This article has multiple issues. Please help improve it or discuss these issues on the talk page . (Learn how and when to remove these template messages) (Learn how and when to remove this template message)

|

Wealth in the United States is commonly measured in terms of net worth, which is the sum of all assets, including the market value of real estate, like a home, minus all liabilities. [1] The United States is the wealthiest country in the world. [2]

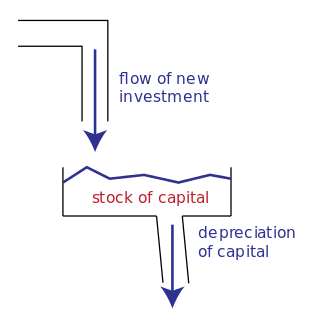

Net worth is the value of all the non-financial and financial assets owned by an institutional unit or sector minus the value of all its outstanding liabilities. Since financial assets minus outstanding liabilities equal net financial assets, net worth can also be conveniently expressed as non-financial assets plus net financial assets. Net worth can apply to companies, individuals, governments or economic sectors such as the sector of financial corporations or to entire countries.

In financial accounting, an asset is any resource owned by the business. Anything tangible or intangible that can be owned or controlled to produce value and that is held by a company to produce positive economic value is an asset. Simply stated, assets represent value of ownership that can be converted into cash. The balance sheet of a firm records the monetary value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business.

Contents

- Income vs. wealth

- Changes in wealth, 1989–2001

- Changes in wealth after 2007

- Mechanisms to gain wealth

- Wealth distribution

- Income distribution

- Complications in interpreting income statistics

- Home ownership and race

- Statistics

- See also

- References

- External links

For example, a household in possession of an $800,000 house, $5,000 in mutual funds, $30,000 in cars, $20,000 worth of stock in their own company, and a $45,000 IRA would have assets totaling $900,000. Assuming that this household would have a $250,000 mortgage, $40,000 in car loans, and $10,000 in credit card debt, its debts would total $300,000. Subtracting the debts from the worth of this household's assets (900,000 − $300,000 = $600,000), this household would have a net worth of $600,000. Net worth can vary with fluctuations in value of the underlying assets.

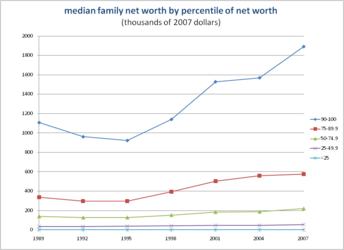

As one would expect, households with greater income often have the highest net worths, though high income cannot be taken as an always accurate indicator of net worth. Overall the number of wealthier households is on the rise, with baby boomers hitting the highs of their careers. [1] In addition, wealth is unevenly distributed, with the wealthiest 25% of US households owning 87% [3] of the wealth in the United States, which was $54.2 trillion in 2009. [4] [5]

Baby boomers are the demographic cohort following the Silent Generation and preceding Generation X. Though there may be a few different timelines said to represent the birth years of the Baby Boom generation, the U.S. Census Bureau and many experts agree that the Baby Boom generation spans 18 birth years from 1946 to 1964. This leaves room for demographers and researchers to define and label cohort subsets if the characteristics and experiences of the youngest or oldest members correlate with or span two generations. When the term "baby boomer" is used in a cultural context, it becomes more difficult to achieve a consensus among scholars, demographers and researchers as to the precise birth years from a cultural perspective.

Wealth inequality in the United States is the unequal distribution of assets among residents of the United States. Wealth includes the values of homes, automobiles, personal valuables, businesses, savings, and investments. The net worth of U.S. households and non-profit organizations was $94.7 trillion in the first quarter of 2017, a record level both in nominal terms and purchasing power parity. If divided equally among 124 million U.S. households, this would be $760,000 per family; however, the bottom 50% of families, representing 62 million American households, average $11,000 net worth. From an international perspective, the difference in US median and mean wealth per adult is over 600%.

U.S. household and non-profit organization net worth rose from $44.2 trillion in Q1 2000 to a pre-recession peak of $67.7 trillion in Q3 2007. It then fell $13.1 trillion to $54.6 trillion in Q1 2009 due to the subprime mortgage crisis. It then recovered, rising consistently to $86.8 trillion by Q4 2015. This is nearly double the 2000 level. [6]

The United States subprime mortgage crisis was a nationwide financial crisis, occurring between 2007 and 2010, that contributed to the U.S. recession of December 2007 – June 2009. It was triggered by a large decline in home prices after the collapse of a housing bubble, leading to mortgage delinquencies and foreclosures and the devaluation of housing-related securities. Declines in residential investment preceded the recession and were followed by reductions in household spending and then business investment. Spending reductions were more significant in areas with a combination of high household debt and larger housing price declines.