Related Research Articles

Monetary economics is the branch of economics that studies the different theories of money: it provides a framework for analyzing money and considers its functions, and it considers how money can gain acceptance purely because of its convenience as a public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects.

The Taylor rule is a monetary policy targeting rule. The rule was proposed in 1992 by American economist John B. Taylor for central banks to use to stabilize economic activity by appropriately setting short-term interest rates.

The Federal Reserve System has faced various criticisms since it was authorized in 1913. Nobel laureate economist Milton Friedman and his fellow monetarist Anna Schwartz criticized the Fed's response to the Wall Street Crash of 1929 arguing that it greatly exacerbated the Great Depression. More recent prominent critics include former Congressman Ron Paul.

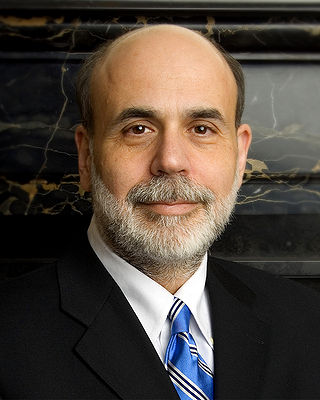

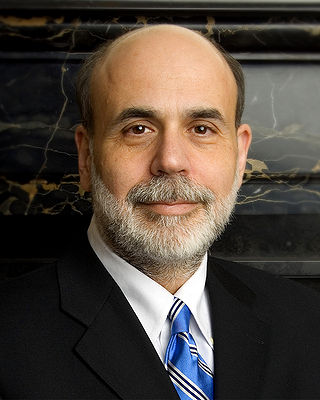

Ben Shalom Bernanke is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Fed, he was appointed a distinguished fellow at the Brookings Institution. During his tenure as chairman, Bernanke oversaw the Federal Reserve's response to the late-2000s financial crisis, for which he was named the 2009 Time Person of the Year. Before becoming Federal Reserve chairman, Bernanke was a tenured professor at Princeton University and chaired the department of economics there from 1996 to September 2002, when he went on public service leave. Bernanke was awarded the 2022 Nobel Memorial Prize in Economic Sciences, jointly with Douglas Diamond and Philip H. Dybvig, "for research on banks and financial crises", more specifically for his analysis of the Great Depression.

Anna Jacobson Schwartz was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for The New York Times. Paul Krugman has said that Schwartz is "one of the world's greatest monetary scholars."[1]

Lars Peter Hansen is an American economist. He is the David Rockefeller Distinguished Service Professor in Economics, Statistics, and the Booth School of Business, at the University of Chicago and a 2013 recipient of the Nobel Memorial Prize in Economics.

Bendheim Center for Finance (BCF) is an interdisciplinary center at Princeton University. It was established in 1997 at the initiative of Ben Bernanke and is dedicated to research and education in the area of money and finance, in lieu of there not being a full professional business school at Princeton.

The Greenspan put was a monetary policy response to financial crises that Alan Greenspan, former chair of the Federal Reserve, exercised beginning with the crash of 1987. Successful in addressing various crises, it became controversial as it led to periods of extreme speculation led by Wall Street investment banks overusing the put's repurchase agreements and creating successive asset price bubbles. The banks so overused Greenspan's tools that their compromised solvency in the global financial crisis of 2007–2008 required Fed chair Ben Bernanke to use direct quantitative easing. The term Yellen put was used to refer to Fed chair Janet Yellen's policy of perpetual monetary looseness.

The financial accelerator in macroeconomics is the process by which adverse shocks to the economy may be amplified by worsening financial market conditions. More broadly, adverse conditions in the real economy and in financial markets propagate the financial and macroeconomic downturn.

James Brian Bullard is the chief executive officer and 12th president of the Federal Reserve Bank of St. Louis, positions he has held since 2008. He is currently serving a term that began on March 1, 2021. In 2014, he was named the 7th most influential economist in the world in terms of media influence.

William C. Dudley is an American economist who served as the president of Federal Reserve Bank of New York from 2009 to 2018 and as vice-chairman of the Federal Open Market Committee. He was appointed to the position on January 27, 2009, following the confirmation of his predecessor, Timothy F. Geithner, as United States Secretary of the Treasury.

Markus Konrad Brunnermeier is an economist, who is the Edwards S. Sanford Professor of Economics at Princeton University.

Hyun Song Shin (Korean: 신현송) is a South Korean economic theorist and financial economist who focuses on global games. He has been the Economic Adviser and Head of Research of the Bank for International Settlements (BIS) since May 1, 2014.

The credit channel mechanism of monetary policy describes the theory that a central bank's policy changes affect the amount of credit that banks issue to firms and consumers for purchases, which in turn affects the real economy.role of commercial banks

Lasse Heje Pedersen is a Danish financial economist known for his research on liquidity risk and asset pricing. He is Professor of Finance at the Copenhagen Business School. Before that, he held the position of a Professor of Finance and Alternative Investments at the New York University Stern School of Business. He has also served in the monetary policy panel and liquidity working group at the Federal Reserve Bank of New York and is a principal at AQR Capital Management.

The interest rate channel is a mechanism of monetary policy, whereby a policy-induced change in the short-term nominal interest rate by the central bank affects the price level, and subsequently output and employment.

Andrew Bruce Abel is an American economist, a professor in the Department of Finance in The Wharton School of the University of Pennsylvania.

Marvin Seth Goodfriend was an American economist. He held the Allan H. Meltzer Professorship in economics at Carnegie Mellon University; he was previously the director of research at the Federal Reserve Bank of Richmond. Following his 2017 nomination to the Federal Reserve Board of Governors, the White House decided to forgo renominating Goodfriend at the beginning of the new term.

The 2022 Nobel Memorial Prize in Economic Sciences was divided equally between the American economists Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig "for research on banks and financial crises" on 10 October 2022. The award was established in 1968 by an endowment "in perpetuity" from Sweden's central bank, Sveriges Riksbank, to commemorate the bank's 300th anniversary. Laureates in the Memorial Prize in Economics are selected by the Royal Swedish Academy of Sciences. The Nobel Committee announced the reason behind their recognition, stating:

"This year’s laureates in the Economic Sciences, Ben Bernanke, Douglas Diamond and Philip Dybvig, have significantly improved our understanding of the role of banks in the economy, particularly during financial crises. An important finding in their research is why avoiding bank collapses is vital."