Impact on Russia

On 16 December 2014, the RTS Index, denominated in U.S. dollars, declined 12%, the most on any given day since the midst of the global financial crisis in November 2008, and the MICEX Index declined 8.1% at one point before ending the day higher. This increased the decline of RTS Index, up until 16 December, of nearly 30% during the month of December. [59] In response to rising interest rates and bank runs, the interest rate on Russian three-month interbank loans rose to 28.3%, higher than at any point in the Great Recession of 2008. [60] [61]

To get rid of the Russian roubles which were declining in value, many Russians chose to purchase durable goods, such as washing machines, televisions, furniture, and jewelry, and to convert their pensions and savings from roubles to US dollars and Euros. [62] [63] Several currency changers offered cash only at much greater exchange rates: USD up to 99.8 RUB (official rate was 61.15) [64] and EUR up to 120–150 RUB (official rate was 76.15). [65] [66]

Some foreign companies halted their business activities in Russia, including Volvo car dealerships and the online stores of Apple and Steam, due to the high volatility and decline of the Russian rouble. [63] [67] Additionally, IKEA temporarily suspended sales of certain goods in Russia, in part due to the volatility and in part due to a lack of adequate supply, as numerous Russians bought IKEA furniture. [60]

Many Western financial institutions, including Goldman Sachs, started cutting the flow of cash to Russian companies since they had restricted some longer-term rouble-denominated repurchase agreements (repos). These actions were intended to protect Western firms from the high volatility of the rouble. Repos had allowed Russian companies to exchange securities for cash with Western financial institutions, so the restrictions added pressure to the Russian financial system. [68]

Russia may also be excluded from the MSCI Emerging Markets Index, composed of 26 countries' indices, if capital controls or currency controls are implemented by Russia, since such measures would make it more difficult for foreign entities to access Russian securities markets. Russia would be reclassified as a standalone market in that event. [69]

The 20 December print edition of The Economist predicted that Russia would face the "lethal combination" of a major recession and high inflation in 2015. [70] Others predicted that the crisis would spread to the banking sector. [71] On the other hand, President Putin has argued that Russia was not in crisis, and that cheaper oil prices would lead to a global economic boom that would push up the price of oil, which would in turn help the Russian economy. [72]

On the week of 15 December, Russian gold and foreign currencies reserves were reduced by "US$15.7 billion to below US$400 billion for the first time since August 2009 and down from [more than] $510 billion at the start of the year." [73] Between 15 and 25 December, annual inflation had climbed to more than 10%. Prices of goods, including beef and fish, rose 40 to 50% within a few months before the end of the year due to Russia's ban on Western imports. [73]

In 2014, car sales in Russia fell by 12% from the previous year. The largest Russian oil company, Rosneft, whose largest shareholding was owned by the British oil company BP at the time, lost U.S. and European assets and 86% of profits in the third quarter 2014. Rosneft attributed the decline to falling oil prices and rouble devaluation. [74]

The crisis threatened the continued existence of the Kontinental Hockey League, and several teams missed or delayed payments to their players. [75]

Russian President Putin ordered Dmitry Medvedev's Cabinet to not take their day off on 2015 New Year's Day because of the crisis. [76] [32] [33]

As of December 2014, prices of meat, fish, and grain were inflated as a result of rouble devaluation. Some businesses had closed down, especially in the far eastern region of Russia's Siberia due to future rising lease fees. [77]

In the first 8 months of 2014 more Russians left the country than in any year since 1999. [78] Many start-ups and companies were seeking to relocate their businesses outside of Russia. [78] The process that was labeled as "Excodus of tech". [78]

The state-owned gas company, Gazprom, lost 86% in the 2014 net income, dropping to 159,000,000,000 ₽ (US$3.1 billion), because of rouble devaluation, plunge on oil prices, Ukraine crisis, and rising impairment costs. Overall revenues of the year grew 6.4% to PP 5.59 trillion ($106.3 billion). [79] [80]

