The economy of Brunei, a small and wealthy country, is a mixture of foreign and domestic entrepreneurship, government regulation and welfare measures, and village traditions. It is almost entirely supported by exports of crude oil and natural gas, with revenues from the petroleum sector accounting for over half of GDP. Per capita GDP is high, and substantial income from overseas investment supplements income from domestic production. The government provides for all medical services and subsidizes food and housing. The government has shown progress in its basic policy of diversifying the economy away from oil and gas. Brunei's leaders are concerned that steadily increased integration in the world economy will undermine internal social cohesion although it has taken steps to become a more prominent player by serving as chairman for the 2000 APEC forum. Growth in 1999 was estimated at 2.5% due to higher oil prices in the second half.

The economy of Mauritania is still largely based on agriculture and livestock, even though most of the nomads and many subsistence farmers were forced into the cities by recurring droughts in the 1970s and 1980s.

BHP is an Australian-British multinational mining, metals and petroleum public company that is headquartered in Melbourne, Victoria, Australia.

The Timor Sea is a relatively shallow sea bounded to the north by the island of Timor, to the east by the Arafura Sea, and to the south by Australia.

TotalEnergies SE is a French multinational integrated oil and gas company founded in 1924 and one of the seven "supermajor" oil companies. Its businesses cover the entire oil and gas chain, from crude oil and natural gas exploration and production to power generation, transportation, refining, petroleum product marketing, and international crude oil and product trading. TotalEnergies is also a large-scale chemicals manufacturer.

A floating production storage and offloading (FPSO) unit is a floating vessel used by the offshore oil and gas industry for the production and processing of hydrocarbons, and for the storage of oil. An FPSO vessel is designed to receive hydrocarbons produced by itself or from nearby platforms or subsea template, process them, and store oil until it can be offloaded onto a tanker or, less frequently, transported through a pipeline. FPSOs are preferred in frontier offshore regions as they are easy to install, and do not require a local pipeline infrastructure to export oil. FPSOs can be a conversion of an oil tanker or can be a vessel built specially for the application. A vessel used only to store oil is referred to as a floating storage and offloading (FSO) vessel.

Petroliam Nasional Berhad, commonly known as Petronas, is a Malaysian oil and gas company. Established in 1974 and wholly owned by the Government of Malaysia, the corporation is vested with all oil and gas resources in Malaysia and is entrusted with the responsibility of developing and adding value to these resources. Petronas is ranked among Fortune Global 500's largest corporations in the world. In the 2017 Forbes Global 2000, Petronas Gas was ranked as the 1881st largest public company in the world. Petronas also ranked 48th globally in 2020 Bentley Infrastructure 500.

The Chinguetti oilfield is an oil field located off the Mauritanian coast in 800 m water depth. It was discovered by the Australian firm Woodside Petroleum in 2001. It is named after the city of Chinguetti.

INPEX Corporation is a Japanese oil company established in February 1966 as North Sumatra Offshore Petroleum Exploration Co., Ltd. INPEX is the largest oil and gas exploration and production company in Japan, with global exploration, development and production projects in 20 countries. In the 2020 Forbes Global 2000, INPEX was ranked as the 597th -largest public company in the world.

Shell Australia is the Australian subsidiary of Shell Plc. Shell has operated in Australia since 1901, initially delivering bulk fuel into Australia, then establishing storage and distribution terminals, oil refineries, and a network of service stations. It extended its Australian activities to oil exploration, petrochemicals and coal mining, and became a leading partner in Australia's largest resource development project, the North West Shelf Venture.

The Bonga Field is an oilfield in Nigeria. It was located in License block OPL 212 off the Nigerian coast, which was renamed OML 118 in February 2000. The field covers approximately 60 km2 in an average water depth of 1,000 metres (3,300 ft). The field was discovered in 1996, with government approval for its development given in 2002. The field began first production in November 2005. The field is worked via an FPSO vessel. The field produces both petroleum and natural gas; the petroleum is offloaded to tankers while the gas is piped back to Nigeria where it is exported via an LNG plant. The field contains approximately 6,000 mm barrels of oil.

