Unemployment, according to the OECD, is people above a specified age not being in paid employment or self-employment but currently available for work during the reference period.

Business cycles are intervals of general expansion followed by recession in economic performance. The changes in economic activity that characterize business cycles have important implications for the welfare of the general population, government institutions, and private sector firms.

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

Democratic capitalism, also referred to as market democracy, is a political and economic system that integrates resource allocation by marginal productivity, with policies of resource allocation by social entitlement. The policies which characterise the system are enacted by democratic governments.

Underconsumption is a theory in economics that recessions and stagnation arise from an inadequate consumer demand, relative to the amount produced. In other words, there is a problem of overproduction and overinvestment during a demand crisis. The theory formed the basis for the development of Keynesian economics and the theory of aggregate demand after the 1930s.

Real wages are wages adjusted for inflation, or, equivalently, wages in terms of the amount of goods and services that can be bought. This term is used in contrast to nominal wages or unadjusted wages.

Economic stagnation is a prolonged period of slow economic growth, usually accompanied by high unemployment. Under some definitions, slow means significantly slower than potential growth as estimated by macroeconomists, even though the growth rate may be nominally higher than in other countries not experiencing economic stagnation.

The Prices and Incomes Accord was a series of agreements between the Australian Labor Party (ALP) and the Australian Council of Trade Unions (ACTU), in effect from 1983 to 1996. Central to these agreements was an incomes policy to address the stagflation crisis by restraining wages. The unions agreed to restrict their wage demands, and in exchange, the government provided a 'social wage' of welfare and tax cuts.

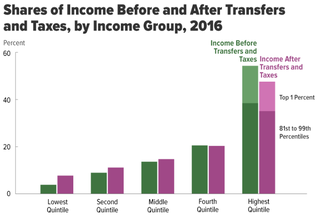

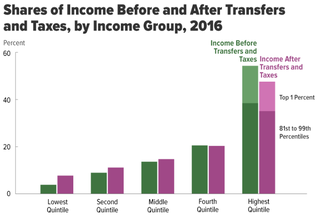

Income inequality has fluctuated considerably in the United States since measurements began around 1915, moving in an arc between peaks in the 1920s and 2000s, with a 30-year period of relatively lower inequality between 1950 and 1980.

Monopoly Capital: An Essay on the American Economic and Social Order is a 1966 book by the Marxian economists Paul Sweezy and Paul A. Baran. It was published by Monthly Review Press. It made a major contribution to Marxian theory by shifting attention from the assumption of a competitive economy to the monopolistic economy associated with the giant corporations that dominate the modern accumulation process. Their work played a leading role in the intellectual development of the New Left in the 1960s and 1970s. As a review in the American Economic Review stated, it represented "the first serious attempt to extend Marx’s model of competitive capitalism to the new conditions of monopoly capitalism." It attracted renewed attention following the Great Recession.

The Lost Decades are a lengthy period of economic stagnation in Japan precipitated by the asset price bubble's collapse beginning in 1990. The singular term Lost Decade originally referred to the 1990s, but the 2000s and the 2010s have been included by commentators as the phenomenon continued.

On July 2, 1990, the economies of the two German states became one. It was the first time in history that a capitalist and a socialist economy had suddenly become one, and there were no precise guidelines on how it could be done. Instead, there were a number of problems, of which the most severe were the comparatively poor productivity of the former East German economy and its links to the economies of the Soviet Union and Eastern Europe, which were rapidly contracting.

The 1990s economic boom in the United States was a major economic expansion that lasted between 1993 and 2001, coinciding with the economic policies of the Clinton administration. It began following the early 1990s recession during the presidency of George H.W. Bush and ended following the infamous dot-com crash in 2000. Until July 2019, it was the longest recorded economic expansion in the history of the United States.

Economics of participation is an umbrella term spanning the economic analysis of worker cooperatives, labor-managed firms, profit sharing, gain sharing, employee ownership, employee stock ownership plans, works councils, codetermination, and other mechanisms which employees use to participate in their firm's decision making and financial results.

In Marxist theory and Marxian economics, the immiseration thesis, also referred to as emiseration thesis, is derived from Karl Marx's analysis of economic development in capitalism, implying that the nature of capitalist production stabilizes real wages, reducing wage growth relative to total value creation in the economy. Even if real wages rise, therefore, the overall labor share of income decreases, leading to the increasing power of capital in society.

In economics, secular stagnation is a condition when there is negligible or no economic growth in a market-based economy. In this context, the term secular means long-term, and is used in contrast to cyclical or short-term. It suggests a change of fundamental dynamics which would play out only in its own time. The concept was originally put forth by Alvin Hansen in 1938. According to The Economist, it was used to "describe what he feared was the fate of the American economy following the Great Depression of the early 1930s: a check to economic progress as investment opportunities were stunted by the closing of the frontier and the collapse of immigration". Warnings of impending secular stagnation have been issued after all deep recessions since the Great Depression, but the hypothesis has remained controversial.

Causes of income inequality in the United States describes the reasons for the unequal distribution of income in the US and the factors that cause it to change over time. This topic is subject to extensive ongoing research, media attention, and political interest.

Job creation and unemployment are affected by factors such as aggregate demand, global competition, education, automation, and demographics. These factors can affect the number of workers, the duration of unemployment, and wage rates.

Poverty in Norway had been declining from World War II until the Great Recession. It is now increasing slowly, and is significantly higher among immigrants from the Middle East and Africa. Before an analysis of poverty can be undertaken, the definition of poverty must first be established, because it is a subjective term. The measurement of poverty in Norway deviates from the measurement used by the OECD. Norway traditionally has been a global model and leader in maintaining low levels on poverty and providing a basic standard of living for even its poorest citizens. Norway combines a free market economy with the welfare model to ensure both high levels of income and wealth creation and equal distribution of this wealth. It has achieved unprecedented levels of economic development, equality and prosperity.

Marxism and Keynesianism is a method of understanding and comparing the works of influential economists John Maynard Keynes and Karl Marx. Both men's works has fostered respective schools of economic thought that have had significant influence in various academic circles as well as in influencing government policy of various states. Keynes' work found popularity in developed liberal economies following the Great Depression and World War II, most notably Franklin D. Roosevelt's New Deal in the United States in which strong industrial production was backed by strong unions and government support. Marx's work led the way to a number of socialist states, notably the Soviet Union and the People's Republic of China. The immense influence of both Marxian and Keynesian schools has led to numerous comparisons of the work of both economists along with synthesis of both schools.