In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business. Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees. "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, company X had revenue of $42 million". Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, revenue is a subsection of the equity section of the balance statement, since it increases equity. It is often referred to as the "top line" due to its position at the very top of the income statement. This is to be contrasted with the "bottom line" which denotes net income.

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase.

An ad valorem tax is a tax whose amount is based on the value of a transaction or of a property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ad valorem tax may also be imposed annually, as in the case of a real or personal property tax, or in connection with another significant event. In some countries, a stamp duty is imposed as an ad valorem tax.

In business and accounting, net income is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest, and taxes for an accounting period.

A Finance Act is the headline fiscal (budgetary) legislation enacted by the UK Parliament, containing multiple provisions as to taxes, duties, exemptions and reliefs at least once per year, and in particular setting out the principal tax rates for each fiscal year.

Taxation in Ireland in 2017 came from Personal Income taxes, and Consumption taxes, being VAT and Excise and Customs duties. Corporation taxes represents most of the balance, but Ireland's Corporate Tax System (CT) is a central part of Ireland's economic model. Ireland summarises its taxation policy using the OECD's Hierarchy of Taxes pyramid, which emphasises high corporate tax rates as the most harmful types of taxes where economic growth is the objective. The balance of Ireland's taxes are Property taxes and Capital taxes.

The Tanzania Revenue Authority (TRA) is the government agency of Tanzania, charged with the responsibility of managing the assessment, collection and accounting of all central government revenue in Tanzania.

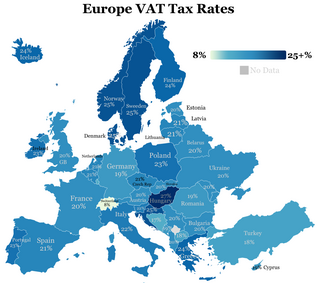

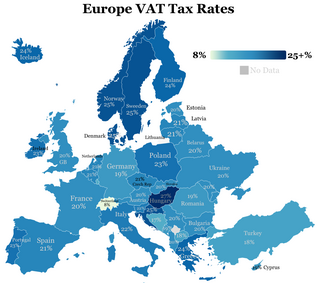

The European Union value-added tax is a value added tax on goods and services within the European Union (EU). The EU's institutions do not collect the tax, but EU member states are each required to adopt in national legislation a value added tax that complies with the EU VAT code. Different rates of VAT apply in different EU member states, ranging from 17% in Luxembourg to 27% in Hungary. The total VAT collected by member states is used as part of the calculation to determine what each state contributes to the EU's budget.

Digital goods are software programs, music, videos or other electronic files that users download exclusively from the Internet. Some digital goods are free, others are available for a fee. The taxation of digital goods and/or services, sometimes referred to as digital tax and/or a digital services tax, is gaining popularity across the globe.

Taxation in Norway is levied by the central government, the county municipality and the municipality. In 2012 the total tax revenue was 42.2% of the gross domestic product (GDP). Many direct and indirect taxes exist. The most important taxes – in terms of revenue – are VAT, income tax in the petroleum sector, employers' social security contributions and tax on "ordinary income" for persons. Most direct taxes are collected by the Norwegian Tax Administration and most indirect taxes are collected by the Norwegian Customs and Excise Authorities.

Taxes in Germany are levied at various government levels: the federal government, the 16 states (Länder), and numerous municipalities (Städte/Gemeinden). The structured tax system has evolved significantly, since the reunification of Germany in 1990 and the integration within the European Union, which has influenced tax policies. Today, income tax and Value-Added Tax (VAT) are the primary sources of tax revenue. These taxes reflect Germany's commitment to a balanced approach between direct and indirect taxation, essential for funding extensive social welfare programs and public infrastructure. The modern German tax system accentuate on fairness and efficiency, adapting to global economic trends and domestic fiscal needs.

The policy of taxation in the Philippines is governed chiefly by the Constitution of the Philippines and three Republic Acts.

Taxation may involve payments to a minimum of two different levels of government: central government through SARS or to local government. Prior to 2001 the South African tax system was "source-based", where in income is taxed in the country where it originates. Since January 2001, the tax system was changed to "residence-based" wherein taxpayers residing in South Africa are taxed on their income irrespective of its source. Non residents are only subject to domestic taxes.

Mandatory tipping is a tip which is added automatically to the customer's bill, without the customer determining the amount or being asked. It may be implemented in several ways, such as applying a fixed percentage to all customer's bills, or to large groups, or on a customer-by-customer basis. Economists have varied opinions on the issue of mandatory tipping. Arguments against mandatory tipping include higher food price at the restaurant to make up for wages and loss of control of dining experience.

In the United Kingdom, the value added tax (VAT) was introduced in 1973, replacing Purchase Tax, and is the third-largest source of government revenue, after income tax and National Insurance. It is administered and collected by HM Revenue and Customs, primarily through the Value Added Tax Act 1994.

The Ghana Revenue Authority (GRA) is the Ghana administration charged with the task of assessing, collecting and accounting for tax revenue in Ghana.

Value-added tax (VAT) was introduced into the Indian taxation system from 1 April 2005. The existing general sales tax laws were replaced with the Value Added Tax Act (2005) and associated VAT rules.

Taxation in Bosnia and Herzegovina includes both federal and local taxes. Tax revenue in Bosnia and Herzegovina stood at 28.6% of GDP in 2013. Most important revenue sources include the income tax, Social Security contributions, corporate tax, and the value added tax, which are all applied on the federal level.

A value-added tax is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax. VAT is an indirect tax, because the consumer who ultimately bears the burden of the tax is not the entity that pays it. Specific goods and services are typically exempted in various jurisdictions.

Value added tax is an indirect tax levied by the Confederation on the basis of Art. 130 of the Federal Constitution. As of 1 January 1995 it replaced the goods turnover tax (WUSt) levied until then. The VAT is structured as an all-phase tax with input tax deduction.