| Company type | Private sector |

|---|---|

| Industry | Banking, Insurance, Capital Markets and allied industries |

| Founded | 1 April 1819 as The Commercial Bank (1819) |

| Defunct | 31 March 1828 |

| Fate | merged with The Calcutta Bank (1824) to form The Union Bank (1828) in 1828 |

| Headquarters | |

Number of locations | Bengal Presidency |

Area served | India |

| Products | Deposits, Personal Banking Schemes, C & I Banking Schemes, Agri Banking Schemes, SME Banking Schemes |

| Services | Banking, Trade Finance |

The Commercial Bank was a bank founded in the year 1819 in British India. The bank was the eleventh oldest bank in India. [1]

The bank was merged with The Calcutta Bank (1824) to form The Union Bank (1828) in 1828. Further, The Union Bank itself became defunct in 1848. [1]

The bank was established in 1819 by the British agency house of Mackintosh & Co. [2] [3]

The bank played a major role in the early economic history of East Bengal and Bangladesh. [4]

Although the bank was largely a private bank, it enjoyed patronage from the then government of India, the East India Company.[ citation needed ]

The bank was staffed by mostly British nationals who were drawn mainly from the East India Company.[ citation needed ]

The bank had most of its offices and branches in East Bengal, which is the present day Bangladesh.[ citation needed ]

The bank lasted in business for only nine years and was finally merged with The Calcutta Bank (1824) to form The Union Bank (1828) in 1828. In 1828, there was an economic crisis which forced a Bank run on the bank and precipitated the merger with The Calcutta Bank (1824) to form The Union Bank (1828) in 1828. [1] [5] [ unreliable source? ]

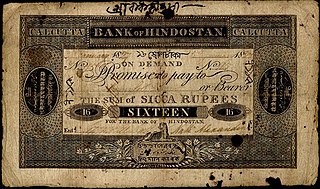

The bank also issued its own currency notes in its nine years of existence. [5] [ unreliable source? ] [6] [7]

The total value of the banknotes issued by the bank is estimated to be around Rupees 16 lakhs. [5] [ unreliable source? ]

The bank is notable for being the eleventh oldest bank in India. [1] It is also notable for being one of the first institutions in India to issue its own paper banknotes or currency notes. [6] [7] [3]

The ability of private banks to issue their own currency notes was taken away by The Paper Currency Act, 1861. [8] [9]

The Australian dollar is the official currency and legal tender of Australia, including all of its external territories, and three independent sovereign Pacific Island states: Kiribati, Nauru, and Tuvalu. In April 2022, it was the sixth most-traded currency in the foreign exchange market and as of Q4 2023 the seventh most-held reserve currency in global reserves.

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt.

The Reserve Bank of India, abbreviated as RBI, is India's central bank and regulatory body responsible for regulation of the Indian banking system. Owned by the Ministry of Finance, Government of India, it is responsible for the control, issue and maintaining supply of the Indian rupee. It also manages the country's main payment systems and works to promote its economic development. Bharatiya Reserve Bank Note Mudran (BRBNM) is a specialised division of RBI through which it prints and mints Indian currency notes (INR) in two of its currency printing presses located in Mysore and Salboni. The RBI, along with the Indian Banks' Association, established the National Payments Corporation of India to promote and regulate the payment and settlement systems in India. Deposit Insurance and Credit Guarantee Corporation was established by RBI as one of its specialized division for the purpose of providing insurance of deposits and guaranteeing of credit facilities to all Indian banks.

The Indian rupee is the official currency in India. The rupee is subdivided into 100 paise. The issuance of the currency is controlled by the Reserve Bank of India. The Reserve Bank manages currency in India and derives its role in currency management based on the Reserve Bank of India Act, 1934.

The Pakistani rupee is the official currency in the Islamic Republic of Pakistan. The issuance of the currency is controlled by the State Bank of Pakistan. It was officially adopted by the Government of Pakistan in 1949. Earlier the coins and notes were issued and controlled by the Reserve Bank of India until 1949, when it was handed over to the Government and State Bank of Pakistan, by the Government and Reserve Bank of India.

