| Taxation in the United Kingdom |

|---|

|

| UK Government Departments |

| UK Government |

|

| Scottish Government |

| Welsh Government |

| Local Government |

The Climate Change Levy (CCL) is a tax on energy delivered to non-domestic users in the United Kingdom.

| Taxation in the United Kingdom |

|---|

|

| UK Government Departments |

| UK Government |

|

| Scottish Government |

| Welsh Government |

| Local Government |

The Climate Change Levy (CCL) is a tax on energy delivered to non-domestic users in the United Kingdom.

Introduced on 1 April 2001 under the Finance Act 2000, it was forecast to cut annual emissions by 2.5 million tonnes by 2010, and forms part of the UK's Climate Change Programme.[ citation needed ] The levy applies to most energy users, with the notable exceptions of those in the domestic and transport sectors.[ citation needed ] Electricity from nuclear is taxed even though it causes no direct carbon emissions.[ citation needed ] Originally electricity generated from new renewables and approved cogeneration schemes was not taxed, but the July 2015 Budget removed this exemption from 1 August 2015, raising £450m/year. [1]

From when it was introduced, the levy was frozen at 0.43p/kWh on electricity, 0.15p/kWh on coal and 0.15p/kWh on gas.[ citation needed ]

A reduction of up to 90% from the levy may be gained by energy-intensive users provided they sign a Climate Change Agreement. [2]

Revenue from the levy was offset by a 0.3% employers' rate reduction in National Insurance. However, the Finance Act 2002 subsequently increased that rate by 1%, reversing the reduction. The revenue used to fund a number of energy efficiency initiatives such as The Carbon Trust. However, revenue recycling was removed at the Spending Review 2010, with the revenue going to the Exchequer. [3]

In the 2006 budget it was announced that the levy would in future rise annually in line with inflation, starting from 1 April 2007. [4] In the 2018 Budget, it was announced that the rates of the Climate Change Levy would be adjusted until 2022 so that the gas rate reaches 60% of the electricity rate in 2021 to 2022. [5]

Rates have changed as tabulated below.

| Fuel type | Rate |

|---|---|

| Electricity | 0.541 p/kWh |

| Gas | 0.188 p/kWh |

| LPG | 1.21 p/kg |

| Any other "taxable commodity" | 1.429 p/kg |

| Fuel type | Rate |

|---|---|

| Electricity | 0.847 p/kWh |

| Gas | 0.339 p/kWh |

| LPG | 2.175 p/kg |

| Any other "taxable commodity" | 2.653 p/kg |

| Fuel type | Rate |

|---|---|

| Electricity | 0.811 p/kWh |

| Gas | 0.406 p/kWh |

| LPG | 2.175 p/kg |

| Any other "taxable commodity" | 3.174 p/kg |

A carbon tax is a tax levied on the carbon emissions from producing goods and services. Carbon taxes are intended to make visible the hidden social costs of carbon emissions. They are designed to reduce greenhouse gas emissions by essentially increasing the price of fossil fuels. This both decreases demand for goods and services that produce high emissions and incentivizes making them less carbon-intensive. When a fossil fuel such as coal, petroleum, or natural gas is burned, most or all of its carbon is converted to CO2. Greenhouse gas emissions cause climate change. This negative externality can be reduced by taxing carbon content at any point in the product cycle.

The United Kingdom's Climate Change Programme was launched in November 2000 by the British government in response to its commitment agreed at the 1992 United Nations Conference on Environment and Development (UNCED). The 2000 programme was updated in March 2006 following a review launched in September 2004.

The Carbon Trust is a United Kingdom-based consultancy established in March 2001. Its aim is to accelerate the pace of private sector decarbonisation and increase energy efficiency in the United Kingdom and worldwide.

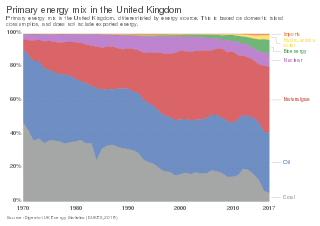

Energy in the United Kingdom came mostly from fossil fuels in 2021. Total energy consumption in the United Kingdom was 142.0 million tonnes of oil equivalent in 2019. In 2014, the UK had an energy consumption per capita of 2.78 tonnes of oil equivalent compared to a world average of 1.92 tonnes of oil equivalent. Demand for electricity in 2023 was 29.6 GW on average, supplied through 235 TWh of UK-based generation and 24 TWh of energy imports.

Various energy conservation measures are taken in the United Kingdom.

The energy policy of the United Kingdom refers to the United Kingdom's efforts towards reducing energy intensity, reducing energy poverty, and maintaining energy supply reliability. The United Kingdom has had success in this, though energy intensity remains high. There is an ambitious goal to reduce carbon dioxide emissions in future years, but it is unclear whether the programmes in place are sufficient to achieve this objective. Regarding energy self-sufficiency, UK policy does not address this issue, other than to concede historic energy security is currently ceasing to exist.

When the Climate Change Levy was introduced in the United Kingdom, the position of energy-intensive industries was considered, given their energy usage, the requirements of the Integrated Pollution Prevention and Control regime and their exposure to international competition. As a result, a 65% discount from the levy was allowed for those sectors that agreed targets for improving their energy efficiency or reducing carbon emissions. The discount on electricity increased to 90% in 2013.

The energy policy of Australia is subject to the regulatory and fiscal influence of all three levels of government in Australia, although only the State and Federal levels determine policy for primary industries such as coal. Federal policies for energy in Australia continue to support the coal mining and natural gas industries through subsidies for fossil fuel use and production. Australia is the 10th most coal-dependent country in the world. Coal and natural gas, along with oil-based products, are currently the primary sources of Australian energy usage and the coal industry produces over 30% of Australia's total greenhouse gas emissions. In 2018 Australia was the 8th highest emitter of greenhouse gases per capita in the world.

