The 1979Oil Crisis, also known as the 1979 Oil Shock or Second Oil Crisis, was an energy crisis caused by a drop in oil production in the wake of the Iranian Revolution. Although the global oil supply only decreased by approximately four percent, the oil markets' reaction raised the price of crude oil drastically over the next 12 months, more than doubling it to $39.50 per barrel ($248/m3). The sudden increase in price was connected with fuel shortages and long lines at gas stations similar to the 1973 oil crisis.

"Seven Sisters" was a common term for the seven transnational oil companies of the "Consortium for Iran" oligopoly or cartel, which dominated the global petroleum industry from the mid-1940s to the mid-1970s. The oligopoly lasted until the 1970s when OPEC and national oil companies gained control over the key governing arrangements for oil production. The companies used interlocking ownership of oil fields to maintain collusion and restrict oil supply, so that the companies would reap greater profits.

Petróleos de Venezuela, S.A. is the Venezuelan state-owned oil and natural gas company. It has activities in exploration, production, refining and exporting oil as well as exploration and production of natural gas. Since its founding on 1 January 1976 with the nationalization of the Venezuelan oil industry, PDVSA has dominated the oil industry of Venezuela, the world's fifth largest oil exporter.

PJSC Rosneft Oil Company is a Russian integrated energy company headquartered in Moscow. Rosneft specializes in the exploration, extraction, production, refining, transport, and sale of petroleum, natural gas, and petroleum products. The company is controlled by the Russian government through the Rosneftegaz holding company. Its name is a portmanteau of the Russian words Rossiyskaya neft.

Big Oil is a name used to describe the world's six or seven largest publicly traded oil and gas companies, also known as supermajors. The term, particularly in the United States, emphasizes their economic power and influence on politics. Big Oil is often associated with the fossil fuels lobby and also used to refer to the industry as a whole in a pejorative or derogatory manner.

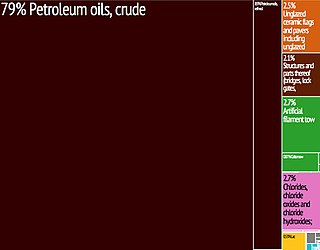

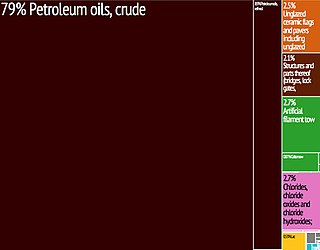

The energy policy of India is to increase energy in India and reduce energy poverty, with more focus on developing alternative sources of energy, particularly nuclear, solar and wind energy. India attained 63% overall energy self-sufficiency in 2017. The primary energy consumption in India grew by 2.3% in 2019 and is the third biggest after China and USA with 5.8% global share. The total primary energy consumption from coal (452.2 Mtoe; 45.88%), crude oil (239.1 Mtoe; 29.55%), natural gas (49.9 Mtoe; 6.17%), nuclear energy (8.8 Mtoe; 1.09%), hydro electricity (31.6 Mtoe; 3.91%) and renewable power (27.5 Mtoe; 3.40%) is 809.2 Mtoe (excluding traditional biomass use) in the calendar year 2018. In 2018, India's net imports are nearly 205.3 million tons of crude oil and its products, 26.3 Mtoe of LNG and 141.7 Mtoe coal totaling to 373.3 Mtoe of primary energy which is equal to 46.13% of total primary energy consumption. India is largely dependent on fossil fuel imports to meet its energy demands – by 2030, India's dependence on energy imports is expected to exceed 53% of the country's total energy consumption. About 80% of India's electricity generation is from fossil fuels. India is surplus in electricity generation and also marginal exporter of electricity in 2017. Since the end of calendar year 2015, huge power generation capacity has been idling for want of electricity demand. India ranks second after China in renewables production with 208.7 Mtoe in 2016. The carbon intensity in India was 0.29 kg of CO2 per kWhe in 2016 which is more than that of USA, China and EU.

The Labour government of Tony Blair in 1997 introduced a windfall tax on what were described as "the excess profits of the privatised utilities". It followed from their manifesto commitment made during the 1997 general election campaign to impose a "windfall levy" on the privatised utilities. The tax came after 18 years of Conservative government, which had seen the privatisation of many state-owned assets, at prices which many considered too low. It aimed to "put right the bad deal which customers and taxpayers got from the privatisation of the utilities". The tax produced an estimated one-off income to the government of £5 billion, which was used to fund the New Deal, a welfare-to-work program that sought to tackle long-term unemployment, as well as providing capital investment for schools and the University for Industry (Learndirect).

Canada has access to all main sources of energy including oil and gas, coal, hydropower, biomass, solar, geothermal, wind, marine and nuclear. It is the world's second largest producer of uranium, third largest producer of hydro-electricity, fourth largest natural gas producer, and the fifth largest producer of crude oil. In 2006, only Russia, the People's Republic of China, the United States and Saudi Arabia produce more total energy than Canada.

The nationalization of oil supplies refers to the process of confiscation of oil production operations and private property, generally in the purpose of obtaining more revenue from oil for oil-producing countries' governments. This process, which should not be confused with restrictions on crude oil exports, represents a significant turning point in the development of oil policy. Nationalization eliminates private business operations—in which private international companies control oil resources within oil-producing countries—and allows oil-producing countries to gain control of private property. Once these countries become the sole owners of these confiscated resources, they have to decide how to maximize the net present value of their known stock of oil in the ground. Several key implications can be observed as a result of oil nationalization. "On the home front, national oil companies are often torn between national expectations that they should 'carry the flag' and their own ambitions for commercial success, which might mean a degree of emancipation from the confines of a national agenda."

