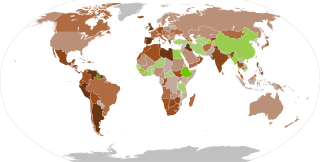

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period by countries. Due to its complex and subjective nature this measure is often revised before being considered a reliable indicator. GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation rates of the countries; therefore, using a basis of GDP per capita at purchasing power parity (PPP) may be more useful when comparing living standards between nations, while nominal GDP is more useful comparing national economies on the international market. Total GDP can also be broken down into the contribution of each industry or sector of the economy. The ratio of GDP to the total population of the region is the per capita GDP.

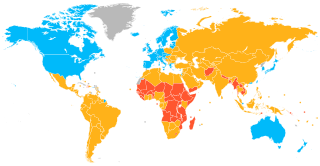

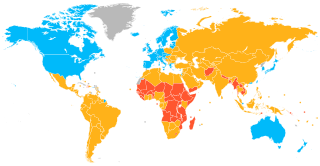

A developed country is a sovereign state that has a high quality of life, developed economy and advanced technological infrastructure relative to other less industrialized nations. Most commonly, the criteria for evaluating the degree of economic development are gross domestic product (GDP), gross national product (GNP), the per capita income, level of industrialization, amount of widespread infrastructure and general standard of living. Which criteria are to be used and which countries can be classified as being developed are subjects of debate. A point of reference of US$20,000 in 2021 USD nominal GDP per capita for the International Monetary Fund (IMF) is a good point of departure, it is a similar level of development to the United States in 1960.

The category of newly industrialized country (NIC), newly industrialized economy (NIE) or middle income country is a socioeconomic classification applied to several countries around the world by political scientists and economists. They represent a subset of developing countries whose economic growth is much higher than other developing countries; and where the social consequences of industrialization, such as urbanization, are reorganizing society.

The world economy or global economy is the economy of all humans of the world, referring to the global economic system, which includes all economic activities which are conducted both within and between nations, including production, consumption, economic management, work in general, exchange of financial values and trade of goods and services. In some contexts, the two terms are distinct "international" or "global economy" being measured separately and distinguished from national economies, while the "world economy" is simply an aggregate of the separate countries' measurements. Beyond the minimum standard concerning value in production, use and exchange, the definitions, representations, models and valuations of the world economy vary widely. It is inseparable from the geography and ecology of planet Earth.

The economy of Asia comprises more than 4.5 billion people living in 49 different nations. Asia is the fastest growing economic region, as well as the largest continental economy by both GDP Nominal and PPP in the world. Moreover, Asia is the site of some of the world's longest modern economic booms, starting from the Japanese economic miracle (1950–1990), Miracle on the Han River (1961–1996) in South Korea, economic boom (1978–2013) in China, Tiger Cub Economies (1990–present) in Indonesia, Malaysia, Thailand, Philippines, and Vietnam, and economic boom in India (1991–present).

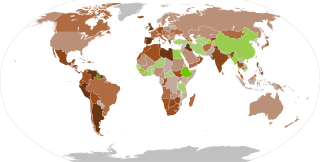

An emerging market is a market that has some characteristics of a developed market, but does not fully meet its standards. This includes markets that may become developed markets in the future or were in the past. The term "frontier market" is used for developing countries with smaller, riskier, or more illiquid capital markets than "emerging". As of 2006, the economies of China and India are considered to be the largest emerging markets. According to The Economist, many people find the term outdated, but no new term has gained traction. Emerging market hedge fund capital reached a record new level in the first quarter of 2011 of $121 billion. The 10 largest emerging and developing economies by either nominal or PPP-adjusted GDP are 4 of the 5 BRICS countries along with Indonesia, Iran, South Korea, Mexico, Saudi Arabia, Taiwan and Turkey.

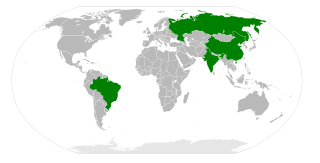

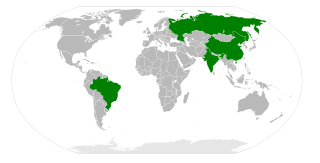

BRIC is a grouping acronym which refers to the countries of Brazil, Russia, India and China deemed to be developing countries at a similar stage of newly advanced economic development, on their way to becoming developed countries. It is typically rendered as "the BRIC," "the BRIC countries," "the BRIC economies," or alternatively as the "Big Four". The name has since been changed to BRICS after the addition of South Africa in 2010.