The Climate Change Committee (CCC), originally named the Committee on Climate Change, is an independent non-departmental public body, formed under the Climate Change Act (2008) to advise the United Kingdom and devolved Governments and Parliaments on tackling and preparing for climate change. The Committee provides advice on setting carbon budgets, and reports regularly to the Parliaments and Assemblies on the progress made in reducing greenhouse gas emissions. Notably, in 2019 the CCC recommended the adoption of a target of net zero greenhouse gas emissions by the United Kingdom by 2050. On 27 June 2019 the British Parliament amended the Climate Change Act (2008) to include a commitment to net zero emissions by 2050. The CCC also advises and comments on the UK's progress on climate change adaptation through updates to Parliament.

The United States produced 5.2 billion metric tons of carbon dioxide equivalent greenhouse gas (GHG) emissions in 2020, the second largest in the world after greenhouse gas emissions by China and among the countries with the highest greenhouse gas emissions per person. In 2019 China is estimated to have emitted 27% of world GHG, followed by the United States with 11%, then India with 6.6%. In total the United States has emitted a quarter of world GHG, more than any other country. Annual emissions are over 15 tons per person and, amongst the top eight emitters, is the highest country by greenhouse gas emissions per person.

The CRC Energy Efficiency Scheme was a mandatory carbon emissions reduction scheme in the United Kingdom which applied to large energy-intensive organisations in the public and private sectors. It was estimated that the scheme would reduce carbon emissions by 1.2 million tonnes of carbon per year by 2020. In an effort to avoid dangerous climate change, the British Government first committed to cutting UK carbon emissions by 60% by 2050, and in October 2008 increased this commitment to 80%. The scheme has also been credited with driving up demand for energy-efficient goods and services.

The availability and uptake of green electricity in the United Kingdom has increased in the 21st century. There are a number of suppliers offering green electricity in the United Kingdom. In theory these types of tariffs help to lower carbon dioxide emissions by increasing consumer demand for green electricity and encouraging more renewable energy plant to be built. Since Ofgem's 2014 regulations there are now set criteria defining what can be classified as a green source product. As well as holding sufficient guarantee of origin certificates to cover the electricity sold to consumers, suppliers are also required to show additionality by contributing to wider environmental and low carbon funds.

The biofuel sector in the United Kingdom, under the auspices of the government's Renewable Transport Fuel Obligation (RTFO), has been progressing towards enhanced sustainable energy solutions. Marking a significant stride in this direction was the government's endorsement and introduction of E10 biofuel in late 2021. This fuel blend, consisting of 90% regular unleaded gasoline and 10% ethanol, was introduced as part of an initiative to reduce greenhouse gas emissions (GHG) from transport fuels. The introduction of E10 led to a shift in the renewable fuel landscape in the UK, particularly influencing an increase in the utilization of non-waste feedstocks. In the year 2022, the biofuel sector, as per government reports, achieved a reduction in GHG emissions by 82% in comparison to traditional fossil fuels.

Different methods of electricity generation can incur a variety of different costs, which can be divided into three general categories: 1) wholesale costs, or all costs paid by utilities associated with acquiring and distributing electricity to consumers, 2) retail costs paid by consumers, and 3) external costs, or externalities, imposed on society.

The Climate Action Plan (CAP) in Boulder, Colorado, is a set of strategies intended to guide community efforts for reducing greenhouse gas emissions. These strategies have focused on improving energy efficiency and conservation in homes and businesses—the source of nearly three-fourths of local emissions. The plan also promotes strategies to reduce emissions from transportation, which account for over 20 percent of local greenhouse gas sources.

A carbon fee and dividend or climate income is a system to reduce greenhouse gas emissions and address climate change. The system imposes a carbon tax on the sale of fossil fuels, and then distributes the revenue of this tax over the entire population as a monthly income or regular payment.

A feed-in tariff (FIT) is paid by energy suppliers in the United Kingdom if a property or organisation generates their own electricity using technology such as solar panels or wind turbines and feeds any surplus back to the grid. The FIT scheme was imposed on suppliers by the UK government, and applied to installations completed between July 2009 and March 2019.

Ireland is a net energy importer. Ireland's import dependency decreased to 85% in 2014. The cost of all energy imports to Ireland was approximately €5.7 billion, down from €6.5 billion (revised) in 2013 due mainly to falling oil and, to a lesser extent, gas import prices. Consumption of all fuels fell in 2014 with the exception of peat, renewables and non-renewable wastes.

Citizens' Climate Lobby (CCL) is an international grassroots environmental group that trains and supports volunteers to build relationships with their elected representatives in order to influence climate policy. The CCL is a registered 501(c)(4) with approximately $680,000 in revenue in the United States in 2018. Operating since 2007, the goal of CCL is to build political support across party lines to put a price on carbon, specifically a revenue-neutral carbon fee and dividend (CF&D) at the national level. CCL is supported by notable climate scientists James Hansen, Katharine Hayhoe, and Daniel Kammen. CCL's advisory board also includes former Secretary of State George P. Shultz, former US Representative Bob Inglis, actor Don Cheadle, and RESULTS founder Sam Daley-Harris.

Green economy policies in Canada are policies that contribute to transitioning the Canadian economy to a more environmentally sustainable one. The green economy can be defined as an economy, "that results in improved human well-being and social equity, while significantly reducing environmental risks and ecological scarcities." Aspects of a green economy would include stable growth in income and employment that is driven by private and public investment into policies and actions that reduce carbon emissions, pollution and prevent the loss of biodiversity.