According to a September 2015 survey conducted by Nielsen Russia, 49% of around 1,000 sampled people had not visited a bar in 2015 mainly due to economic crisis; 46%, not a pub; 62%, not a nightclub. In comparison, according to a 2014 survey, 28% had not visited a bar in the previous year, 2014; 32%, not a pub; 45%, not a nightclub. Survey conductors concluded that rising prices in restaurants and bars had been factors to declining attendance in those places. [81]

By the end of 2015 direct foreign investments in Russian economy fell by 92% and more than 200 start-ups ceased to exist by closing down. [82]

Demographic consequences

Calculations presented by a group of demographers from the Russian Presidential Academy of National Economy and Public Administration suggested the crisis could have very serious demographic consequences (simultaneous growth of mortality and decline of fertility) [83]

As of March 2015, officially, three million Russians more than the previous year lived with less than 9,662₽ (US$169) monthly income, totalling to twenty-three million. [84]

In 2016 over 330,000 Russian citizens applied for US permanent residency through the Green Card lottery program, a 24% increase over the previous year. [85] According to New World Wealth study, over 2,000 millionaires emigrated from Russia. [86]

Global financial markets

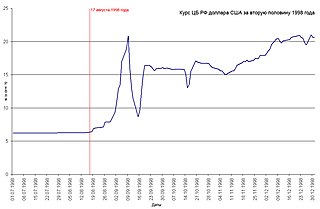

The financial crisis in Russia affected other global financial markets. U.S. financial markets declined, with the Dow Jones Industrial Average down nearly 3% in 3 business days, in part due to the Russian financial crisis. [87] The crisis drew comparisons to the 1998 Russian financial crisis that affected global markets. [88] Economist Olivier Blanchard of the IMF noted that the uncertainty caused by Russia's economic crisis could lead to greater worldwide risk aversion in a manner similar to the Financial crisis of 2007–08. [50] However, the 2014 international sanctions on Russia decreased Russia's financial connections with the broader financial world, which in turn lowered the risk that an ailing Russian economy would affect the worldwide economy. [88] Since 1998, Russia and many other countries have adopted a floating exchange rate, which could also help to prevent Russian financial woes from affecting the rest of the world. [88]

Foreign exchange trading service FXCM said on 16 December 2014 it would restrict U.S. dollar-rouble trading starting the next day, due to the volatility of the rouble. They also said that most Western banks have stopped reporting the exchange rate of the U.S. dollar for roubles (USD/RUB). Liquidity in the U.S. dollar-rouble market has also declined sharply. [68]

Financial institutions that hold relatively high amounts of Russian debt or other assets were affected by the Russian financial crisis. The PIMCO Emerging Markets Bond Fund also had 21% of its holdings in Russian corporate and sovereign debt as of the end of September 2014, which declined about 7.9% from about 16 November 2014 to 16 December 2014. [89]

Companies from North America and Europe that heavily relied on Russian economy were affected by the crisis. American car company Ford Motor Company experienced a 40% decline in car sales in January–November 2014, according to Association of European Businesses, and terminated "about 950 jobs at its Russia joint in April [2014]." German car company Volkswagen experienced a 20% decline in the same period. American oil company ExxonMobil alongside Rosneft was unable to continue an Arctic project after the discovery of oil there due to sanctions over the Russo-Ukrainian war. British oil company BP lost 17% of market share. French energy company Total S.A. shelved joint shale exploration plans with Russian oil company Lukoil due to sanctions. [74]

German engineering company Siemens lost 14% of Russian revenue in 2014. German sportswear company Adidas closed down stores and suspended development plans in Russia. Danish beer company Carlsberg Group lost more than 20% of Russian shares. American fast food company McDonald's closed twelve stores, which Russian officials said was due to "sanitary violations". French food conglomerate Danone experienced a loss of operating margins in the first half of 2014 due to rising milk prices. [74]

In January 2015, ratings agency Standard & Poor's lowered Russia's credit rating to junk status and economic rating from BBB− to BB+. [90] Moody's followed this decision in February 2015. [91]