A spending review or occasionally comprehensive spending review is a governmental process in the United Kingdom carried out by HM Treasury to set firm expenditure limits and, through public service agreements, define the key improvements that the public can expect from these resources.

Taxation in the United Kingdom may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion.

The June 2010 United Kingdom Budget, officially also known as Responsibility, freedom, fairness: a five-year plan to re-build the economy, was delivered by George Osborne, Chancellor of the Exchequer, to the House of Commons in his budget speech that commenced at 12.33pm on Tuesday, 22 June 2010. It was the first budget of the Conservative-Liberal Democrat coalition formed after the general election of May 2010. The government dubbed it an "emergency budget", and stated that its purpose was to reduce the national debt accumulated under the Labour government.

The 2011 United Kingdom budget, officially called 2011 Budget - A strong and stable economy, growth and fairness, was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on 23 March 2011.

In the United Kingdom, the value-added tax was introduced in 1973, replacing Purchase Tax, and is the third-largest source of government revenue, after income tax and National Insurance. It is administered and collected by HM Revenue and Customs, primarily through the Value Added Tax Act 1994.

The 2012 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday 21 March 2012.

The 1981 United Kingdom budget was delivered by Geoffrey Howe, the then Chancellor of the Exchequer, to the House of Commons on 10 March 1981. It was Geoffrey Howe's second budget and the second of the first Thatcher ministry. The budget represented a strongly monetarist response to the stagflation and high government borrowing which the UK was suffering at the time. The budget speech lasted for 91 minutes.

Anneliese Jane Dodds is a British Labour and Co-operative politician serving as Chair of the Labour Party since 2021. She was Shadow Chancellor of the Exchequer from April 2020 to May 2021, the first woman to hold the position. She has been Member of Parliament (MP) for Oxford East since 2017 and was a Member of the European Parliament (MEP) for South East England from 2014 to 2017.

Rishi Sunak is a British politician who has served as Chancellor of the Exchequer since 2020. A member of the Conservative Party, he was previously Chief Secretary to the Treasury from 2019 to 2020. He has been the Member of Parliament (MP) for Richmond (Yorks) in North Yorkshire since 2015.

Bobby Arora is a British billionaire businessman, trading director of the retail chain B & M.

The 2020 United Kingdom budget, officially known as Budget 2020: Delivering on Our Promises to the British People, was a budget delivered by Rishi Sunak, Chancellor of the Exchequer, to the House of Commons on Wednesday 11 March 2020. It was Sunak's first budget, the first since the withdrawal of the United Kingdom from the European Union, the first since Boris Johnson becoming Prime Minister and the first to be held in the spring since March 2017.

The Mayor of West Yorkshire is a directly elected mayor responsible for the metropolitan county of West Yorkshire in England. The Mayor chairs and leads the West Yorkshire Combined Authority, and assumes the office and powers of the West Yorkshire Police and Crime Commissioner.

Her Majesty's Government responded to the COVID-19 pandemic in the United Kingdom in various ways. Because of devolution, following the arrival of COVID-19 on 31 January 2020, the different home nations' administrative responses to the pandemic have been different to one another; the Scottish Government, the Welsh Government, and the Northern Ireland Executive have produced different policies to those that apply in England. The National Health Service is the publicly funded healthcare system of Britain, and has separate branches for each of its four nations.

Project Birch is the British government's bailout plan for companies during the COVID-19 pandemic. As of September 2020, only one company has qualified for help.

The July 2020 United Kingdom summer statement was a statement from the British Government, or mini-budget statement, delivered on 8 July 2020 by Rishi Sunak, the Chancellor of the Exchequer. It followed the budget delivered earlier in the year, and preceded the Winter Economy Plan. The purpose of the statement was to announce measures aimed at helping to promote economic recovery following the impact of the COVID-19 pandemic. The statement was delivered to the House of Commons, where Sunak unveiled a spending package worth £30bn. Concerns were subsequently raised by organisations including HM Revenue and Customs and the Institute for Fiscal Studies about the statement's impact, as well as its cost-effectiveness, while at least one major retailer declined to take advantage of a financial bonus scheme intended for rehiring employees placed on furlough during the pandemic.

The Winter Economy Plan was a statement from the British Government, or mini-budget statement, delivered on 24 September 2020 by Rishi Sunak, the Chancellor of the Exchequer. It succeeded the summer statement held earlier in the year, and was a partial replacement to the cancelled budget scheduled for the Autumn. The purpose of the statement was to announce measures aimed at further helping to promote economic recovery following the impact of the COVID-19 pandemic. The statement was delivered to the House of Commons. The plan aimed to further promote economic recovery while preserving jobs and businesses which were considered viable.

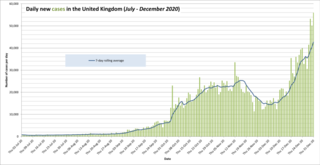

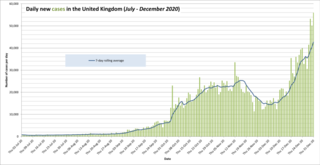

The following is a timeline of the COVID-19 pandemic in the United Kingdom from July 2020 to December 2020.

This is an economic history of the 2020s. Economic history refers to the study of economies or economic events of the past, including financial and business history.

Free ports in the United Kingdom refers a series of government assigned special economic zones where customs rules such as taxes do not apply until goods leave the specified zone. The theoretical purpose of such free ports is to encourage economic activity in the surrounding area and increase manufacturing. Critics of such schemes, including the parliamentary opposition, see them as possible tax havens and open to money laundering.