio as a veto referendum. Senate Bill 5 (SB5) was repealed by Ohio voters after a campaign by firefighters, police officers and teachers against the measure, which would have limited collective bargaining for public employees in the state. The formal title of the proposal that this measure nullified is Senate Bill 5. Among other provisions, SB 5 would have prevented unions from charging fair share dues to employees who opt out. The process to place the referendum on the ballot for voters to decide was completed by supporters, as signatures were certified by the Ohio Secretary of State. The group behind the referendum effort was the political action committee We Are Ohio.

Maine Question 1 was a voter referendum on an initiated state statute that occurred November 6, 2012. The title of the citizen initiative is "An Act to Allow Marriage Licenses for Same-Sex Couples and Protect Religious Freedom". The question that appeared on the ballot was: "Do you want to allow the State of Maine to issue marriage licenses to same-sex couples?"

The Virgil Goode presidential campaign of 2012 began when former U.S. Congressman Virgil Goode of Virginia announced his decision to seek the 2012 presidential nomination of the Constitution Party in February 2012. During the nomination campaign, he put forth a four-point plank that included his plans to restrict immigration, balance the federal budget, decrease the size of government, and institute congressional term limits.

Prepared Meals Tax in North Carolina is a 1% tax that is imposed upon meals that are prepared at restaurants. The tax is only imposed by local jurisdictions upon the granting of approval by the North Carolina General Assembly. The provision is found in G.S. 105-164.3(28) and reads as follows:

The 2010 Virginia State Elections took place on Election Day, November 2, 2010, the same day as the U.S. House elections in the state. The only statewide elections on the ballot were three constitutional referendums to amend the Virginia State Constitution. Because Virginia state elections are held on off-years, no statewide officers or state legislative elections were held. All referendums were referred to the voters by the Virginia General Assembly.

The 1992 Virginia State Elections took place on Election Day, November 3, 1992, the same day as the U.S. Presidential and the U.S. House elections in the state. The only statewide elections on the ballot were one constitutional referendum to amend the Virginia State Constitution and three government bond referendums. Because Virginia state elections are held on off-years, no statewide officers or state legislative elections were held. All referendums were referred to the voters by the Virginia General Assembly.

The 1990 Virginia State Elections took place on Election Day, November 5, 1990, the same day as the U.S. Senate and U.S. House elections in the state. The only statewide elections on the ballot were four constitutional referendums to amend the Virginia State Constitution. Because Virginia state elections are held on off-years, no statewide officers or state legislative elections were held. All referendums were referred to the voters by the Virginia General Assembly.

The New Jersey casino expansion amendment (2016) was a proposed constitutional amendment in New Jersey that would have allowed casino gambling outside of Atlantic City.

Maine Question 1, formally An Act To Allow Slot Machines or a Casino in York County, was a citizen-initiated referendum question that appeared on the November 7, 2017, statewide ballot in Maine. It sought to award a license for the construction and operation of a casino in York County, Maine by a qualified entity as spelled out in the proposed law, with tax revenue generated by the casino to go to specific programs. The wording of the proposed law effectively permitted only one company, Capital 7, to be awarded the license. The ballot measure was defeated, with 83% of voters opposing it.

California state elections in 2018 were held on Tuesday, November 6, 2018, with the primary elections being held on June 5, 2018. Voters elected one member to the United States Senate, 53 members to the United States House of Representatives, all eight state constitutional offices, all four members to the Board of Equalization, 20 members to the California State Senate, and all 80 members to the California State Assembly, among other elected offices.

The 2018 Virginia State Elections took place on Election Day, November 6, 2018, the same day as the U.S. Senate and U.S. House elections in the state. The only statewide election on the ballot were two constitutional referendums to amend the Virginia State Constitution. Because Virginia state elections are held on off-years, no statewide officers or state legislative elections were held. The referendum was referred to the voters by the Virginia General Assembly. The amendment easily passed, although final vote totals await the final certification of results by the state board of elections.