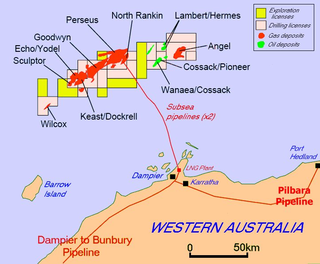

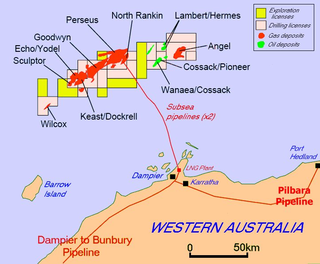

The North West Shelf Venture, situated in the north-west of Western Australia, is Australia's largest resource development project. It involves the extraction of petroleum at offshore production platforms, onshore processing and export of liquefied natural gas, and production of natural gas for industrial, commercial and domestic use within the state.

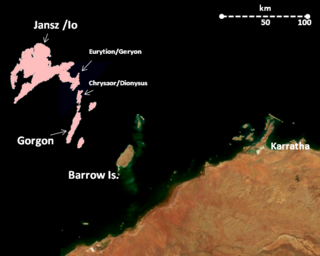

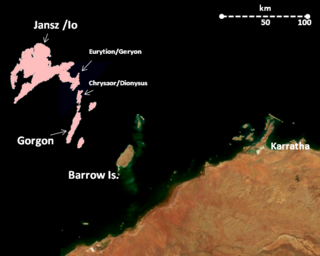

The Gorgon gas project is a multi-decade natural gas project in Western Australia, involving the development of the Greater Gorgon gas fields, subsea gas-gathering infrastructure, and a liquefied natural gas (LNG) plant on Barrow Island. The project also includes a domestic gas component. Construction was completed in 2017.

The petroleum industry in Western Australia is the largest contributor to Australia's production of most petroleum products.

Shell plc is a British publicly traded multinational oil and gas company headquartered at Shell Centre in London, United Kingdom. Shell is a public limited company with a primary listing on the London Stock Exchange (LSE) and secondary listings on Euronext Amsterdam and the New York Stock Exchange. It is one of the oil and gas "supermajors" and by revenue and profits is one of the largest companies in the world, ranking within the top 10 of the Fortune global 500 since 2000. Measured by both its own emissions, and the emissions of all the fossil fuels it sells, Shell was the ninth-largest corporate producer of greenhouse gas emissions in the period 1988–2015.

A floating liquefied natural gas (FLNG) facility is a floating production storage and offloading unit that conducts liquefied natural gas (LNG) operations for developing offshore natural gas resources. Floating above an offshore natural gas field, the FLNG facility produces, liquefied stores and transfers LNG at sea before carriers ship it directly to markets.

The Browse LNG was a liquefied natural gas plant project proposed for construction at James Price Point, 52 kilometres (32 mi) north of Broome on the Dampier Peninsula, Western Australia. It was considered by a joint venture including Woodside Petroleum, Shell, BP, Japan Australia LNG and BHP Billiton. It would have processed natural gas extracted from the Browse Basin. Liquefied natural gas would then be shipped from a port facility also located in the Browse LNG Precinct.

James Price Point is a headland in the Kimberley region of Western Australia. It is 52 kilometres (32 mi) north of Broome.

The Scarborough gas field is a natural gas field located in the Indian Ocean north-west of Exmouth on the coast of Western Australia. The total Contingent Resource of the Scarborough gas field is around 7.3 trillion cubic feet. In 2018 Woodside bought ExxonMobil' 50% share of the retention lease, adding to the 25% it had acquired from BHP in 2016. Woodside now owns 75% of the retention lease and are operator of the joint venture, with BHP retaining the final 25%. On the 7 April, 2022, the Company announced that final Australian federal and state government approvals for the project had been received.