In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale natural or anthropogenic disaster. In the United States, it is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales". In the United Kingdom, it is defined as a negative economic growth for two consecutive quarters.

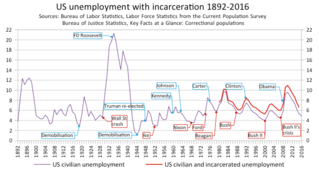

Unemployment, according to the Organisation for Economic Co-operation and Development (OECD), is persons above a specified age not being in paid employment or self-employment but currently available for work during the reference period.

In economics, a depression is a sustained, long-term downturn in economic activity in one or more economies. It is a more severe economic downturn than a recession, which is a slowdown in economic activity over the course of a normal business cycle.

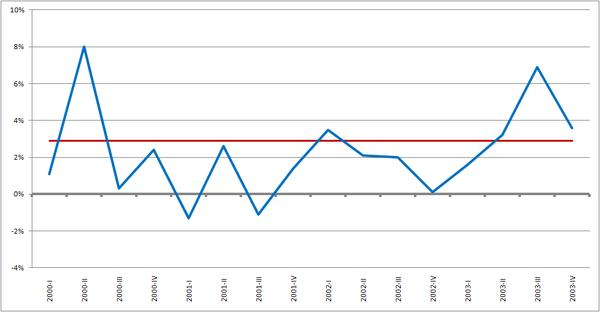

The business cycle, also known as the economic cycle or trade cycle, is the downward and upward movement of gross domestic product (GDP) around its long-term growth trend. The length of a business cycle is the period of time containing a single boom and contraction in sequence. These fluctuations typically involve shifts over time between periods of relatively rapid economic growth and periods of relative stagnation or decline.

The early 1990s recession describes the period of economic downturn affecting much of the Western world in the early 1990s, believed to be caused by restrictive monetary policy enacted by central banks primarily in response to inflation concerns, the loss of consumer and business confidence as a result of the 1990 oil price shock, the end of the Cold War and the subsequent decrease in defense spending, the savings and loan crisis and a slump in office construction resulting from overbuilding during the 1980s. The global GDP growth returned to normal by 1994. The impacts of the recession included the resignation of Canadian prime minister Brian Mulroney, reduction of active companies by 15% and unemployment up to nearly 20% in Finland, civil disturbances in the United Kingdom and the growth of discount stores in the United States and beyond.

The National Bureau of Economic Research (NBER) is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic community." The NBER is well known for providing start and end dates for recessions in the United States.

The Great Recession was a period of marked general decline (recession) observed in national economies globally that occurred between 2007–2009. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression.

The Depression of 1920–1921 was a sharp deflationary recession in the United States, United Kingdom and other countries, beginning 14 months after the end of World War I. It lasted from January 1920 to July 1921. The extent of the deflation was not only large, but large relative to the accompanying decline in real product.

The 1990s economic boom in the United States was an economic expansion that began after the end of the early 1990s recession in March 1991, and ended in March 2001 with the start of the early 2000s recession during the Dot-com bubble crash (2000–2002). It was the longest recorded economic expansion in the history of the United States until July 2019.

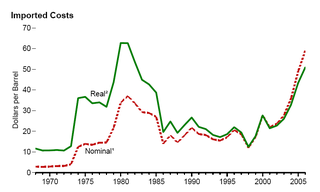

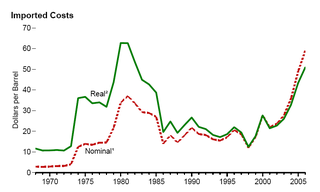

The 1973–1975 recession or 1970s recession was a period of economic stagnation in much of the Western world during the 1970s, putting an end to the overall Post–World War II economic expansion. It differed from many previous recessions by being a stagflation, where high unemployment and high inflation existed simultaneously.

The Recession of 1969–1970 was a relatively mild recession in the United States. According to the National Bureau of Economic Research the recession lasted for 11 months, beginning in December 1969 and ending in November 1970, following an economic slump which began in 1968 and by the end of 1969 had become serious, thus ending the third longest economic expansion in U.S. history which had begun in February 1961.

The 1970s energy crisis occurred when the Western world, particularly the United States, Canada, Western Europe, Australia, and New Zealand, faced substantial petroleum shortages, real and perceived, as well as elevated prices. The two worst crises of this period were the 1973 oil crisis and the 1979 energy crisis, when the Yom Kippur War and the Iranian Revolution triggered interruptions in Middle Eastern oil exports.

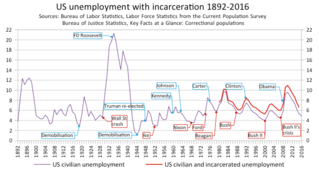

Unemployment in the United States discusses the causes and measures of U.S. unemployment and strategies for reducing it. Job creation and unemployment are affected by factors such as economic conditions, global competition, education, automation, and demographics. These factors can affect the number of workers, the duration of unemployment, and wage levels.

The Great Recession in the United States was a severe financial crisis combined with a deep recession. While the recession officially lasted from December 2007 to June 2009, it took many years for the economy to recover to pre-crisis levels of employment and output. This slow recovery was due in part to households and financial institutions paying off debts accumulated in the years preceding the crisis along with restrained government spending following initial stimulus efforts. It followed the bursting of the housing bubble, the housing market correction and subprime mortgage crisis.

The United States entered recession in 1990, which lasted 8 months through March 1991. Although the recession was mild relative to other post-war recessions, it was characterized by a sluggish employment recovery, most commonly referred to as a jobless recovery. Unemployment continued to rise through June 1992, even though economic growth had returned the previous year.

The United States entered recession in January 1980 and returned to growth six months later in July 1980. Although recovery took hold, the unemployment rate remained unchanged through the start of a second recession in July 1981. The downturn ended 16 months later, in November 1982. The economy entered a strong recovery and experienced a lengthy expansion through 1990.

The early 1990s recession saw a period of economic downturn affect much of the world in the late 1980s and early 1990s. The economy of Australia suffered its worst recession since the Great Depression.

The coronavirus recession, also known as the COVID-19 recession, Second Great Depression, or the Great Lockdown, is a severe and global recession which arose as an economic consequence of the ongoing COVID-19 pandemic. The first major sign of the coronavirus recession was the 2020 stock market crash on 20 February, and the International Monetary Fund (IMF) reported on 14 April that all of the G7 nations had already entered or were entering into a "deep recession" and that there had already been a significant slowdown of growth in emerging economies. IMF projections suggest that the coronavirus recession will be the most severe global economic downturn since the Great Depression, and that it will be "far worse" than the Great Recession of 2009.