Commonwealth banknote-issuing institutions also British Empire Paper Currency Issuers comprises a list of public, private, state-owned banks and other government bodies and Currency Boards who issued legal tender: banknotes.

Bangladesh is a developing country with an impoverished banking system, particularly in terms of the services and customer care provided by the government run banks. In recent times, private banks are trying to imitate the banking structure of the more developed countries, but this attempt is often foiled by inexpert or politically motivated government policies executed by the central bank of Bangladesh, Bangladesh Bank. The outcome is a banking system fostering corruption and illegal monetary activities/laundering etc. by the politically powerful and criminals, while at the same time making the attainment of services or the performance of international transactions difficult for the ordinary citizens, students studying abroad or through distance learning, general customers etc.

The Indian 20-rupee banknote is a common denomination of the Indian rupee. The current ₹20 banknote in circulation is a part of the Mahatma Gandhi New Series. The Reserve Bank introduced the ₹20 note in the Mahatma Gandhi New Series in 2019, making it the last denomination to be introduced in the series.

The Revised Standard Reference Guide to Indian Paper Money is a 2012 book by Rezwan Razack and Kishore Jhunjhunwalla. The book is a comprehensive compilation of facts, milestones, and other details regarding paper money in India. It was published in India by Coins & Currencies. Kishore Jhunjhunwalla and Rezwan Razack are avid collectors of Indian currency. The book traces the evolution of Indian currency dating back to 1770. It captures the various nuances of modern-day currency as well as incidents that helped shape this sector over the years. The book is in its second edition—the first was authored by Jhunjhunwalla, whose collection was later purchased by Rezwan Razack. The revised edition was published after 10 years of research. The book was introduced to the public by Uma Shankar, Regional Director of the Reserve Bank of India on 13 January 2012.

Bank of Hindostan (1770–1832), a now defunct bank, was the third oldest bank in India.

The 2000 rupee note was introduced by the Reserve Bank of India on 8 November 2016. The introduction of this denomination of the Indian rupee was part of the government's demonetization exercise aimed at curbing corruption, black money and counterfeit currency. On the same day, the Indian government announced the demonetization of the existing 500 rupee and 1000 rupee notes. The intention behind demonetization was to invalidate the old notes to disrupt illegal activities and promote a shift towards digital transactions.

The Currency Building is an early 19th-century building in the B. B. D. Bagh central business district of Kolkata in West Bengal, India. The building was originally built in 1833 to house the Calcutta branch of the Agra Bank. In 1868, it was converted for use by the Office of the Issue and Exchange of Government Currency, an office of the Controller of the Currency under the British Raj. From 1935 until 1937, the Reserve Bank of India (RBI) used the building as its first central office. The building remained in use, and was used at one time by the Central Public Works Department (CPWD) as a storehouse. Authorities decided to demolish it in 1994.

The General Bank of Bengal and Bihar was a bank in British India that operated between 1773 and 1775.

The Bengal Bank was a bank founded in 1784 in British India. The bank was the fifth oldest bank in India.

The Union Bank was a bank founded in the year 1828 in British India by Prince Dwarkanath Tagore. The bank was the fourteenth oldest bank in India.

The Paper Currency Act, 1861 is an act in India dating from the British colonial rule, that is currently no longer in force.

Many European trading companies came to India's during the 18th century. These trading companies set up private banks which issued paper currencies in Indian subcontinent first. But these notes were text-based. Charles Canning, 1st Earl Canning first introduced paper currency in Indian subcontinent in 1861 officially.

The Calcutta Bank was a bank founded in the year 1824 in British India. The bank was the twelfth oldest bank in India.

The Bank of India was a bank founded in the year 1828 in British India and was closed down one year later in 1829. It was the thirteenth oldest bank in India.