A debit card is a payment card that can be used in place of cash to make purchases. It is similar to a credit card, but unlike a credit card, the money for the purchase must be in the cardholder's bank account at the time of a purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

A loyalty program is a marketing strategy designed to encourage customers to continue to shop at or use the services of a business associated with the program. Today, such programs cover most types of commerce, each having varying features and rewards schemes, including in banking, entertainment, hospitality, retailing and travel. The market approach has shifted from product-centric to a customer-centric one due to a highly competitive market and a wide array of services offered to customers, therefore, it's important that marketing strategies prioritize growing a sustainable business and increasing customer satisfaction.

Discounts and allowances are reductions to a basic price of goods or services.

Discover is a credit card brand issued primarily in the United States. It was introduced by Sears in 1985. When launched, Discover did not charge an annual fee and offered a higher-than-normal credit limit, features that were disruptive to the existing credit card industry. A subsequent innovation was "Cashback Bonus" on purchases.

A gift card also known as gift certificate in North America, or gift voucher or gift token in the UK is a prepaid stored-value money card, usually issued by a retailer or bank, to be used as an alternative to cash for purchases within a particular store or related businesses. Gift cards are also given out by employers or organizations as rewards or gifts. They may also be distributed by retailers and marketers as part of a promotion strategy, to entice the recipient to come in or return to the store, and at times such cards are called cash cards. Gift cards are generally redeemable only for purchases at the relevant retail premises and cannot be cashed out, and in some situations may be subject to an expiry date or fees. American Express, MasterCard, and Visa offer generic gift cards which need not be redeemed at particular stores, and which are widely used for cashback marketing strategies. A feature of these cards is that they are generally anonymous and are disposed of when the stored value on a card is exhausted.

A rebate is a form of buying discount and is an amount paid by way of reduction, return, or refund that is paid retrospectively. It is a type of sales promotion that marketers use primarily as incentives or supplements to product sales. Rebates are also used as a means of enticing price-sensitive consumers into purchasing a product. The mail-in rebate (MIR) is the most common. A MIR entitles the buyer to mail in a coupon, receipt, and barcode in order to receive a check for a particular amount, depending on the particular product, time, and often place of purchase. Rebates are offered by either the retailer or the product manufacturer. Large stores often work in conjunction with manufacturers, usually requiring two or sometimes three separate rebates for each item, and sometimes are valid only at a single store. Rebate forms and special receipts are sometimes printed by the cash register at time of purchase on a separate receipt or available online for download. In some cases, the rebate may be available immediately, in which case it is referred to as an instant rebate. Some rebate programs offer several payout options to consumers, including a paper check, a prepaid card that can be spent immediately without a trip to the bank, or even as a PayPal payout.

Credit card interest is a way in which credit card issuers generate revenue. A card issuer is a bank or credit union that gives a consumer a card or account number that can be used with various payees to make payments and borrow money from the bank simultaneously. The bank pays the payee and then charges the cardholder interest over the time the money remains borrowed. Banks suffer losses when cardholders do not pay back the borrowed money as agreed. As a result, optimal calculation of interest based on any information they have about the cardholder's credit risk is key to a card issuer's profitability. Before determining what interest rate to offer, banks typically check national, and international, credit bureau reports to identify the borrowing history of the card holder applicant with other banks and conduct detailed interviews and documentation of the applicant's finances.

A merchant account is a type of bank account that allows businesses to accept payments in multiple ways, typically debit or credit cards. A merchant account is established under an agreement between an acceptor and a merchant acquiring bank for the settlement of payment card transactions. In some cases a payment processor, independent sales organization (ISO), or member service provider (MSP) is also a party to the merchant agreement. Whether a merchant enters into a merchant agreement directly with an acquiring bank or through an aggregator, the agreement contractually binds the merchant to obey the operating regulations established by the card associations. A high-risk merchant account is a business account or merchant account that allows the business to accept online payments though they are considered to be of high-risk nature by the banks and credit card processors. The industries that possess this account are adult industry, travel, Forex trading business, multilevel marketing business. "High-Risk" is the term that is used by the acquiring banks to signify industries or merchants that are involved with the higher financial risk.