In Statistics, Economics and Finance, an index is a statistical measure of change in a representative group of individual data points. These data may be derived from any number of sources, including company performance, prices, productivity, and employment. Economic indices track economic health from different perspectives.

VISTA is an acronym for Vietnam, Indonesia, South Africa, Turkey, Argentina, used in economics in grouping and discussing emerging markets. The concept was first proposed in 2006 by BRICs Economic Research Institute of Japan, but has not been significantly popularised in the academic and business world. This has led to economic experts proposing different definitions and implications of VISTA. While some see the economic potential of these emerging economies as individually promising, others challenge that the concept of economic acronyms is limiting as the countries' social and development factors are usually not taken into account. For investors, VISTA has been considered as an opportunity to enter into a newly–emerging market, particularly following the post-BRICS era.

A global recession is recession that affects many countries around the world—that is, a period of global economic slowdown or declining economic output.

Terence James O'Neill, Baron O'Neill of Gatley is a British economist best known for coining BRICs, the acronym that stands for Brazil, Russia, India, and China—the four once rapidly developing countries that were thought to challenge the global economic power of the developed G7 economies. He is also a former chairman of Goldman Sachs Asset Management and former Conservative government minister. As of January 2014, he is an Honorary Professor of Economics at the University of Manchester. He was appointed Commercial Secretary to the Treasury in the Second Cameron Ministry, a position he held until his resignation on 23 September 2016. He chaired the UK's Independent Review into Antimicrobial Resistance for two years, which completed its work in May 2016. Since 2008, he has written monthly columns for international media organization Project Syndicate. He is the current chairman of the Council of Chatham House, the Royal Institute of International Affairs.

The CIVETS are six emerging market countries – Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa. These countries are grouped for several reasons, such as "a diverse and dynamic economy" and "a young, growing population". This list is comparable to the Next Eleven, devised by Jim O'Neill of Goldman Sachs.

3G countries or Global Growth Generating countries are 11 countries which have been identified as sources of growth potential and of profitable investment opportunities.

BRICS is the acronym coined to associate five major emerging economies: Brazil, Russia, India, China and South Africa. Also Argentina requested a former membership application that seems to be succesful. The BRICS members are known for their significant influence on world affairs. Since 2009, the governments of the BRICS states have met annually at formal summits. China hosted the most recent 14th BRICS summit on 24 July 2022 virtually. BRICS host New Development Bank, Contingent Reserve Arrangement, BRICS payment system, and BRICS basket reserve currency officially announced in 2022.

Ruchir Sharma is an investor, author, fund manager and columnist for the Financial Times. He is the Chairman of Rockefeller International, and was an emerging markets investor at Morgan Stanley Investment Management.

MINT is an acronym referring to the economies of Mexico, Indonesia, Nigeria, and Turkey. The term was originally coined in 2014 by Fidelity Investments, a Boston-based asset management firm, and was popularized by Jim O'Neill of Goldman Sachs, who had created the term BRIC. The term is primarily used in the economic and financial spheres as well as in academia. Its usage has grown specially in the investment sector, where it is used to refer to the bonds issued by these governments. These four countries are also part of the "Next Eleven".

Banco Bilbao Vizcaya Argentaria, S.A., better known by its initialism BBVA, is a Spanish multinational financial services company based in Madrid and Bilbao, Spain. It is one of the largest financial institutions in the world, and is present mainly in Spain, South America, North America, Turkey, and Romania.

The Asian Development Outlook is an annual publication produced by the Asian Development Bank (ADB). It offers economic analysis and forecasts, as well as an examination of social development issues, for most countries in Asia. It is published each March/April with an update published in September and brief supplements published in July and December. The publication is prepared by staff of ADB's regional departments, and field offices, under the coordination of the Economic Research and Regional Cooperation Department with the goal of developing "consistent forecasts for the region".

The COVID-19 recession, also referred to as the Great Lockdown, is a global economic recession caused by the COVID-19 pandemic. The recession began in most countries in February 2020.

The 2022 stock market decline is an ongoing economic event involving a decline in stock markets globally.