Carla Howell is an American politician, small government advocate and activist. She was the Libertarian Party of Massachusetts candidate for Massachusetts State Auditor in 1998, U.S. Senate in 2000, and Governor in 2002. She then served in multiple leadership positions in the U.S. Libertarian Party. She has also organized tax-cut initiative ballot measures in Massachusetts and worked for the Libertarian National Committee.

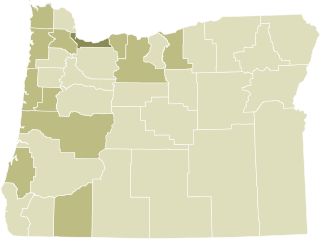

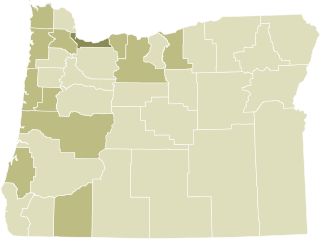

The Oregon tax revolt is a political movement in Oregon which advocates for lower taxes. This movement is part of a larger anti-tax movement in the western United States which began with the enactment of Proposition 13 in California. The tax revolt, carried out in large part by a series of citizens' initiatives and referendums, has reshaped the debate about taxes and public services in Oregon.

Timothy Donald Eyman is an American anti-tax activist and businessman.

Rex Andrew Sinquefield is an American businessman, investor, and philanthropist who has been called an "index-fund pioneer" for creating the first passively managed index fund open to the general public. Sinquefield was also a co-founder of Dimensional Fund Advisors. He is active in Missouri politics.

The Committee for Sensible Marijuana Policy is a Boston, Massachusetts based organization that was devoted to passing Question 2, a cannabis decriminalization initiative also known as the Massachusetts Sensible Marijuana Policy Initiative that was passed in Massachusetts in 2008 and officially became law on January 2, 2009. Whitney A. Taylor is the treasurer and chairwoman of the organization.

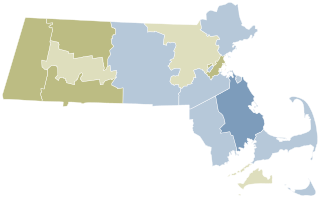

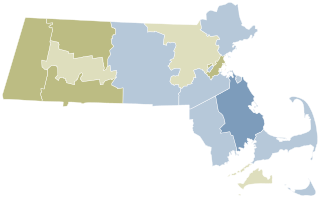

The Sensible Marijuana Policy Initiative, also known as Massachusetts Ballot Question 2, was an initiated state statute that replaced prior criminal penalties with new civil penalties on adults possessing an ounce or less of marijuana. The initiative appeared on the November 4, 2008, ballot in Massachusetts.

The Greyhound Protection Act is a Massachusetts statute that gradually eliminated commercial dog racing by 2010. It was enacted as Question 3 on the November 4, 2008 ballot in Massachusetts.

Oregon Ballot Measure 59 was an initiated state statute ballot measure sponsored by Bill Sizemore that appeared on the November 4, 2008 general election ballot in Oregon, United States. If it had passed, Oregon would have join Alabama, Iowa, and Louisiana as the only states to allow federal income taxes to be fully deducted on state income tax returns.

The South Dakota Open and Clean Government Act, or Initiated Measure 10, was a South Dakota initiative that would ban taxpayer-funded lobbying, stop the exchange of campaign donations for state contracts, and open a website with information on state contracts. The Open and Clean Government Act was proposed as a citizen-initiated state statute and appeared on the November 4, 2008 ballot.

Proposition 23 was a California ballot proposition that was on the November 2, 2010 California statewide ballot. It was defeated by California voters during the statewide election by a 23% margin. If passed, it would have suspended AB 32, a law enacted in 2006, legally referred to its long name, the Global Warming Solutions Act of 2006. Sponsors of the initiative referred to their measure as the California Jobs Initiative while opponents called it the Dirty Energy Prop.

A Massachusetts general election was held on November 5, 2002 in the Commonwealth of Massachusetts.

A Massachusetts general election was held on November 8, 1994 in the Commonwealth of Massachusetts.

The No Sales Tax for Alcohol Question, also known as Question 1, was on the November 2, 2010 ballot in Massachusetts. The measure asked voters whether to repeal a sales tax on alcohol sales. The ballot measure for the 2010 ballot was added after the Massachusetts State Legislature increased the sales tax in the state from 5% to 6.25% and eliminated an exemption for alcohol sold in liquor stores.

The Massachusetts Comprehensive Permits and Regional Planning Initiative, also known as Question 2, appeared on the November 2, 2010 ballot in the state of Massachusetts as an initiative. Question 2 was rejected by the Massachusetts voters by 1,254,759 "No" votes to 900,405 "Yes" votes. The measure had been sponsored by Better Not Bigger, a local advocacy group in the state.

Massachusetts Question 3, filed under the name, the 3 percent Sales Tax Relief Act, appears on the November 2, 2010 ballot in the state of Massachusetts as an initiative. The measure, if enacted by voters, would reduce the state sales tax rate from 6.25 to 3 percent. The measure is being sponsored by the Alliance to Roll Back Taxes headed by Carla Howell. The measure would be enacted into a law 30 days after the election if approved by voters.

The California state elections was held on Election Day, November 6, 2012. On the ballot were eleven propositions, various parties' nominees for the United States presidency, the Class I Senator to the United States Senate, all of California's seats to the House of Representatives, all of the seats of the State Assembly, and all odd-numbered seats of the State Senate.

Direct democracy refers to decision making or direct vote a proposal, law, or political issue by the electorate, rather than being voted on by representatives in a state or local legislature or council.

The Massachusetts Automatic Gas Tax Increase Repeal Initiative, Question 1 was on the November 4, 2014 statewide ballot. Approved by voters, the measure repeals a 2013 law that would automatically adjust gas taxes according to inflation, allowing for automatic annual increases in the state's gas tax.

The American Anti-Corruption Act (AACA), sometimes shortened to Anti-Corruption Act, is a piece of model legislation designed to limit the influence of money in American politics by overhauling lobbying, transparency, and campaign finance laws. It was crafted in 2011 "by former Federal Election Commission chairman Trevor Potter in consultation with dozens of strategists, democracy reform leaders and constitutional attorneys from across the political spectrum," and is supported by reform organizations such as Represent.Us, which advocate for the passage of local, state, and federal laws modeled after the AACA. It is designed to limit or outlaw practices perceived to be major contributors to political corruption.

Three ballot measures were certified for the November 6, 2018, general election in the state of Massachusetts.