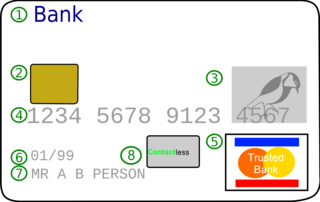

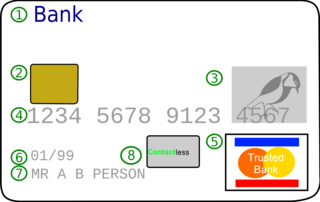

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer and access automated teller machines (ATMs). Such cards are known by a variety of names including bank cards, ATM cards, client cards, key cards or cash cards.

Debit card cashback is a service offered to retail customers whereby an amount is added to the total purchase price of a transaction paid by debit card and the customer receives that amount in cash along with the purchase. Debit card cashback is offered either by various banks only to some card holders or by companies like VISA, Mastercard or American Express. For example, a customer purchasing $18.99 worth of goods at a supermarket might ask for twenty dollars cashback. They would pay a total of $38.99 with their debit card and receive $20 in cash along with their goods.

A cashback website is a type of reward website that pays its members a percentage of money earned when they purchase goods and services via its affiliate links.

Interchange fee is a term used in the payment card industry to describe a fee paid between banks for the acceptance of card-based transactions. Usually for sales/services transactions it is a fee that a merchant's bank pays a customer's bank ; and for cash transactions the interchange fee is paid from the issuer to acquirer, often called reverse interchange.

The BancNet (BN) Point-Of-Sale System is a local PIN-based electronic funds transfer (EFTPOS) payments solution operated by BancNet on behalf of the member banks and China UnionPay (CUP). The BN point of sale (POS) System allows merchants to accept the automated teller machine (ATM) cards of any active BancNet member bank as payment for goods or services and obliges BN to settle the transaction as early as the following banking day through a direct deposit to a settlement account with any member bank. Acceptance of CUP cards is limited to SM Prime Holdings, Inc.'s Department Store, Supermarket, Hypermarket, Super Sale, Watson's, Sports Central, SM Appliance, Toy Kingdom, and select Surplus Stores.

Discover Financial Services is an American financial services company that owns and operates Discover Bank, which offers checking and savings accounts, personal loans, home equity loans, student loans and credit cards. It also owns and operates the Discover and Pulse networks, and owns Diners Club International. Discover Card is the third largest credit card brand in the United States, when measured by cards in force, with nearly 50 million cardholders. Discover is currently headquartered in the Chicago suburb of Riverwoods, Illinois.

An incentive program is a formal scheme used to promote or encourage specific actions or behavior by a specific group of people during a defined period of time. Incentive programs are particularly used in business management to motivate employees and in sales to attract and retain customers. Scientific literature also refers to this concept as pay for performance.

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt. The card issuer creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards, and a few gemstone-encrusted metal cards.

Gas rebate credit cards or gas cashback cards became popular in the United States in the wake of the 2000s energy crisis and the rising price of gasoline.

A surcharge, also known as checkout fee, is an extra fee charged by a merchant when receiving a payment by cheque, credit card, charge card or debit card which at least covers the cost to the merchant of accepting that means of payment, such as the merchant service fee imposed by a credit card company. Retailers generally incur higher costs when consumers choose to pay by credit card due to higher merchant service fees compared to traditional payment methods such as cash.

Card transaction data is financial data generally collected through the transfer of funds between a card holder's account and a business's account. It consists of the use of either a debit card or a credit card to generate data on the transfer for the purchase of goods or services. Transaction data describes an action composed of events in which master data participates. Transaction focuses on the price, discount and method of payment interaction between the customer and the organization. They are based on volatility as each transaction data changes every time a purchase is made, one time it could be $10, the next $55. Since debit and credit cards are commonly used to pay for goods and services, they represent a strong percentage of the consumption expenditure in the country.