Related Research Articles

State Bank of India (SBI) is an Indian multinational public sector bank and financial services statutory body headquartered in Mumbai, Maharashtra. SBI is the 47th largest bank in the world by total assets and ranked 221st in the Fortune Global 500 list of the world's biggest corporations of 2020, being the only Indian bank on the list. It is a public sector bank and the largest bank in India with a 23% market share by assets and a 25% share of the total loan and deposits market. It is also the tenth largest employer in India with nearly 250,000 employees. In 2023, the company’s seat in Forbes Global 2000 was 77.

Indian Bank is an Indian public sector bank, established in 1907 and headquartered in Chennai. It serves over 100 million customers with 40,187 employees, 5,847 branches with 4,937 ATMs and Cash deposit machines. Total business of the bank has touched ₹1,221,773 crore (US$150 billion) as of March 31, 2024.

State Bank of Hyderabad (SBH) was a regional bank in Hyderabad, with headquarters at Gunfoundry, Abids, Hyderabad, Telangana. Founded by the 7th Nizam of Hyderabad State, Mir Osman Ali Khan, it is now one of the five associate banks of State Bank of India (SBI) and was one of the nationalised banks in India. It was established on 8 February 1941 as the Hyderabad State Bank. From 1956 until 31 March 2017, it had been an associate bank of the SBI, the largest such. After formation of Telangana in 2014, SBH was the lead bank of the newly created state. The State Bank of Hyderabad was merged with State Bank of India on 1 April 2017.

State Bank of Mysore was a Public Sector bank in India, with headquarters at Bangalore. It was one of the five associate banks of State Bank of India, all of which were consolidated with the State Bank of India with effect from 1 April 2017.

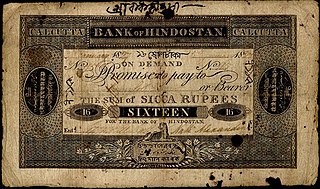

Modern banking in India originated in the mid of 18th century. Among the first banks were the Bank of Hindustan, which was established in 1770 and liquidated in 1829–32; and the General Bank of India, established in 1786 but failed in 1791.

The IDBI Bank Limited is a Scheduled Commercial Bank under the ownership of Life Insurance Corporation of India (LIC) and Government of India. It was established by Government of India as a wholly owned subsidiary of Reserve Bank of India in 1964 as Industrial Development Bank of India, a Development Finance Institution, which provided financial services to industrial sector. In 2005, the institution was merged with its subsidiary commercial division, IDBI Bank, and was categorised as "Other Development Finance Institution" category. Later in March 2019, Government of India asked LIC to infuse capital in the bank due to high NPA and capital adequacy issues and also asked LIC to manage the bank to meet the regulatory norms. Consequent upon LIC acquiring 51% of the total paid-up equity share capital, the bank was categorised as a 'Private Sector Bank' for regulatory purposes by Reserve Bank of India with effect from 21 January 2019. IDBI was put under Prompt Corrective Action of the Reserve Bank of India and on 10 March 2021 IDBI came out of the same. At present direct and indirect shareholding of Government of India in IDBI Bank is approximately 95%, which Government of India (GoI) vide its communication F.No. 8/2/2019-BO-II dated 17 December 2019, has clarified and directed all Central/State Government departments to consider IDBI Bank for allocation of Government Business. Many national institutes find their roots in IDBI like SIDBI, EXIM, National Stock Exchange of India, SEBI, National Securities Depository Limited. Presently, IDBI Bank is one of the largest Commercial Banks in India.

The Bank of Calcutta was founded on 2 June 1806, mainly to fund General Arthur Wellesley's wars against Tipu Sultan and the Marathas. It was the tenth oldest bank in India and was renamed Bank of Bengal on 2 January 1809.

Axis Bank Limited, formerly known as UTI Bank (1993–2007), is an Indian multinational banking and financial services company headquartered in Mumbai, Maharashtra. It is India's third largest private sector bank by assets and fourth largest by market capitalisation. It sells financial services to large and mid-size companies, SMEs and retail businesses.

Public Sector Undertakings (Banks) are a major type of government-owned banks in India, where a majority stake (i.e., more than 50%) is held by the Ministry of Finance (India) of the Government of India or State Ministry of Finance of various State Governments of India. The shares of these government-owned-banks are listed on stock exchanges. Their main objective is social welfare.

Bank of Hindostan (1770–1832), a now defunct bank, was the third oldest bank in India.

The Bank of Bombay was the second oldest bank in India after The Madras Bank (1683). It was started in 1720, and lasted until 1770.

The General Bank of Bengal and Bihar was a bank in British India that operated between 1773 and 1775.

The Bengal Bank was a bank founded in 1784 in British India. The bank was the fifth oldest bank in India.

The Carnatic Bank was an Indian bank founded in the year 1788 in British India. The bank was the seventh oldest bank in India. The bank was eventually merged with the Bank of Madras in 1843.

The Commercial Bank was a bank founded in the year 1819 in British India. The bank was the eleventh oldest bank in India.

The Calcutta Bank was a bank founded in the year 1824 in British India. The bank was the twelfth oldest bank in India.

The Government Savings Bank (1833) was an Indian bank founded in 1833 in British India and operated until it was liquidated in 1843. The bank was the fifteenth oldest bank in India.

The British Bank of Madras (1795) was a bank founded in the year 1795 in British India. The bank was the eighth oldest bank in India.

The Asiatic Bank (1804) was a bank founded in the year 1804 in British India. The bank was the ninth oldest bank in India.

References

- ↑ "The World's Biggest Employers". Forbes . Retrieved 31 July 2015.

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 "Reserve Bank of India - Museum". rbi.org.in.

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 Shrivastava, Mohan Prasad (2007). Banking Reforms and Globalisation. APH. ISBN 9788131301593.

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 Bankingrbi.org.in Archived 17 December 2021 at the Wayback Machine

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 "The State Bank of India (Subsidiary Banks) Act, 1959". indiankanoon.org. Retrieved 20 September 2023.