Keynesian economics are the various macroeconomic theories and models of how aggregate demand strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. It is influenced by a host of factors that sometimes behave erratically and impact production, employment, and inflation.

Milton Friedman was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the complexity of stabilization policy. With George Stigler, Friedman was among the intellectual leaders of the Chicago school of economics, a neoclassical school of economic thought associated with the work of the faculty at the University of Chicago that rejected Keynesianism in favor of monetarism until the mid-1970s, when it turned to new classical macroeconomics heavily based on the concept of rational expectations. Several students, young professors and academics who were recruited or mentored by Friedman at Chicago went on to become leading economists, including Gary Becker, Robert Fogel, and Robert Lucas Jr.

Post-Keynesian economics is a school of economic thought with its origins in The General Theory of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney Weintraub, Paul Davidson, Piero Sraffa and Jan Kregel. Historian Robert Skidelsky argues that the post-Keynesian school has remained closest to the spirit of Keynes' original work. It is a heterodox approach to economics based on a non-equilibrium approach.

Franco Modigliani ( was an Italian-American economist and the recipient of the 1985 Nobel Memorial Prize in Economics. He was a professor at University of Illinois at Urbana–Champaign, Carnegie Mellon University, and MIT Sloan School of Management.

In economics and political science, fiscal policy is the use of government revenue collection and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation and to increase employment. In modern economies, inflation is conventionally considered "healthy" in the range of 2%–3%. Additionally, it is designed to try to keep GDP growth at 2%–3% and the unemployment rate near the natural unemployment rate of 4%–5%. This implies that fiscal policy is used to stabilise the economy over the course of the business cycle.

Supply-side economics is a macroeconomic theory postulating that economic growth can be most effectively fostered by lowering taxes, decreasing regulation, and allowing free trade. According to supply-side economics theory, consumers will benefit from greater supply of goods and services at lower prices, and employment will increase. Supply-side fiscal policies are designed to increase aggregate supply, as opposed to aggregate demand, thereby expanding output and employment while lowering prices. Such policies are of several general varieties:

- Investments in human capital, such as education, healthcare, and encouraging the transfer of technologies and business processes, to improve productivity. Encouraging globalized free trade via containerization is a major recent example.

- Tax reduction, to provide incentives to work, invest and take risks. Lowering income tax rates and eliminating or lowering tariffs are examples of such policies.

- Investments in new capital equipment and research and development (R&D), to further improve productivity. Allowing businesses to depreciate capital equipment more rapidly gives them an immediate financial incentive to invest in such equipment.

- Reduction in government regulations, to encourage business formation and expansion.

Nicholas Kaldor, Baron Kaldor, born Káldor Miklós, was a Hungarian-born British economist. He developed the "compensation" criteria called Kaldor–Hicks efficiency for welfare comparisons (1939), derived the cobweb model, and argued for certain regularities observable in economic growth, which are called Kaldor's growth laws. Kaldor worked alongside Gunnar Myrdal to develop the key concept Circular Cumulative Causation, a multicausal approach where the core variables and their linkages are delineated.

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit, the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. A central point of controversy in economics, government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression.

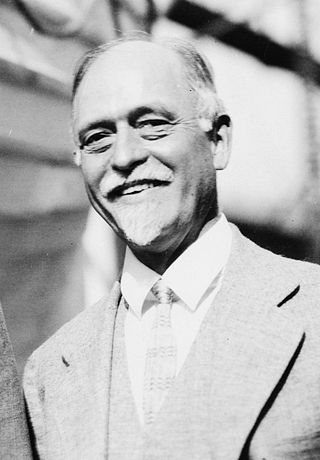

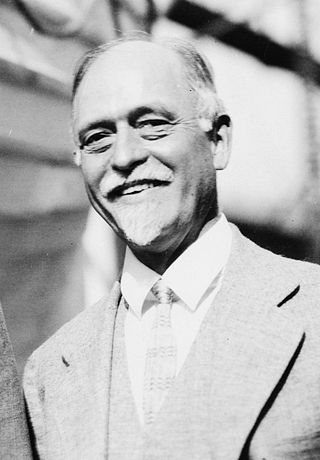

Irving Fisher was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school. Joseph Schumpeter described him as "the greatest economist the United States has ever produced", an assessment later repeated by James Tobin and Milton Friedman.

John Brian Taylor is the Mary and Robert Raymond Professor of Economics at Stanford University, and the George P. Shultz Senior Fellow in Economics at Stanford University's Hoover Institution.

Alvin Harvey Hansen was an American economist who taught at the University of Minnesota and was later a chair professor of economics at Harvard University. Often referred to as "the American Keynes", he was a widely read popular author on economic issues, and an influential advisor to the government on economic policy. Hansen helped create the Council of Economic Advisors and the Social Security system. He is best remembered today for introducing Keynesian economics in the United States in the 1930s and 40s.

Modern monetary theory or modern money theory (MMT) is a heterodox macroeconomic theory that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of the financial assets needed to pay taxes and satisfy savings desires. According to MMT, governments do not need to worry about accumulating debt since they can pay interest by printing money. MMT argues that the primary risk once the economy reaches full employment is inflation, which acts as the only constraint on spending. MMT also argues that inflation can be controlled by increasing taxes on everyone, to reduce the spending capacity of the private sector.

The history of economic thought is the study of the philosophies of the different thinkers and theories in the subjects that later became political economy and economics, from the ancient world to the present day.

Sidney Weintraub was an American economist, one of the most prominent American members of the Post Keynesian economics school. He was the co-founder and co-editor of The Journal of Post Keynesian Economics (1978). His views included criticism of monetarism and the neoclassical synthesis, and promotion of the tax-based incomes policy (TIP).

Alberto Francesco Alesina was an Italian economist who was the Nathaniel Ropes Professor of Political Economy at Harvard University from 2003 until his death in 2020. He was known principally as an economist of politics and culture, and was famed for his usage of economic tools to study social and political issues. He was described as having “almost single-handedly” established the modern field of political economy, and as a likely contender for the Nobel Memorial Prize in Economic Sciences.

Public economics(or economics of the public sector) is the study of government policy through the lens of economic efficiency and equity. Public economics builds on the theory of welfare economics and is ultimately used as a tool to improve social welfare. Welfare can be defined in terms of well-being, prosperity, and overall state of being.

Redistribution of income and wealth is the transfer of income and wealth from some individuals to others through a social mechanism such as taxation, welfare, public services, land reform, monetary policies, confiscation, divorce or tort law. The term typically refers to redistribution on an economy-wide basis rather than between selected individuals.

The post–World War II economic expansion, also known as the postwar economic boom or the Golden Age of Capitalism, was a broad period of worldwide economic expansion beginning with the aftermath of World War II and ending with the 1973–1975 recession. The United States, the Soviet Union, Australia and Western European and East Asian countries in particular experienced unusually high and sustained growth, together with full employment.

Geoffrey Colin Harcourt was an Australian academic economist and leading member of the post-Keynesian school. He studied at the University of Melbourne and then at King's College, Cambridge.

The Poverty of "Development Economics" is a 1983 book by Deepak Lal. Adam Szirmai notes that this book "summarised and popularised much of the earlier criticisms on the dominant paradigm" in development economics and that it "was an influential publication which contributed to the enormous shift in thinking about development." The dominant paradigm that he was criticising is described by Lal as the "dirigiste dogma". However, this has been criticised with claims that Lal overstated his case claiming that those he criticised had wanted to "supplant" rather than supplement the price and market system, but that he failed to provide evidence for this.