A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for non-domiciled investors, even if the official rates may be higher.

Gerard Ryle is an Irish-Australian investigative reporter who has written on subjects including politics, financial and medical scandals, and police corruption. From 2011, he has been director of the International Consortium of Investigative Journalists, which has published research on international tax evasion and money laundering, citing the leaked Panama Papers, Paradise Papers and Pandora Papers.

The Organized Crime and Corruption Reporting Project (OCCRP) is a global network of investigative journalists with staff on six continents. It was founded in 2006 and specializes in organized crime and corruption.

The International Consortium of Investigative Journalists, Inc. (ICIJ), is an independent global network of 280 investigative journalists and over 140 media organizations spanning more than 100 countries. It is based in Washington, D.C., with personnel in Australia, France, Spain, Hungary, Serbia, Belgium and Ireland.

Mossack Fonseca & Co. was a Panamanian law firm and corporate service provider. At one time it was the world's fourth-largest provider of offshore financial services. From its establishment in 1977 until the publication of the Panama Papers in April 2016, the company remained mostly obscured from public attention, even though it was a major firm in the global offshore industry and acted for approximately 300,000 companies. Prior to its dissolution, the company employed roughly 600 staff members spread across 42 countries.

Luxembourg Leaks is the name of a financial scandal revealed in November 2014 by a journalistic investigation conducted by the International Consortium of Investigative Journalists. It is based on confidential information about Luxembourg's tax rulings set up by PricewaterhouseCoopers from 2002 to 2010 to the benefits of its clients. This investigation resulted in making available to the public tax rulings for over three hundred multinational companies based in Luxembourg.

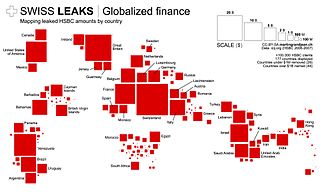

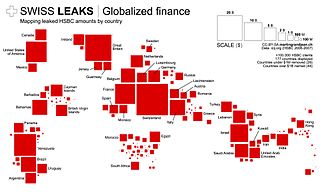

Swiss Leaks is a journalistic investigation, released in February 2015, of a giant tax evasion scheme allegedly operated with the knowledge and encouragement of the British multinational bank HSBC via its Swiss subsidiary, HSBC Private Bank (Suisse). Triggered by leaked information from French computer analyst Hervé Falciani on accounts held by over 100,000 clients and 20,000 offshore companies with HSBC in Geneva, the disclosed information was then called "the biggest leak in Swiss banking history".

RISE Moldova is an independent, non-governmental and nonprofit organization consisting of investigative journalists, programmers and activists from Moldova and Romania. Investigations made by RISE Moldova journalists were shortlisted for the European Press Prize for two years in a row.

The Panama Papers are 11.5 million leaked documents published beginning April 3, 2016. The papers detail financial and attorney–client information for more than 214,488 offshore entities. These documents, some dating back to the 1970s, were created by, and taken from, the former Panamanian offshore law firm and corporate service provider Mossack Fonseca, and compiled with similar leaks into a searchable database.

This article lists some of the reactions and responses from countries and other official bodies regarding the leak of legal documents related to offshore tax havens from the law firm Mossack Fonseca, called the Panama Papers.

Linkurious is a software company specialized in graph-based technology for various use cases such as financial crime, intelligence, cybersecurity, supply chain management or data governance.

The Paradise Papers are a set of over 13.4 million confidential electronic documents relating to offshore investments that were leaked to the German reporters Frederik Obermaier and Bastian Obermayer, from the newspaper Süddeutsche Zeitung. The newspaper shared them with the International Consortium of Investigative Journalists, and a network of more than 380 journalists. Some of the details were made public on 5 November 2017 and stories are still being released.

The Panama Papers are 11.5 million leaked documents that detail financial and attorney-client information for more than 214,488 offshore entities. The documents, some dating back to the 1970s, were created by and taken from, Panamanian law firm and corporate service provider Mossack Fonseca, and were leaked in 2015 by an anonymous source.

The Mauritius Leaks were the report of a datajournalistic investigation by the International Consortium of Investigative Journalists (ICIJ) in 2019 about how the former British colony Mauritius has transformed itself into a thriving financial centre and tax haven.

The Panama Papers are 11.5 million leaked documents that detail financial and attorney–client information for more than 214,488 offshore entities. The documents, some dating back to the 1970s, were created by, and taken from, Panamanian law firm and corporate service provider Mossack Fonseca, and were leaked in 2015 by an anonymous source.

The Panama Papers are 11.5 million leaked documents that detail financial and attorney–client information for more than 214,488 offshore entities. The files were uncovered and exposed by the International Consortium of Investigative Journalists, the German newspaper Süddeutsche Zeitung and other news organizations. The documents, some dating back to the 1970s, were created by, and taken from, Panamanian law firm and corporate service provider Mossack Fonseca, and were leaked in 2015 by an anonymous source.

The Panama Papers are 11.5 million leaked documents that detail financial and attorney–client information for more than 214,488 offshore entities. The documents, some dating back to the 1970s, were created by, and taken from, Panamanian law firm and corporate service provider Mossack Fonseca, and were leaked in 2015 by an anonymous source.

The Pandora Papers are 11.9 million leaked documents with 2.9 terabytes of data that the International Consortium of Investigative Journalists (ICIJ) published beginning on 3 October 2021. The leak exposed the secret offshore accounts of 35 world leaders, including current and former presidents, prime ministers, and heads of state as well as more than 100 business leaders, billionaires, and celebrities. The news organizations of the ICIJ described the document leak as their most expansive exposé of financial secrecy yet, containing documents, images, emails and spreadsheets from 14 financial service companies, in nations including Panama, Switzerland and the United Arab Emirates. The size of the leak surpassed their previous release of the Panama Papers in 2016, which had 11.5 million confidential documents and 2.6 terabytes of data. The ICIJ said it is not identifying its source for the documents.

![Group structure and statistics of "Gourmet Master Co. Ltd.", as of 31 December 2017, with hyperlinks to the ICIJ Offshore Leaks Database.

Cf. usage instructions for this interactive SVG at the file's description page on Wikimedia Commons. Group structure and statistics of "Gourmet Master Co. Ltd.", as of 31 December 2017 - [Kai Man Mei Shi Da Ren Gu Fen You Xian Gong Si ] De Ji Tuan Jia Gou Ji Tong Ji ,Jie Zhi 2017Nian 12Yue 31Ri .svg](http://upload.wikimedia.org/wikipedia/commons/thumb/5/55/Group_structure_and_statistics_of_%E2%80%9CGourmet_Master_Co._Ltd.%E2%80%9D%2C_as_of_31_December_2017_-_%E3%80%8C%E9%96%8B%E6%9B%BC%E7%BE%8E%E9%A3%9F%E9%81%94%E4%BA%BA%E8%82%A1%E4%BB%BD%E6%9C%89%E9%99%90%E5%85%AC%E5%8F%B8%E3%80%8D%E7%9A%84%E9%9B%86%E5%9C%98%E6%9E%B6%E6%A7%8B%E5%8F%8A%E7%B5%B1%E8%A8%88%EF%BC%8C%E6%88%AA%E8%87%B32017%E5%B9%B412%E6%9C%8831%E6%97%A5.svg/220px-thumbnail.svg.png)