Reaganomics, or Reaganism, refers to the neoliberal economic policies promoted by U.S. President Ronald Reagan during the 1980s. These policies are commonly associated with and characterized as supply-side economics, trickle-down economics, or "voodoo economics" by opponents, while Reagan and his advocates preferred to call it free-market economics.

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to fund government spending and various public expenditures, and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent.

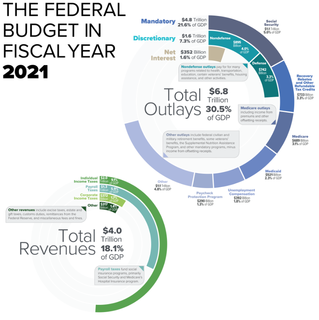

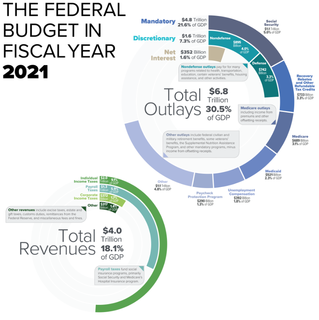

A government budget is a financial statement presenting the government's proposed revenues and spending for a financial year. The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a government budget surplus, and a negative balance is a government budget deficit. A budget is prepared for each level of government and takes into account public social security obligations.

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

The Index of Economic Freedom is an annual index and ranking created in 1995 by The Heritage Foundation and The Wall Street Journal to measure the degree of economic freedom in the world's nations. The creators of the index claim to take an approach inspired by that of Adam Smith in The Wealth of Nations, that "basic institutions that protect the liberty of individuals to pursue their own economic interests result in greater prosperity for the larger society".

A country's gross government debt is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt.

In a tax system, the tax rate is the ratio at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, and effective. These rates can also be presented using different definitions applied to a tax base: inclusive and exclusive.

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment. These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product.

In economics, the debt-to-GDP ratio is the ratio between a country's government debt and its gross domestic product (GDP). A low debt-to-GDP ratio indicates that an economy produces goods and services sufficient to pay back debts without incurring further debt. Geopolitical and economic considerations – including interest rates, war, recessions, and other variables – influence the borrowing practices of a nation and the choice to incur further debt. It should not be confused with a deficit-to-GDP ratio, which, for countries running budget deficits, measures a country's annual net fiscal loss in a given year as a percentage share of that country's GDP; for countries running budget surpluses, a surplus-to-GDP ratio measures a country's annual net fiscal gain as a share of that country's GDP.

The United States federal budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050.

The history of the United States public debt started with federal government debt incurred during the American Revolutionary War by the first U.S treasurer, Michael Hillegas, after the country's formation in 1776. The United States has continuously had a fluctuating public debt since then, except for about a year during 1835–1836. To allow comparisons over the years, public debt is often expressed as a ratio to gross domestic product (GDP). Historically, the United States public debt as a share of GDP has increased during wars and recessions, and subsequently declined.

Political debates about the United States federal budget discusses some of the more significant U.S. budgetary debates of the 21st century. These include the causes of debt increases, the impact of tax cuts, specific events such as the United States fiscal cliff, the effectiveness of stimulus, and the impact of the Great Recession, among others. The article explains how to analyze the U.S. budget as well as the competing economic schools of thought that support the budgetary positions of the major parties.

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the Federal budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt.

Taxation in Brazil is complex, with over sixty forms of tax. Historically, tax rates were low and tax evasion and avoidance were widespread. The 1988 Constitution called for an enhanced role of the State in society, requiring increased tax revenue. In 1960, and again between 1998 and 2004, efforts were made to make the collection system more efficient. Tax revenue gradually increased from 13.8% of GDP in 1947 to 37.4% in 2005. Tax revenue has become quite high by international standards, but without realising commensurate social benefit. More than half the total tax is in the regressive form of taxes on consumption.

Taxation in Armenia is regulated by the State Revenue Committee, which is the tax authority of the Armenian government. Meanwhile, the Armenian Tax Service is responsible for the collection of taxes, providing revenue services, preventing tax fraud and tax evasion, and implementing various tax reform programs in conjunction with the State Revenue Committee.