The 1980s oil glut was a serious surplus of crude oil caused by falling demand following the 1970s energy crisis. The world price of oil had peaked in 1980 at over US$35 per barrel ; it fell in 1986 from $27 to below $10. The glut began in the early 1980s as a result of slowed economic activity in industrial countries due to the crises of the 1970s, especially in 1973 and 1979, and the energy conservation spurred by high fuel prices. The inflation-adjusted real 2004 dollar value of oil fell from an average of $78.2 in 1981 to an average of $26.8 per barrel in 1986.

The Consumer First Energy Act of 2008 is a set of initiatives laid out by the US Democratic Party on Wednesday May 7, 2008. The plan was first mentioned by House Speaker Nancy Pelosi on April 27, 2006. The few details that have been released include:

Guyana is one of the newest petroleum producing regions in the world, making the first commercial grade crude oil draw in December 2019. Crude oil is sent abroad for refining.

Exxon Mobil Corporation, stylized as ExxonMobil, is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller's Standard Oil, and was formed on November 30, 1999, by the merger of Exxon and Mobil. ExxonMobil's primary brands are Exxon, Mobil, Esso, and ExxonMobil Chemical, which produces plastic, synthetic rubber, and other chemical products. ExxonMobil is incorporated in New Jersey.

Sources include: Dow Jones (DJ), New York Times (NYT), Wall Street Journal (WSJ), and the Washington Post (WP).

GasHole is a documentary film about the history of oil prices and the future of alternative fuels. The film was completed in 2008, premiered and released directly to DVD in 2010. The film details the dependency of the United States on foreign supplies of oil. The documentary is directed by Scott D. Roberts and Jeremy Wagener and narrated by Peter Gallagher.

In 2019, the total energy production in Indonesia is 450.79 Mtoe, with a total primary energy supply is 231.14 Mtoe and electricity final consumption is 263.32 TWh. Energy use in Indonesia has been long dominated by fossil resources. Once a major oil exporter in the world and joined OPEC in 1962, the country has since become a net oil importer despite still joined OPEC until 2016, making it the only net oil importer member in the organization. Indonesia is also the fourth-largest biggest coal producer and one of the biggest coal exporter in the world, with 24,910 million tons of proven coal reserves as of 2016, making it the 11th country with the most coal reserves in the world. In addition, Indonesia has abundant renewable energy potential, reaching almost 417,8 gigawatt (GW) which consisted of solar, wind, hydro, geothermal energy, ocean current, and bioenergy, although only 2,5% have been utilized. Furthermore, Indonesia along with Malaysia, have two-thirds of ASEAN's gas reserves with total annual gas production of more than 200 billion cubic meters in 2016.

Mining is important to the national economy of Mongolia. Mongolia is one of the 29 resource-rich developing countries identified by the International Monetary Fund and exploration of copper and coal deposits are generating substantial additional revenue. Coal, copper, and gold are the principal reserves mined in Mongolia. Several gold mines are located about 110 kilometres (68 mi) north of Ulaanbaatar, such as Boroo Gold Mine and Gatsuurt Gold Mine. Khotgor Coal Mine is an open-pit coal mining site about 120 kilometres (75 mi) west of Ulaangom. Ömnögovi Province in the south of Mongolia is home to large scale mining projects such as the Tavan Tolgoi coal mine and the Oyu Tolgoi copper mine. Oyu Tolgoi mine is reported to have the potential to boost the national economy by a third but is subject to dispute over how the profits should be shared. The International Monetary Fund (IMF) has estimated that 71 percent of the income from the mine would go to Mongolia.

The Windfall tax or windfall profits tax in Mongolia was a taxation on the profits made by mining companies operating in Mongolia. It was implemented in 2006 and was the highest windfall profits tax in the world. It was a tax on unsmelted copper and gold concentrate that was produced in Mongolia. The tax was repealed in 2009 and phased out over two years. Repealing the 68% tax law was considered essential to enable foreign mining companies to invest in mineral resources development of Mongolia.

Chad maintains sizable reserves of crude oil which, alongside agriculture, makes up the largest share of the landlocked former French colony's export revenue. Producing around 100,000 barrels of oil a day, most of Chad's crude comes from its reserves in the Doba Basin in southern Chad where oil was discovered in the early 1970s by foreign drillers. There is an estimated one billion barrels of oil in Chad, most of it being exploited by hundreds of rigs operated by Western companies such as Exxon-Mobil and Royal Dutch Shell. However, many challenges exist to Chad's petroleum industry including but not limited to corruption, internal conflict, and geography. Since Chad is landlocked, most of Chad's oil exports are transported out of the country by a pipeline that leads to the Cameroonian port city of Kribi. This pipeline, owned by a consortium, has come under fire due to allegations of exploitation by international corruption watchdogs, and Chadian politicians. In addition, environmentalists have voiced their concerns over the pipeline's impact on the natural environment, citing several spills.

The Crude Oil Windfall Profit Tax Act of 1980 was enacted as part of a compromise between the Carter Administration and the Congress over the decontrol of crude oil prices. The Act was intended to recoup the revenue earned by oil producers as a result of the sharp increase in oil prices brought about by the OPEC oil embargo. According to the Congressional Research Service, the Act's title was a misnomer. "Despite its name, the crude oil windfall profit tax... was not a tax on profits. It was an excise tax... imposed on the difference between the market price of oil, which was technically referred to as the removal price, and a statutory 1979 base price that was adjusted quarterly for inflation and state severance taxes."